- Canada

- /

- Food and Staples Retail

- /

- TSX:GCL

Colabor Group Inc.'s (TSE:GCL) 28% Cheaper Price Remains In Tune With Earnings

The Colabor Group Inc. (TSE:GCL) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 18% share price drop.

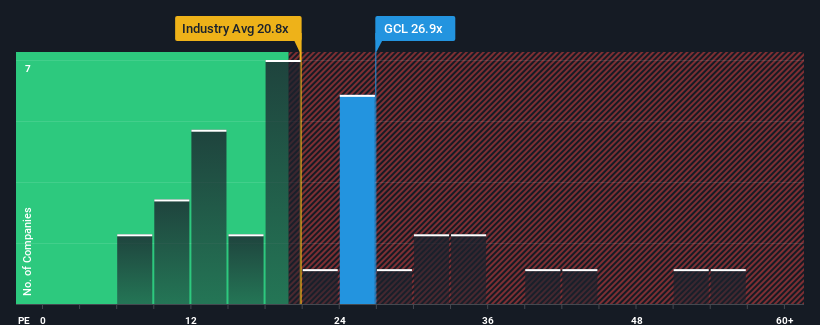

In spite of the heavy fall in price, Colabor Group may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 26.9x, since almost half of all companies in Canada have P/E ratios under 14x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Colabor Group as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Colabor Group

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Colabor Group's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. As a result, earnings from three years ago have also fallen 19% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 48% each year during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 8.4% each year growth forecast for the broader market.

With this information, we can see why Colabor Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, Colabor Group's P/E still exceeds the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Colabor Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Colabor Group has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If these risks are making you reconsider your opinion on Colabor Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GCL

Colabor Group

Colabor Group Inc., together with its subsidiaries, markets, distributes, and wholesales food and food-related products in Canada.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026