- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

North West (TSX:NWC) Negative Same Store Sales Challenge Defensive Retail Narrative

Reviewed by Simply Wall St

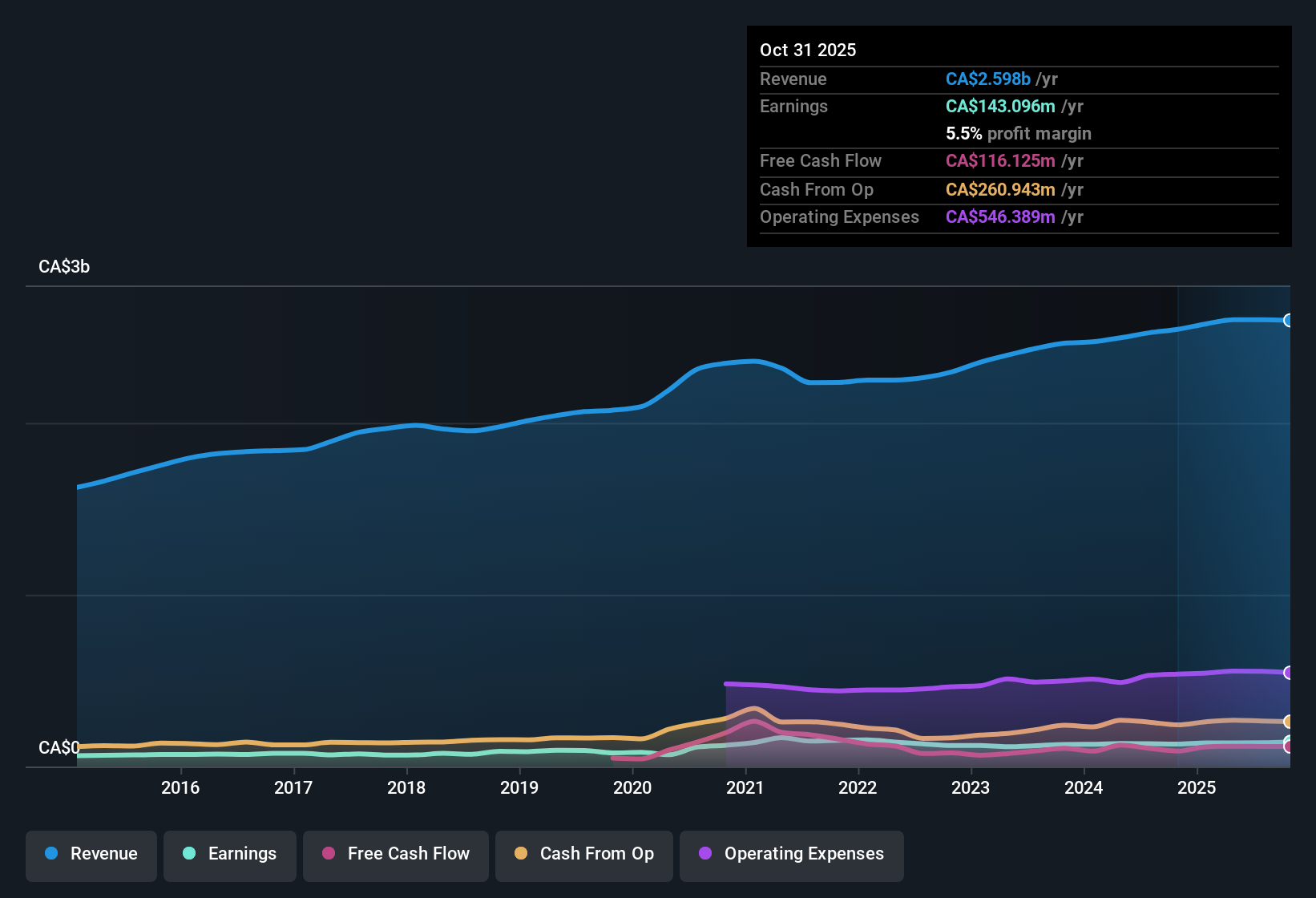

North West (TSX:NWC) has just posted its Q3 2026 scorecard, with Q2 providing the latest full revenue and profit markers, showing total revenue of CA$647 million, basic EPS of CA$0.75, and net income of CA$36 million. Over recent quarters, the company has seen revenue hover around the mid CA$600 million range, from CA$646 million in Q2 2025 to CA$637 million in Q3 2025 and CA$675 million in Q4 2025. Basic EPS moved from CA$0.74 in Q2 2025 to CA$0.74 in Q3 2025 and CA$0.86 in Q4 2025, before landing at CA$0.54 in Q1 2026 and CA$0.75 in Q2 2026. This sets up a quarter where investors will be parsing how these earnings translate into sustainable margins.

See our full analysis for North West.With the latest print on the table, the next step is to pit these numbers against the dominant narratives around North West, highlighting where the data backs the story and where expectations might need a reset.

Curious how numbers become stories that shape markets? Explore Community Narratives

Same Store Sales Turn Negative

- Same store sales slipped from 4.0 percent growth in Q1 2026 to minus 1.1 percent in Q2 and minus 1.7 percent in Q3, marking a clear shift from positive to negative comparable sales within just two quarters.

- What stands out for a bullish view on North West as a defensive retailer is that this recent drop in comps sits against a trailing twelve month backdrop where revenue still grew about 4.7 percent per year and net profit margin held at 5.3 percent, suggesting demand for essentials remains intact even as like for like volumes soften.

- That 5.3 percent margin, unchanged year over year on the latest trailing figures, points to steady profitability despite the move from plus 4.0 percent to negative same store sales in 2026.

- For someone leaning bullish, the combination of slightly slower revenue growth than the wider Canadian market at 4.7 percent versus 5.1 percent and now negative comps is a reminder to check whether the long term stability story is keeping pace with day to day operating trends.

TTM Earnings Drift Versus Five Year Trend

- Over the last five years, earnings have declined at about 2.2 percent per year even though earnings over the most recent twelve months grew 4.4 percent compared with the prior year, highlighting a short term improvement that still sits on top of a weaker longer term trend.

- Critics highlight that this five year earnings drag, alongside modest 4.7 percent annual revenue growth, questions how durable the latest 4.4 percent earnings uptick really is when you line it up against the negative same store sales in 2026 and the step down in quarterly EPS from CA$0.86 in Q4 2025 to CA$0.54 in Q1 2026 and CA$0.75 in Q2 2026.

- That pattern means the recent twelve month improvement is coming from a relatively low base and is not yet a clear break from the 2.2 percent annual decline that defined the last five years.

- For a cautious investor, the combination of declining five year earnings, recent negative comps and only slightly below market revenue growth makes it reasonable to ask whether the business is just stabilizing rather than entering a stronger growth phase.

Discounted Valuation With Income Support

- At a share price of CA$47.37, North West trades at about 16.3 times earnings compared with peer and industry averages of 22.8 times and 21.6 times, sits roughly 62.6 percent below a DCF fair value of about CA$126.73, and offers a 3.46 percent dividend yield alongside analyst targets that imply upside to CA$59.00 or roughly 24.6 percent.

- What is striking for a bullish case is how this valuation gap lines up with the business stability metrics, because trailing revenue of about CA$2.6 billion and net income of roughly CA$138.4 million still support that 5.3 percent net margin, which means investors are paying a below peer multiple for a retailer that has not seen its profitability margins deteriorate over the last year.

- Bulls argue that a 16.3 times earnings multiple, combined with a 3.46 percent dividend yield, gives them both income and potential re rating if earnings growth continues to run ahead of the five year trend rather than matching it.

- Even with revenue growth slightly below the wider market at 4.7 percent, the 24.6 percent gap between CA$47.37 and the CA$59.00 analyst target plus the large spread to the DCF fair value leaves room for sentiment to improve if the company can stabilize comps and keep that 5.3 percent margin intact.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on North West's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

North West's negative same store sales, long term earnings decline and only slightly below market growth suggest that its stability story is more about holding ground than compounding.

If you want businesses where growth trends look more predictable and less fragile, use our stable growth stocks screener (2091 results) to quickly focus on companies delivering steadier, cycle tested performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026