Canada Goose (TSX:GOOS) Valuation: Assessing Potential Upside After Latest Results

Reviewed by Kshitija Bhandaru

See our latest analysis for Canada Goose Holdings.

Canada Goose Holdings has seen some modest momentum, with the share price currently at $20.39 and a 1-year total shareholder return of just 0.22%. While recent price movement has been subdued, long-term returns remain underwhelming. This suggests that investors are still waiting for a more compelling growth story to emerge.

If you're wondering what else is showing signs of momentum beyond Canada Goose, it's a great time to broaden your search and discover fast growing stocks with high insider ownership

With modest gains and steady fundamentals, the key question now is whether Canada Goose offers value that the market has yet to recognize, or if the current share price already reflects all its potential. Is there still a buying opportunity here, or has future growth been fully priced in?

Most Popular Narrative: 3% Undervalued

With Canada Goose’s fair value set at CA$21.03, just above its last close at CA$20.39, the narrative suggests the market might still be missing modest upside, hinging on a handful of critical growth factors.

Direct-to-consumer (DTC) channel momentum, with 15% DTC comparable sales growth and ongoing digital investment (including livestreaming success on Douyin/WeChat in China), is elevating gross margins and providing higher profitability potential compared to wholesale-heavy models.

Want to know what’s propelling this premium brand’s valuation? The full narrative reveals the numbers and bold forecasts for future sales, profits, and the earnings multiple that analysts say must fall sharply to justify the target. Think these projections are out of reach or just the beginning? Click to uncover the expectations shaping the fair value.

Result: Fair Value of $21.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges in key markets like the U.K. and Japan, as well as rising operating expenses, could have an impact on Canada Goose’s future growth trajectory.

Find out about the key risks to this Canada Goose Holdings narrative.

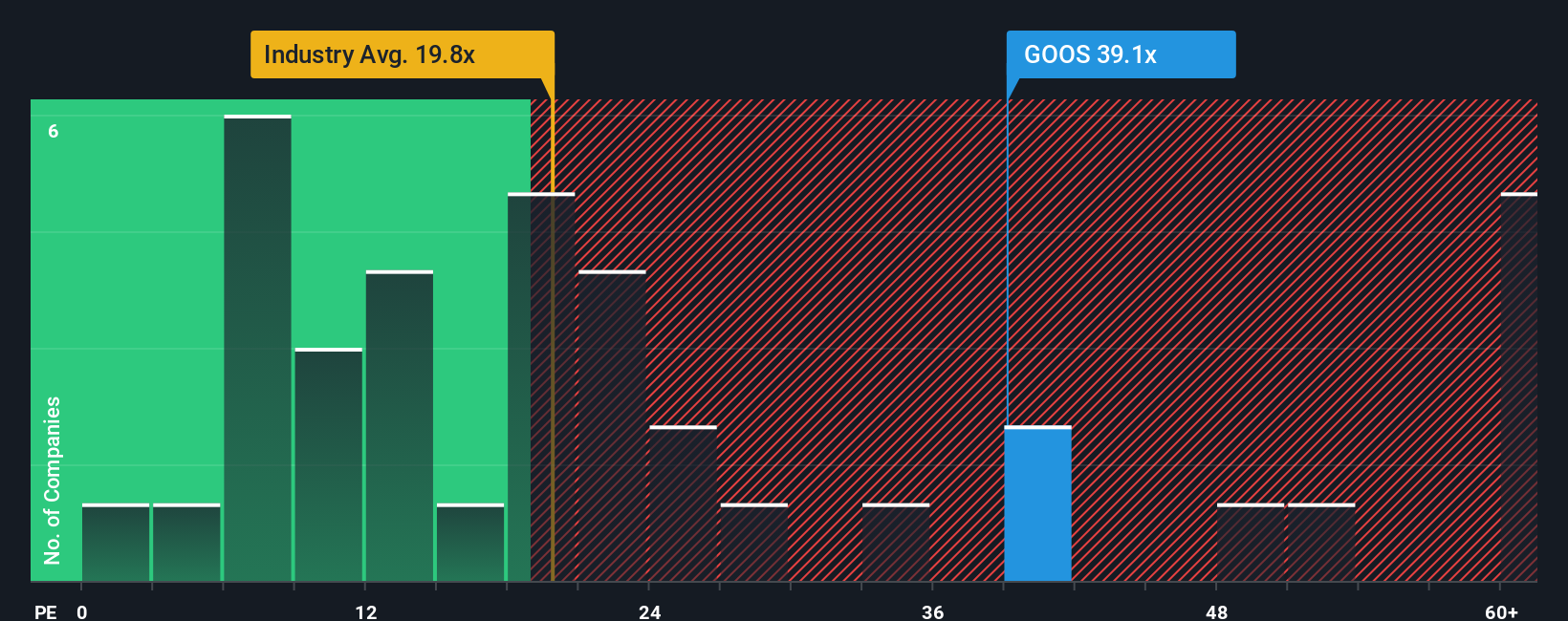

Another View: Price Ratios Raise a Red Flag

Looking beyond fair value estimates, the market is valuing Canada Goose at a price-to-earnings ratio of 42.1x. That’s noticeably higher than its North American Luxury peers at 22.1x and even above its fair ratio of 17.7x. This premium means the bar is set high, leaving little margin for error if growth falls short. Does this signal overconfidence, or is the brand’s potential actually worth the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canada Goose Holdings Narrative

If you see things differently or want to dive deeper on your own, you can easily build your personal view in just a few minutes with Do it your way.

A great starting point for your Canada Goose Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at one opportunity when a world of smart investments awaits? Uncover unique stocks and trends you may be missing with these powerful idea generators:

- Target rising yields and put your money to work in companies producing strong recurring income through these 19 dividend stocks with yields > 3%.

- Ride the wave of innovation by spotting trailblazers in artificial intelligence. Start with these 25 AI penny stocks for the next big breakthrough.

- Catch value before the crowd by tracking down hidden gems using these 887 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOOS

Canada Goose Holdings

Designs, manufactures, and sells performance luxury outerwear, apparel, footwear, and accessories for men, women, youth, children, and babies.

Mediocre balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives