The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies CHAR Technologies Ltd. (CVE:YES) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for CHAR Technologies

How Much Debt Does CHAR Technologies Carry?

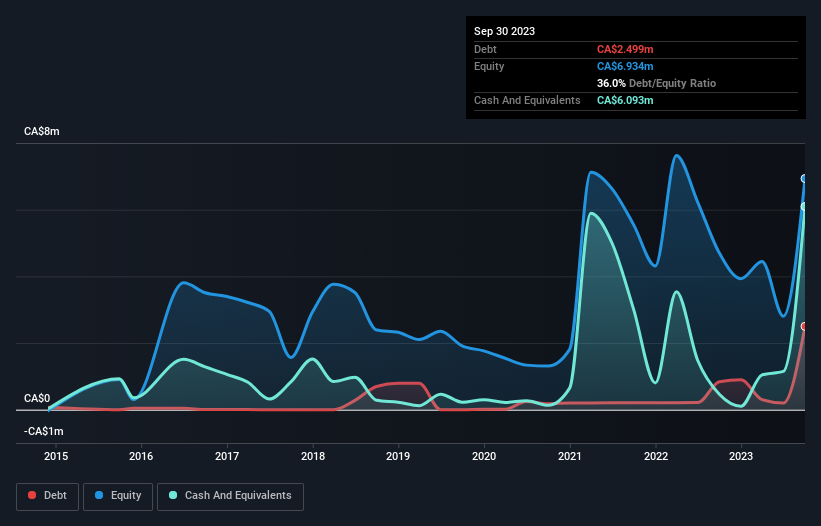

As you can see below, at the end of September 2023, CHAR Technologies had CA$2.50m of debt, up from CA$838.1k a year ago. Click the image for more detail. But it also has CA$6.09m in cash to offset that, meaning it has CA$3.59m net cash.

How Strong Is CHAR Technologies' Balance Sheet?

According to the last reported balance sheet, CHAR Technologies had liabilities of CA$3.23m due within 12 months, and liabilities of CA$8.71m due beyond 12 months. Offsetting these obligations, it had cash of CA$6.09m as well as receivables valued at CA$1.67m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$4.18m.

Of course, CHAR Technologies has a market capitalization of CA$44.4m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, CHAR Technologies also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine CHAR Technologies's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, CHAR Technologies reported revenue of CA$2.0m, which is a gain of 37%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is CHAR Technologies?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months CHAR Technologies lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of CA$9.5m and booked a CA$8.4m accounting loss. Given it only has net cash of CA$3.59m, the company may need to raise more capital if it doesn't reach break-even soon. With very solid revenue growth in the last year, CHAR Technologies may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with CHAR Technologies (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:YES

CHAR Technologies

Engages in converting woody materials and organic waste into renewable gases and biocarbon.

High growth potential with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026