- Canada

- /

- Oil and Gas

- /

- TSX:FSY

Undervalued TSX Penny Stocks To Consider In July 2025

Reviewed by Simply Wall St

As the Canadian market navigates the complexities of new tariffs and shifting economic policies, investors are looking for opportunities that balance potential growth with financial stability. Penny stocks, though an older term, still capture the essence of investing in smaller or emerging companies that might offer significant value. By focusing on those with strong fundamentals and a clear path to growth, investors can uncover promising opportunities among these lesser-known stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.70 | CA$70.8M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.02 | CA$116.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.53 | CA$432.22M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.75 | CA$498.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.01 | CA$18.43M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.76 | CA$183.23M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.93 | CA$184.2M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.60 | CA$11.13M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 446 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

D-BOX Technologies (TSX:DBO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: D-BOX Technologies Inc. designs, manufactures, and commercializes haptic motion systems for theatrical entertainment, sim racing and simulation, and training across multiple continents with a market cap of CA$64.36 million.

Operations: The company's revenue is derived from three primary segments: Theatrical, generating CA$21.39 million; Sim Racing, contributing CA$10.02 million; and Simulation and Training, accounting for CA$8.61 million.

Market Cap: CA$64.36M

D-BOX Technologies has shown robust financial performance, with its earnings growing by 264.7% over the past year and a high Return on Equity of 23.7%. The company’s revenue streams are well-diversified across theatrical, sim racing, and simulation sectors, totaling CA$42.79 million for the fiscal year ending March 31, 2025. Recent strategic expansions with HOYTS in Australia/New Zealand and Cinemark in the U.S. enhance its global presence significantly. However, recent executive changes could introduce some uncertainty as they aim to optimize their organizational structure for future growth while maintaining stable operations and financial health.

- Navigate through the intricacies of D-BOX Technologies with our comprehensive balance sheet health report here.

- Gain insights into D-BOX Technologies' historical outcomes by reviewing our past performance report.

Forsys Metals (TSX:FSY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Forsys Metals Corp. is involved in the acquisition, exploration, and development of uranium mineral properties in Africa and has a market cap of CA$117.98 million.

Operations: Forsys Metals Corp. does not report any specific revenue segments.

Market Cap: CA$117.98M

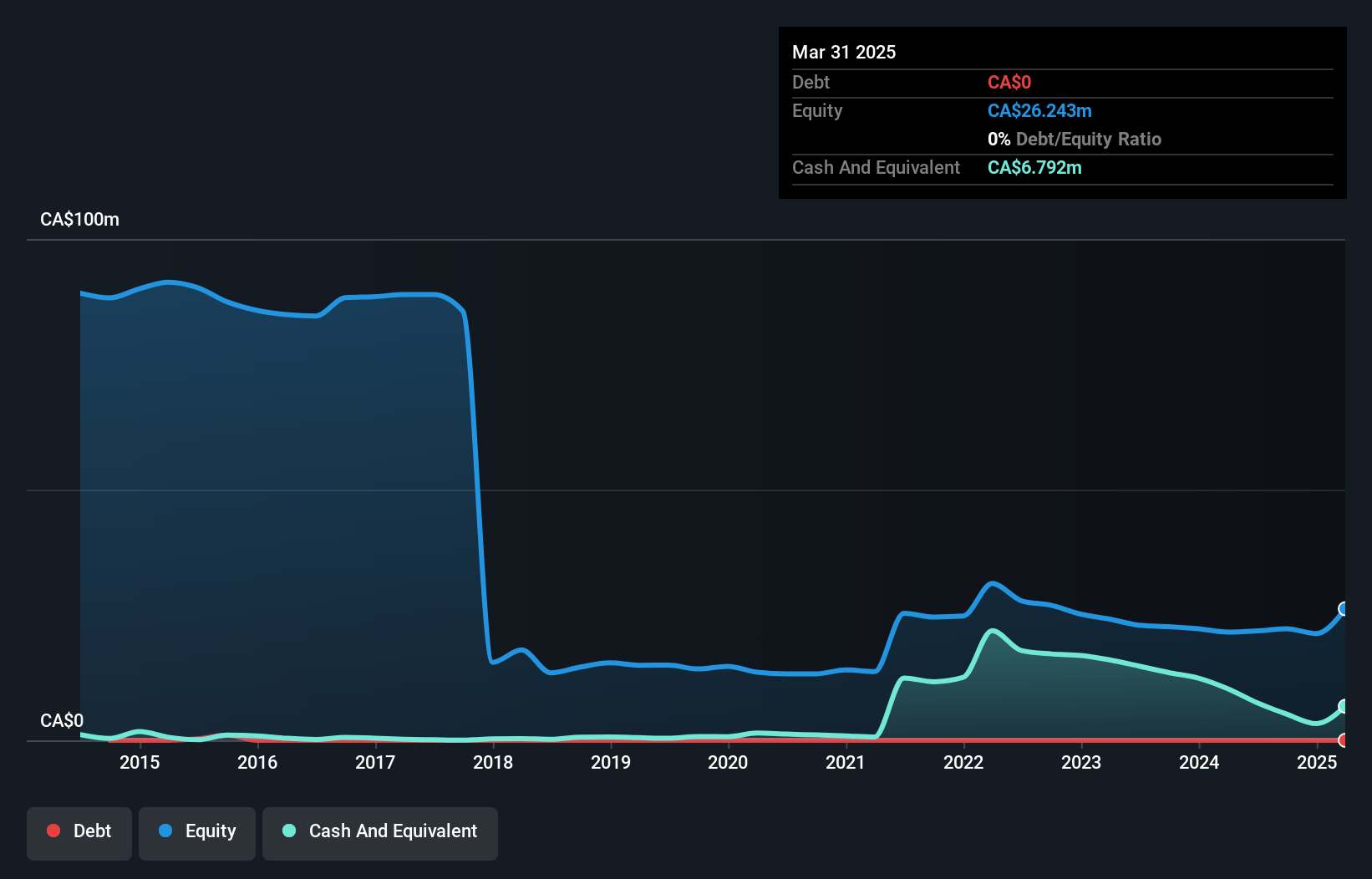

Forsys Metals, a pre-revenue company with a market cap of CA$117.98 million, remains focused on uranium exploration in Africa. Despite being debt-free and having experienced management and board teams, it faces financial challenges with less than a year of cash runway and accumulated losses increasing by 25.8% annually over the past five years. The company's share price has been highly volatile, reflecting its unstable financial position. Recent earnings reports show reduced net losses compared to the previous year, indicating some improvement but highlighting continued unprofitability as it navigates its strategic path forward in the mining sector.

- Click to explore a detailed breakdown of our findings in Forsys Metals' financial health report.

- Assess Forsys Metals' previous results with our detailed historical performance reports.

Empress Royalty (TSXV:EMPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Empress Royalty Corp. is a Canadian company focused on creating and investing in a portfolio of precious metal royalty and streaming interests, with a market capitalization of CA$106.73 million.

Operations: The company's revenue is primarily generated from the acquisition of mining royalty and streaming interests, amounting to $9.80 million.

Market Cap: CA$106.73M

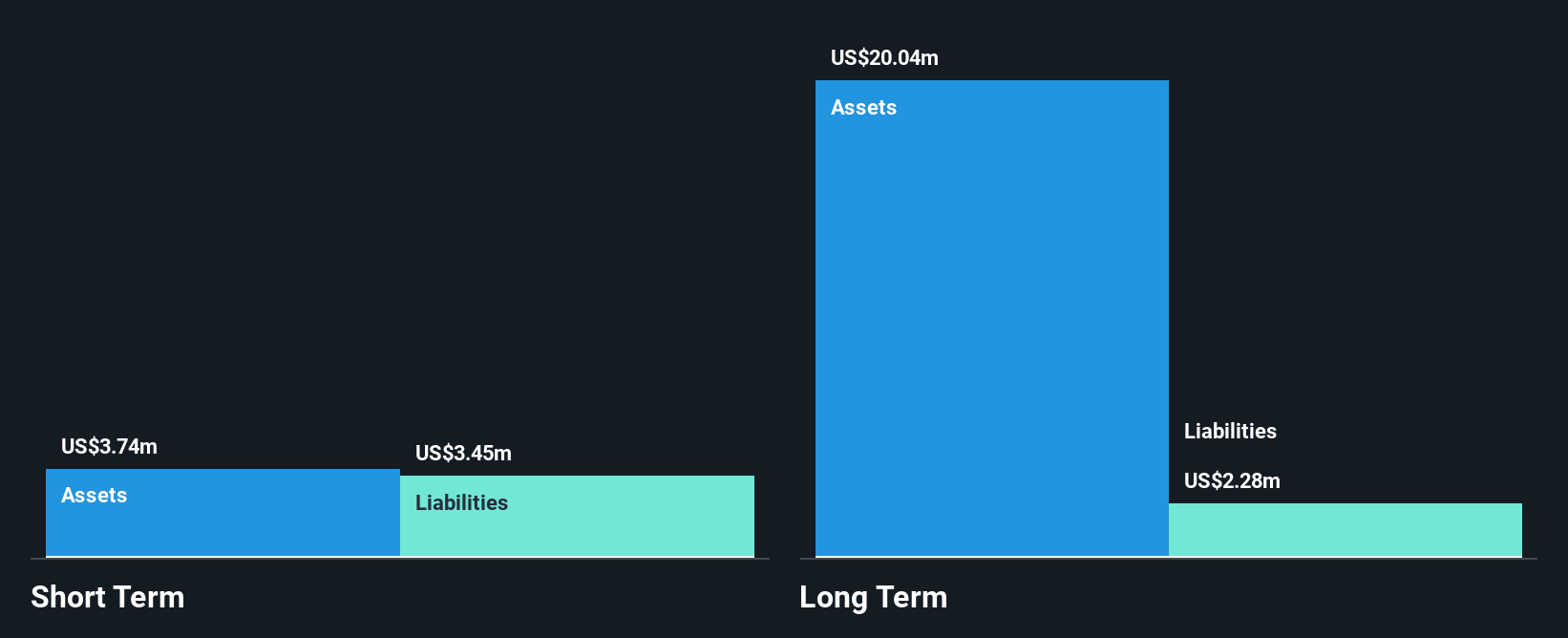

Empress Royalty Corp., with a market cap of CA$106.73 million, has transitioned to profitability, reporting net income of US$0.44 million for Q1 2025 compared to a loss the previous year. The company benefits from stable weekly volatility despite high overall share price fluctuations and operates with satisfactory debt management, as operating cash flow covers its debt well. However, interest payments are not fully covered by EBIT. Empress's short-term assets exceed both short- and long-term liabilities, indicating sound financial health amidst its strategic focus on precious metal royalty interests. Recent presentations highlight active engagement in industry events.

- Click here and access our complete financial health analysis report to understand the dynamics of Empress Royalty.

- Understand Empress Royalty's earnings outlook by examining our growth report.

Key Takeaways

- Click this link to deep-dive into the 446 companies within our TSX Penny Stocks screener.

- Seeking Other Investments? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FSY

Forsys Metals

Engages in the acquisition, exploration, and development of uranium mineral properties in Africa.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives