- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Does North West’s Recent 10% Price Rise Reflect Its True Value in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether North West is still attractively priced today or whether the market has already incorporated most of the potential upside, this is a good place to unpack what the numbers are really indicating.

- The stock has inched up 0.8% over the last week and 9.6% over the last month. That compares with a modest 1.4% gain year to date and a slightly negative 1 year return of -2.3%, following a stronger 3 year and 5 year performance of 53.7% and 78.6% respectively.

- Recent moves appear to reflect shifting sentiment around consumer resilience in North West’s core markets and renewed interest in stable, dividend-paying retailers, rather than any single headline. Investors have been weighing the company’s defensive profile in remote and underserved communities against questions about how much future growth is implied by the current share price.

- Under this framework, North West scores 4 out of 6 on undervaluation checks. This suggests there may still be some value available, but not without caveats. The next step is to walk through the key valuation methods and, in conclusion, consider a more nuanced way to think about what the stock might be worth.

Find out why North West's -2.3% return over the last year is lagging behind its peers.

Approach 1: North West Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today’s value. For North West, this uses a 2 Stage Free Cash Flow to Equity approach.

North West generated about CA$119.5 million in free cash flow over the last twelve months. Analyst forecasts, supplemented by Simply Wall St extrapolations beyond year five, see this rising steadily, with free cash flow projected to reach roughly CA$378.8 million by 2035.

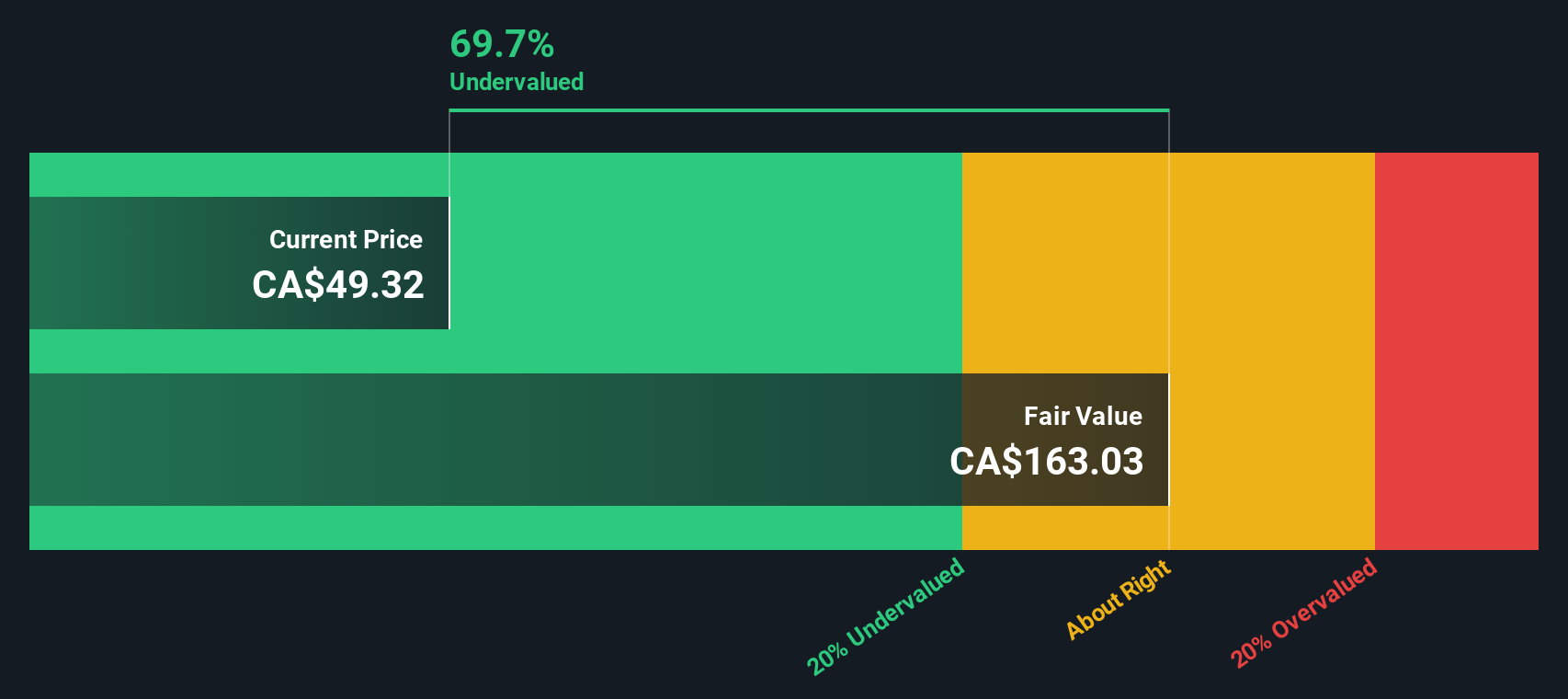

When all those future cash flows are discounted back, the DCF model indicates an intrinsic value of about CA$165.71 per share. Compared with the current share price, this implies the stock is trading at roughly a 69.9% discount. This points to substantial upside potential if the cash flow assumptions prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests North West is undervalued by 69.9%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: North West Price vs Earnings

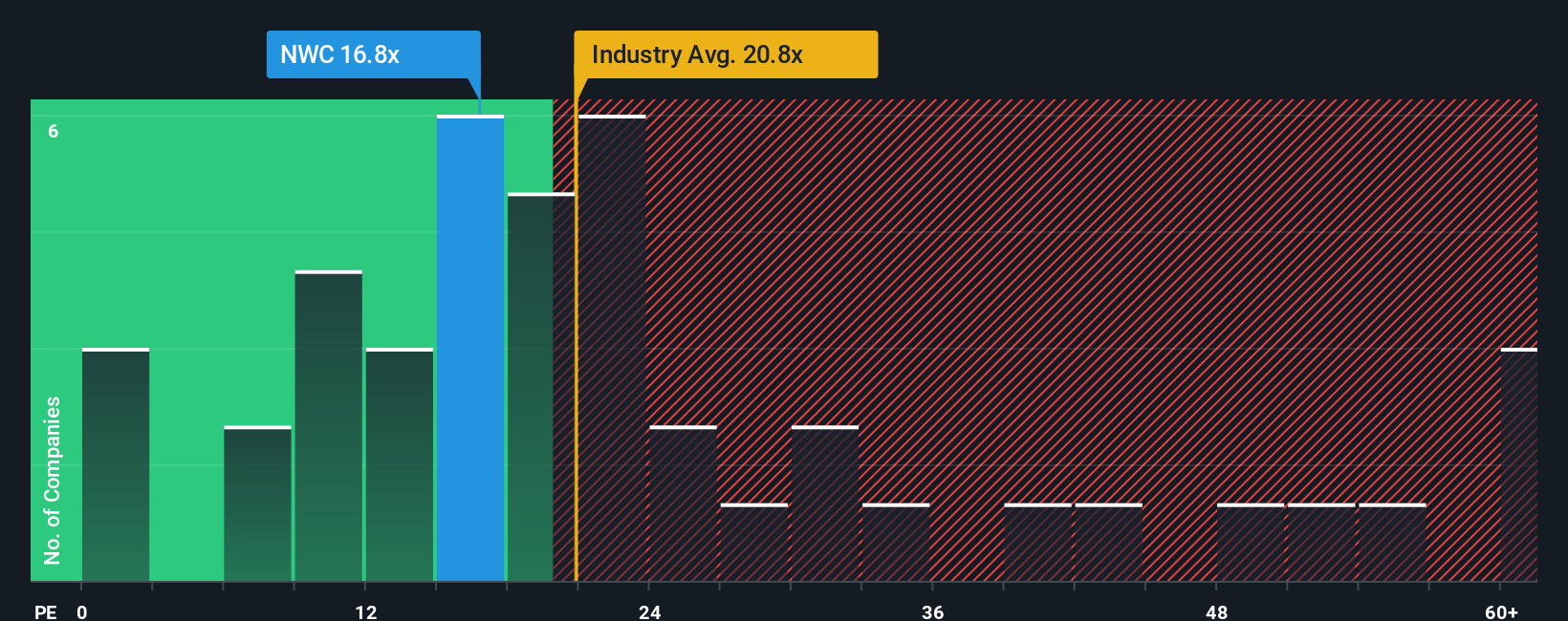

For a profitable, established retailer like North West, the price to earnings (PE) ratio is a useful yardstick because it links the share price directly to the company’s current earnings power. Investors are essentially asking how many dollars they are willing to pay today for each dollar of profit North West generates.

What counts as a reasonable or fair PE depends on how quickly earnings are expected to grow and how risky those earnings are. Higher growth and lower perceived risk can justify a higher PE, while slower or more volatile earnings usually warrant a lower multiple.

North West currently trades on a PE of about 17.25x, slightly below the Consumer Retailing industry average of roughly 17.60x and below the peer group average of around 22.69x. Simply Wall St’s Fair Ratio is a proprietary estimate of what the PE should be, given North West’s earnings growth profile, margins, risk factors, industry and market cap. This tailored benchmark is more informative than simple peer or industry comparisons because it adjusts for the company’s specific strengths and weaknesses. With the Fair Ratio sitting above the current 17.25x, North West appears modestly undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

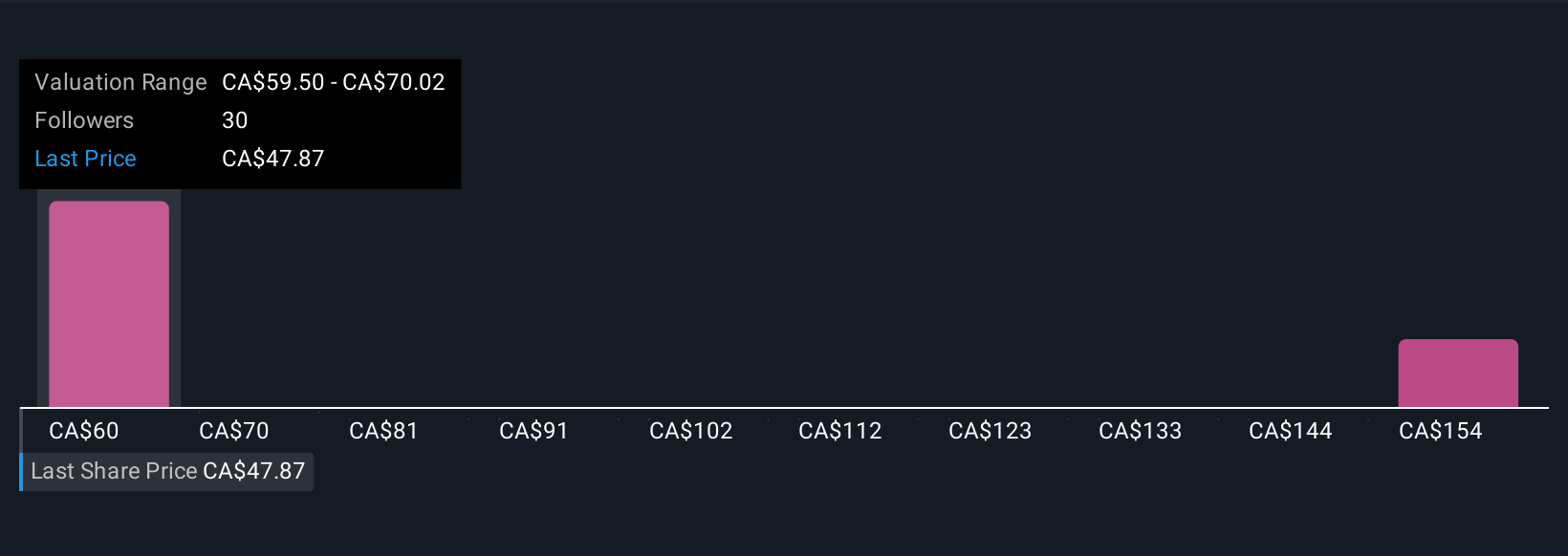

Upgrade Your Decision Making: Choose your North West Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about a company to the numbers behind it. A Narrative on Simply Wall St is your own view of North West’s future, where you set assumptions for revenue growth, profit margins and risk, which then feeds into a forecast and a fair value estimate. This connects three things in one place: what you believe about the business, how that flows through to future financials, and what you think the shares are actually worth. Narratives are easy to build and explore on the Community page of Simply Wall St, where millions of investors already share and refine their views. They can support your decision making by helping you compare each Narrative’s Fair Value to today’s share price, and they update dynamically as new earnings or news come in. For example, one North West Narrative might assume resilient demand and higher margins, while another prices in slower growth and cost pressure, leading to very different fair values and decisions.

Do you think there's more to the story for North West? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026