- Canada

- /

- Food and Staples Retail

- /

- TSX:ATD

Alimentation Couche-Tard (TSX:ATD) Eyes Improved Takeover Bid for Seven & i Holdings Amid Growth Initiatives

Reviewed by Simply Wall St

Click to explore a detailed breakdown of our findings on Alimentation Couche-Tard.

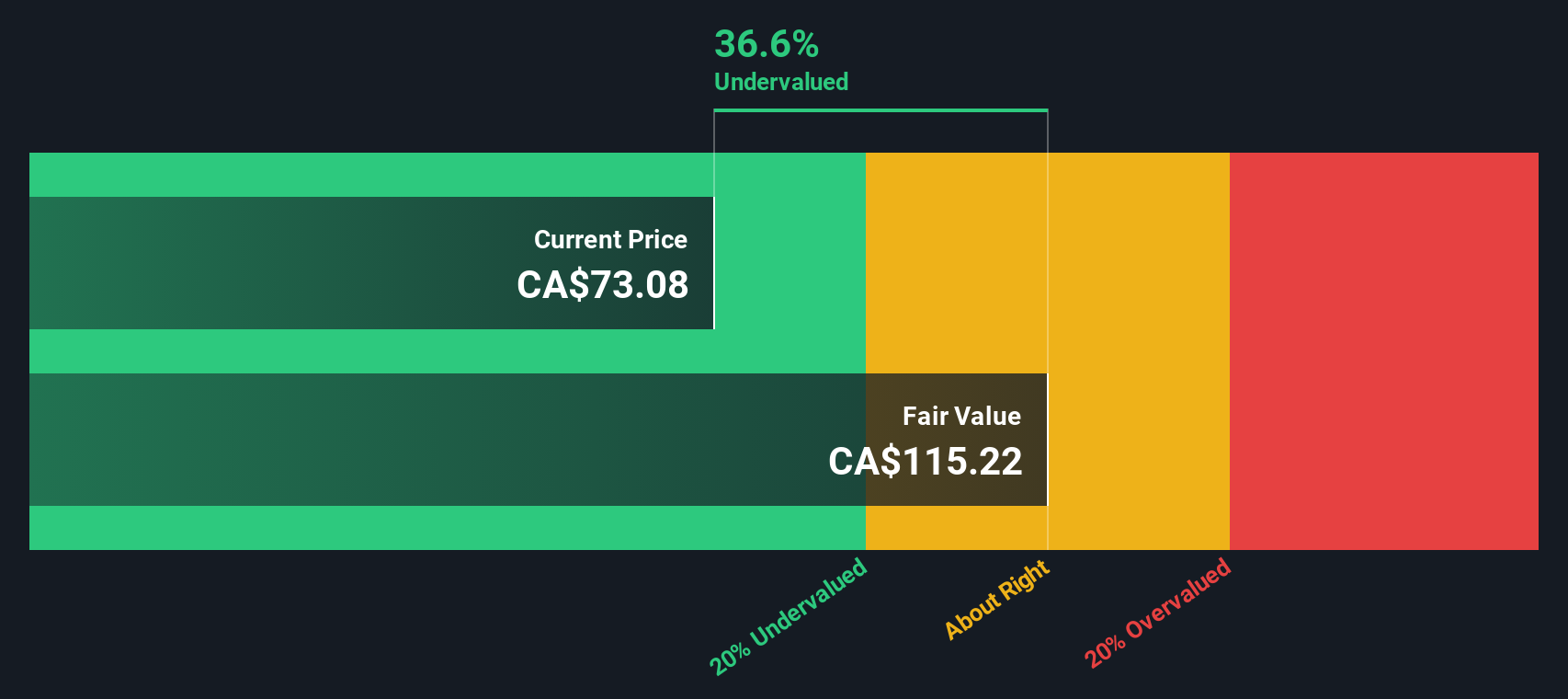

Strengths: Core Advantages Driving Sustained Success For Alimentation Couche-Tard

Alimentation Couche-Tard demonstrates robust financial health, underscored by its merchandise and services gross profit increase of approximately $82 million or 5.5%, as highlighted by CFO Filipe Da Silva. The company's strategic initiatives, including the innovative "GetGo" food-first convenience store experience, reflect its commitment to growth and expansion. CEO Alex Miller emphasized the company's strong balance sheet and long-term strategy, which positions it well for future growth. Additionally, the company is currently trading below its estimated fair value, indicating it may be undervalued compared to its peers and industry averages based on its Price-To-Earnings Ratio. These factors collectively enhance Alimentation Couche-Tard's market positioning and financial stability.

Weaknesses: Critical Issues Affecting Alimentation Couche-Tard's Performance and Areas For Growth

Despite its strengths, Alimentation Couche-Tard faces several performance challenges. Same-store revenues decreased by 1.1% in the United States, 2.1% in Europe and other regions, and 3.9% in Canada, as noted by CEO Alex Miller. The company's earnings have also experienced a decline, with adjusted diluted net earnings per share decreasing by 3.5% from $0.86 to $0.83. Furthermore, the company's revenue growth forecast of 2.7% per year is slower than the Canadian market average of 6.9% per year. Additionally, the company's Return on Equity (ROE) of 19.2% is considered low compared to industry standards. These factors highlight areas where the company needs to improve to align with market expectations.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Alimentation Couche-Tard has several opportunities to enhance its market position and capitalize on emerging trends. The company's strategic initiatives, such as the integration of GetGo team members and their popular made-to-order food and loyalty programs, present significant growth potential. Additionally, the company plans to open nearly 100 new stores in North America this fiscal year, further expanding its footprint. The gradual improvement in fuel margins also presents a positive market trend that the company can leverage. Moreover, the expected closure of a major transaction in calendar 2025 could provide additional growth opportunities. These initiatives are likely to strengthen Alimentation Couche-Tard's competitive advantage and drive future growth.

Threats: Key Risks and Challenges That Could Impact Alimentation Couche-Tard's Success

Alimentation Couche-Tard faces several external threats that could impact its success. The company operates in a highly competitive industry, and CEO Alex Miller noted that the industry continues to behave rationally. Economic factors, such as the unfavorable impact of challenging economic conditions on global fuel demand, pose significant risks. Additionally, operational risks related to the implementation of enhancements and back-office automation could affect the company's efficiency. Market risks, including early wins with B2B customers in new European countries, also present challenges. These factors highlight the need for Alimentation Couche-Tard to navigate external pressures effectively to maintain its market position.

Conclusion

Alimentation Couche-Tard's financial health, highlighted by a significant increase in merchandise and services gross profit, and strategic initiatives like the "GetGo" food-first convenience store experience, position the company well for future growth. However, challenges such as declining same-store revenues and slower revenue growth compared to the Canadian market average indicate areas needing improvement. The company's expansion plans, including opening nearly 100 new stores in North America and leveraging improving fuel margins, present substantial growth opportunities. Despite external threats, such as economic conditions affecting global fuel demand, the company's current trading price below its estimated fair value suggests it may be a compelling investment opportunity, reflecting its potential for enhanced market positioning and financial stability.

Key Takeaways

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:ATD

Alimentation Couche-Tard

Operates and licenses convenience stores in North America, Europe, and Asia.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives