- Canada

- /

- Metals and Mining

- /

- TSXV:XXIX

TSX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The Canadian market has remained flat over the past week but has shown an 18% increase over the last year, with earnings expected to grow by 14% annually. Penny stocks may be considered a throwback term, yet they continue to offer intriguing opportunities for growth, particularly when these smaller or newer companies demonstrate strong balance sheets and solid fundamentals. This article explores several penny stocks that stand out for their financial strength and potential to deliver impressive returns amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.79M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.63 | CA$129.13M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$434.8M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$236.24M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$656.3M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$13.32M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$25.79M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$411.5M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$181.56M | ★★★★★☆ |

Click here to see the full list of 941 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

GR Silver Mining (TSXV:GRSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GR Silver Mining Ltd. is involved in acquiring and exploring mineral resource properties, with a market cap of CA$59.86 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$59.86M

GR Silver Mining Ltd., with a market cap of CA$59.86 million, is pre-revenue but recently achieved profitability, reporting a net income of CA$25.74 million for Q3 2024 due to a significant one-off gain. The company has no debt and its short-term assets exceed both short and long-term liabilities, providing financial stability. The management team has an average tenure of 2.9 years, considered experienced, though the board is relatively new with an average tenure of 2.1 years. Its price-to-earnings ratio stands at 8.6x, below the Canadian market average of 14.7x.

- Dive into the specifics of GR Silver Mining here with our thorough balance sheet health report.

- Understand GR Silver Mining's track record by examining our performance history report.

Mene (TSXV:MENE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mene Inc. is a company that designs, manufactures, and markets 24 karat gold and platinum jewelry globally, with a market cap of CA$32.54 million.

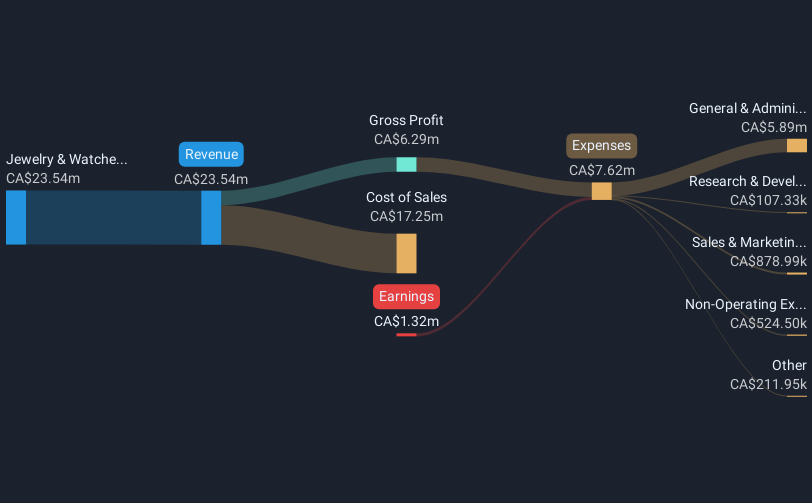

Operations: The company's revenue is primarily generated from its Jewelry & Watches segment, totaling CA$23.54 million.

Market Cap: CA$32.54M

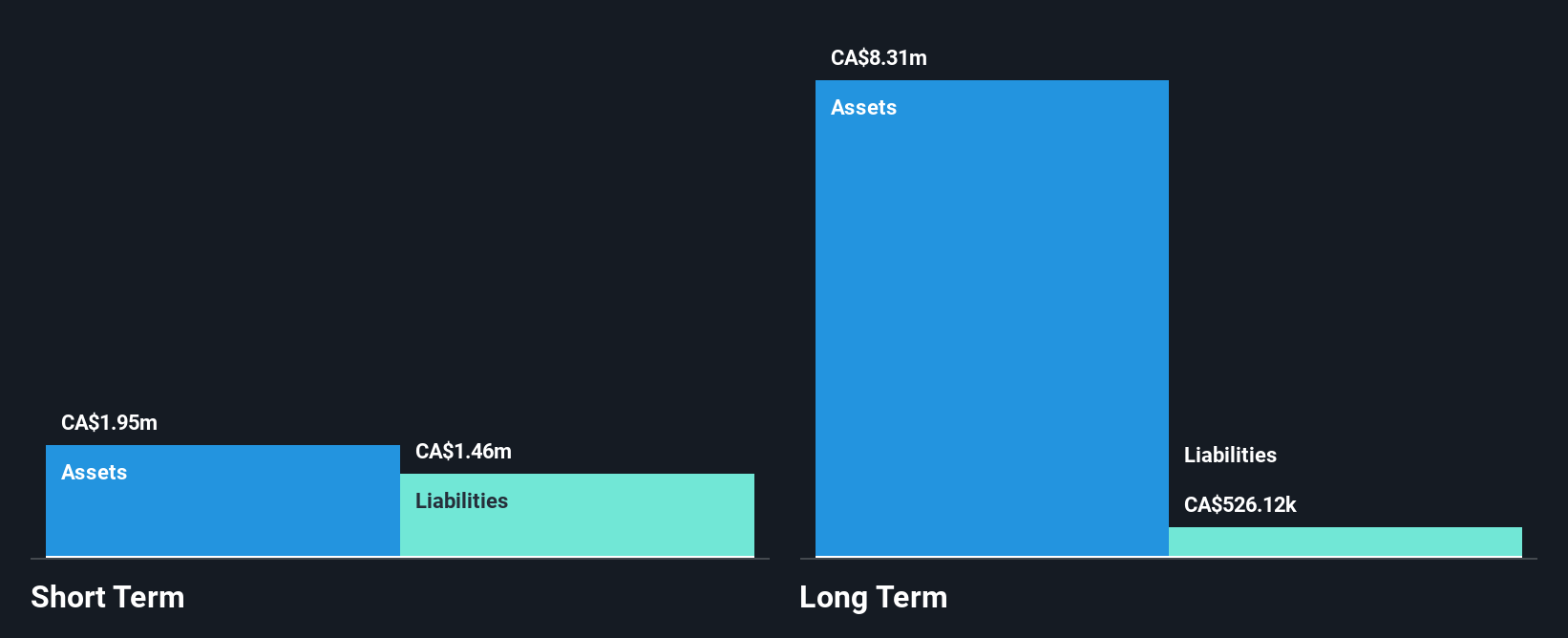

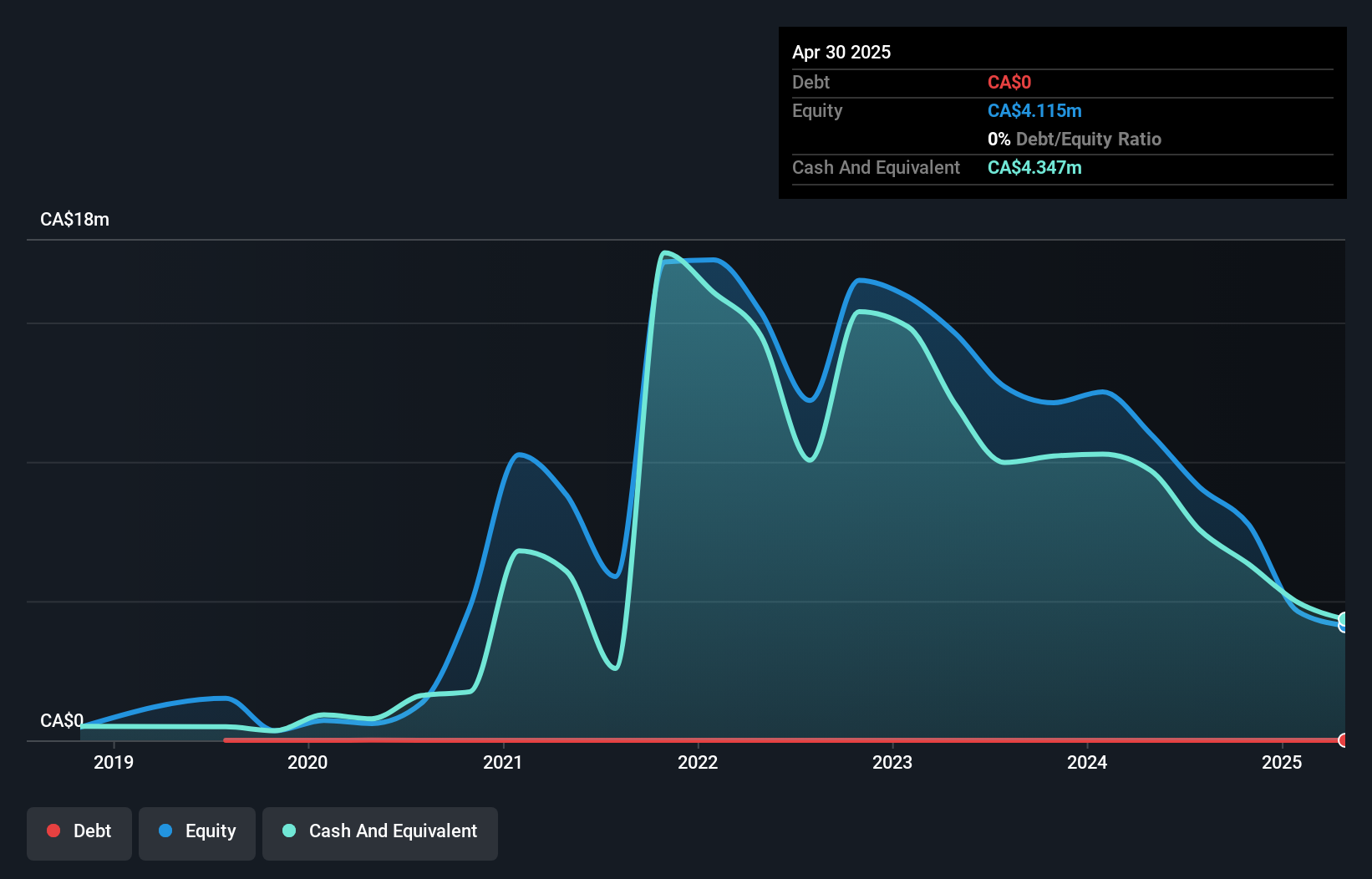

Mene Inc., with a market cap of CA$32.54 million, reported Q3 2024 sales of CA$5.39 million, showing growth from the previous year. The company is debt-free and has a cash runway exceeding three years due to positive free cash flow, despite being unprofitable. Its short-term assets comfortably cover both short and long-term liabilities, indicating solid financial health. However, Mene's share price remains highly volatile compared to other Canadian stocks. The management team is relatively new with an average tenure of 1.4 years, while the board is more experienced at 6.2 years on average.

- Click to explore a detailed breakdown of our findings in Mene's financial health report.

- Explore historical data to track Mene's performance over time in our past results report.

XXIX Metal (TSXV:XXIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XXIX Metal Corp. is involved in the exploration, development, and production of mineral properties in Canada with a market cap of CA$20.05 million.

Operations: XXIX Metal Corp. currently does not report any specific revenue segments.

Market Cap: CA$20.05M

XXIX Metal Corp., with a market cap of CA$20.05 million, is pre-revenue and focuses on mineral exploration in Canada, notably at the Opemiska Project. Recent announcements highlight a 20-hole drill program at the Saddle Zone to expand high-grade mineralization, potentially enhancing resource estimates by converting waste into ore. The company has no long-term liabilities and maintains a cash runway exceeding three years despite being unprofitable. Its short-term assets significantly outweigh its liabilities, indicating financial stability. Management and board members are experienced with average tenures of 4.1 and 6.8 years respectively, providing seasoned oversight amidst ongoing exploration efforts.

- Navigate through the intricacies of XXIX Metal with our comprehensive balance sheet health report here.

- Evaluate XXIX Metal's historical performance by accessing our past performance report.

Seize The Opportunity

- Reveal the 941 hidden gems among our TSX Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:XXIX

XXIX Metal

Engages in the exploration, development, and production of mineral properties in Canada.

Flawless balance sheet slight.

Market Insights

Community Narratives