The Canadian market has shown resilience, with stocks performing well alongside easing inflation and supportive economic policies that have bolstered growth and corporate profits. In this context, penny stocks—though a term from earlier market days—remain relevant for investors seeking opportunities in smaller or newer companies. By focusing on those with strong financial health, these stocks can offer potential value and stability amidst the evolving economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.33 | CA$157.09M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$280.2M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.27 | CA$112.45M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.99 | CA$347.6M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$210.78M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.57 | CA$981.2M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.36M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 914 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Erdene Resource Development (TSX:ERD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Erdene Resource Development Corporation is engaged in the exploration and development of precious and base metal deposits in Mongolia, with a market cap of CA$211.64 million.

Operations: Erdene Resource Development Corporation currently does not report any revenue segments.

Market Cap: CA$211.64M

Erdene Resource Development Corporation, with a market cap of CA$211.64 million, is pre-revenue and currently unprofitable, reporting a net loss of CA$6.23 million for the first nine months of 2024. Despite this, recent drilling results at its Bayan Khundii gold project in Mongolia show promising expansion potential beyond current resource boundaries, suggesting future growth prospects. The company has no debt and its seasoned management team aids in navigating these developmental stages. However, limited cash runway poses financial challenges as it progresses towards production scheduled for mid-2025 with Mongolian Mining Corporation's partnership.

- Take a closer look at Erdene Resource Development's potential here in our financial health report.

- Evaluate Erdene Resource Development's historical performance by accessing our past performance report.

Microbix Biosystems (TSX:MBX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Microbix Biosystems Inc. is a life science company that develops and commercializes proprietary biological and technological solutions for human health across North America, Europe, and internationally, with a market cap of CA$40.68 million.

Operations: The company's revenue is comprised of CA$19.31 million from product sales and CA$4.05 million from licensing fees and royalties.

Market Cap: CA$40.68M

Microbix Biosystems, with a market cap of CA$40.68 million, has demonstrated financial stability and growth potential in the penny stock sector. The company reports revenues from product sales (CA$19.31 million) and licensing fees (CA$4.05 million), indicating it is not pre-revenue. Recent achievements include EU regulatory compliance for its diagnostic quality assessment products, enhancing its market access in Europe. Despite some insider selling recently, Microbix maintains solid financial metrics with more cash than debt and short-term assets exceeding liabilities. Its seasoned management team supports strategic initiatives like expanding its HPV testing solutions showcased at international conferences.

- Unlock comprehensive insights into our analysis of Microbix Biosystems stock in this financial health report.

- Gain insights into Microbix Biosystems' outlook and expected performance with our report on the company's earnings estimates.

Unisync (TSX:UNI)

Simply Wall St Financial Health Rating: ★★★★☆☆

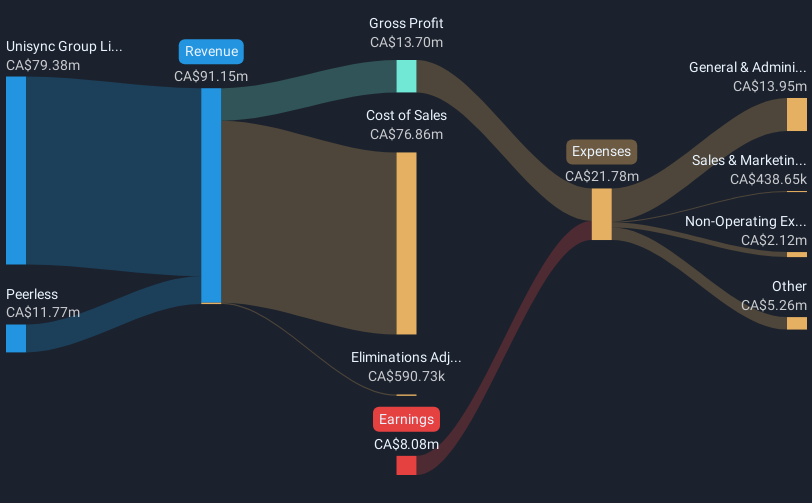

Overview: Unisync Corp., with a market cap of CA$28.52 million, operates through its subsidiaries to manufacture and distribute garments in Canada and the United States.

Operations: The company's revenue is primarily derived from its Unisync Group Limited (UGL) segment, which accounts for CA$79.38 million, and the Peerless segment, contributing CA$11.77 million.

Market Cap: CA$28.52M

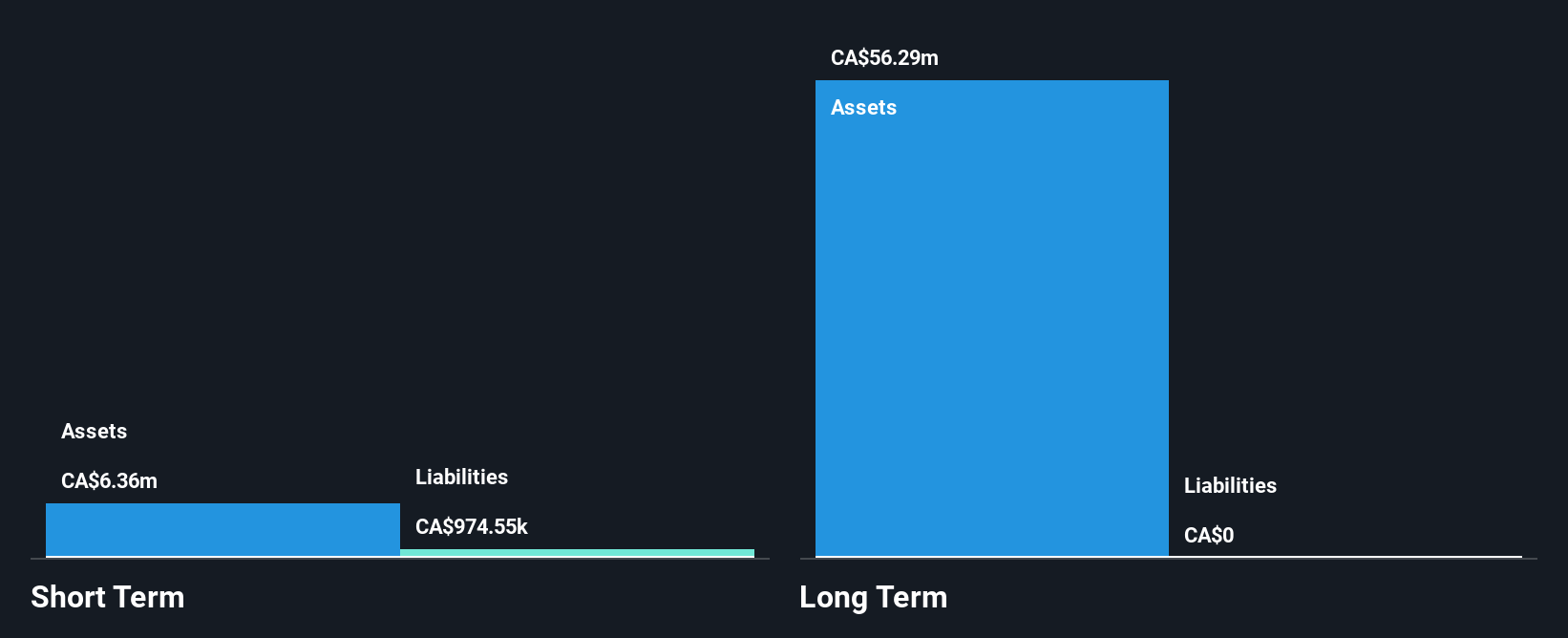

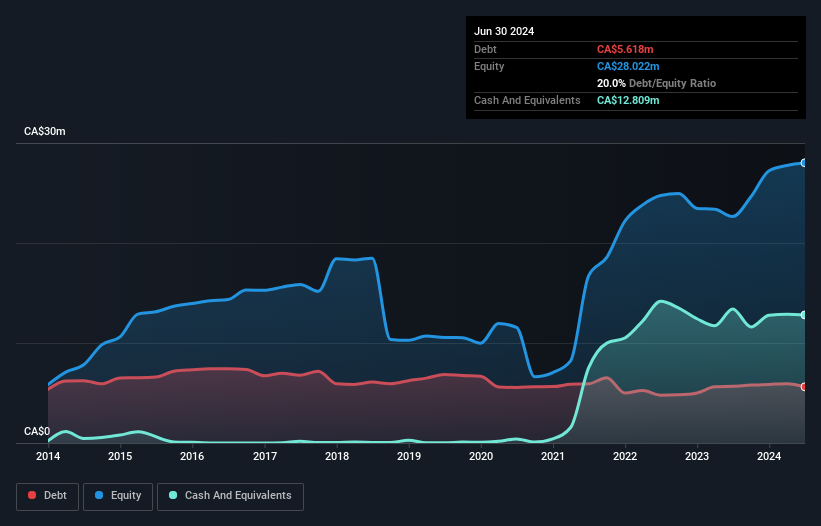

Unisync Corp., with a market cap of CA$28.52 million, faces challenges typical of penny stocks, including unprofitability and a high net debt to equity ratio of 227.9%. Despite this, the company maintains financial stability with short-term assets (CA$62.9M) exceeding both short-term (CA$51.6M) and long-term liabilities (CA$29.7M). While earnings have declined by 29.3% annually over the past five years, Unisync's cash runway remains secure for over three years due to positive free cash flow management. The seasoned board and management team provide experienced oversight as they navigate these financial hurdles without significant shareholder dilution recently.

- Dive into the specifics of Unisync here with our thorough balance sheet health report.

- Gain insights into Unisync's past trends and performance with our report on the company's historical track record.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 911 more companies for you to explore.Click here to unveil our expertly curated list of 914 TSX Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:UNI

Unisync

Manufactures and distributes garments in Canada and the United States.

Good value with adequate balance sheet.

Market Insights

Community Narratives