- Canada

- /

- Trade Distributors

- /

- TSX:BRY

TSX Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

The Canadian market has shown resilience, with financials and materials sectors contributing to its strong performance amid easing monetary policies and solid economic fundamentals. For investors seeking growth opportunities, penny stocks—though often considered niche—remain a relevant investment area. These smaller or newer companies can offer significant returns when backed by strong financial health, making them worth considering for those looking to uncover hidden value in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.56 | CA$165.86M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.66 | CA$278.54M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.22 | CA$119.58M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$395.45M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$237.5M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.51 | CA$955.1M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$4.87M | ★★★★★★ |

Click here to see the full list of 915 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Bri-Chem (TSX:BRY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bri-Chem Corp., along with its subsidiaries, operates in the wholesale distribution of oilfield chemicals for the North American oil and gas industry, with a market cap of CA$7.27 million.

Operations: The company's revenue is derived from Fluids Distribution in the USA (CA$51.85 million) and Canada (CA$12.83 million), as well as Fluids Blending & Packaging in the USA (CA$7.88 million) and Canada (CA$22.19 million).

Market Cap: CA$7.27M

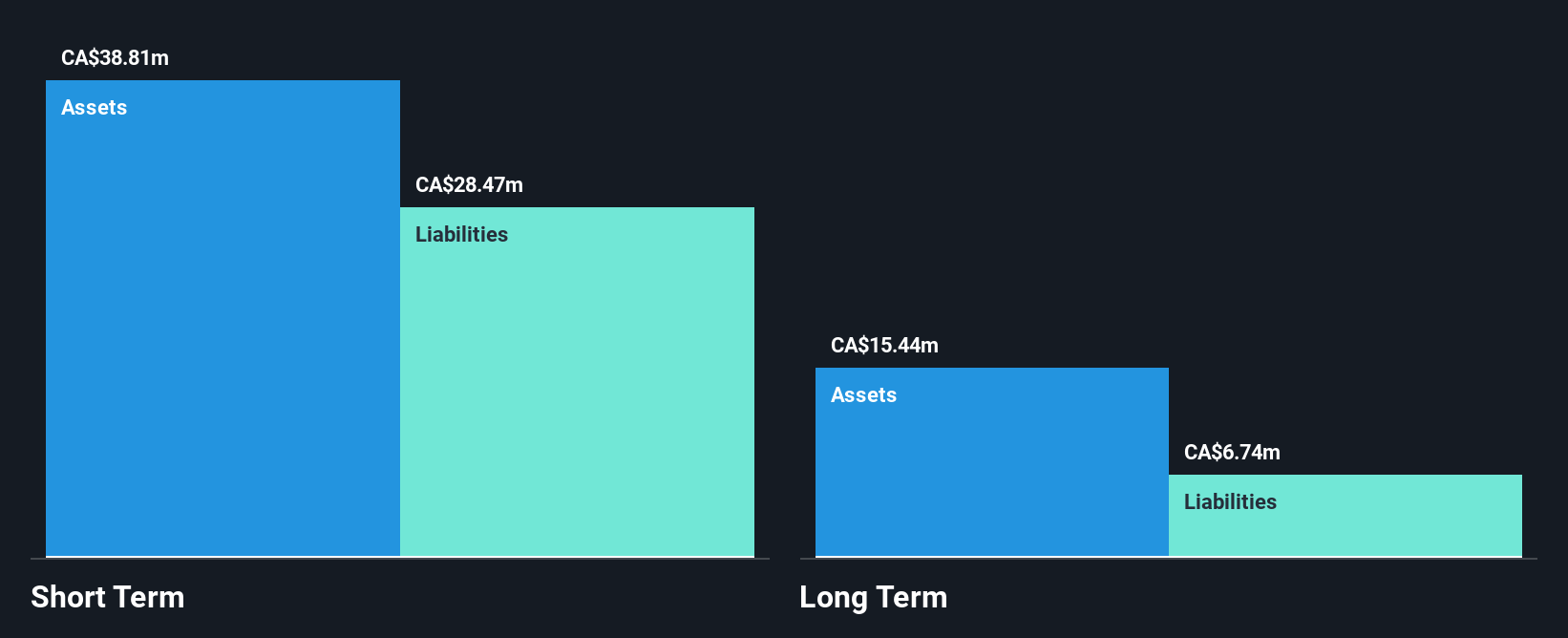

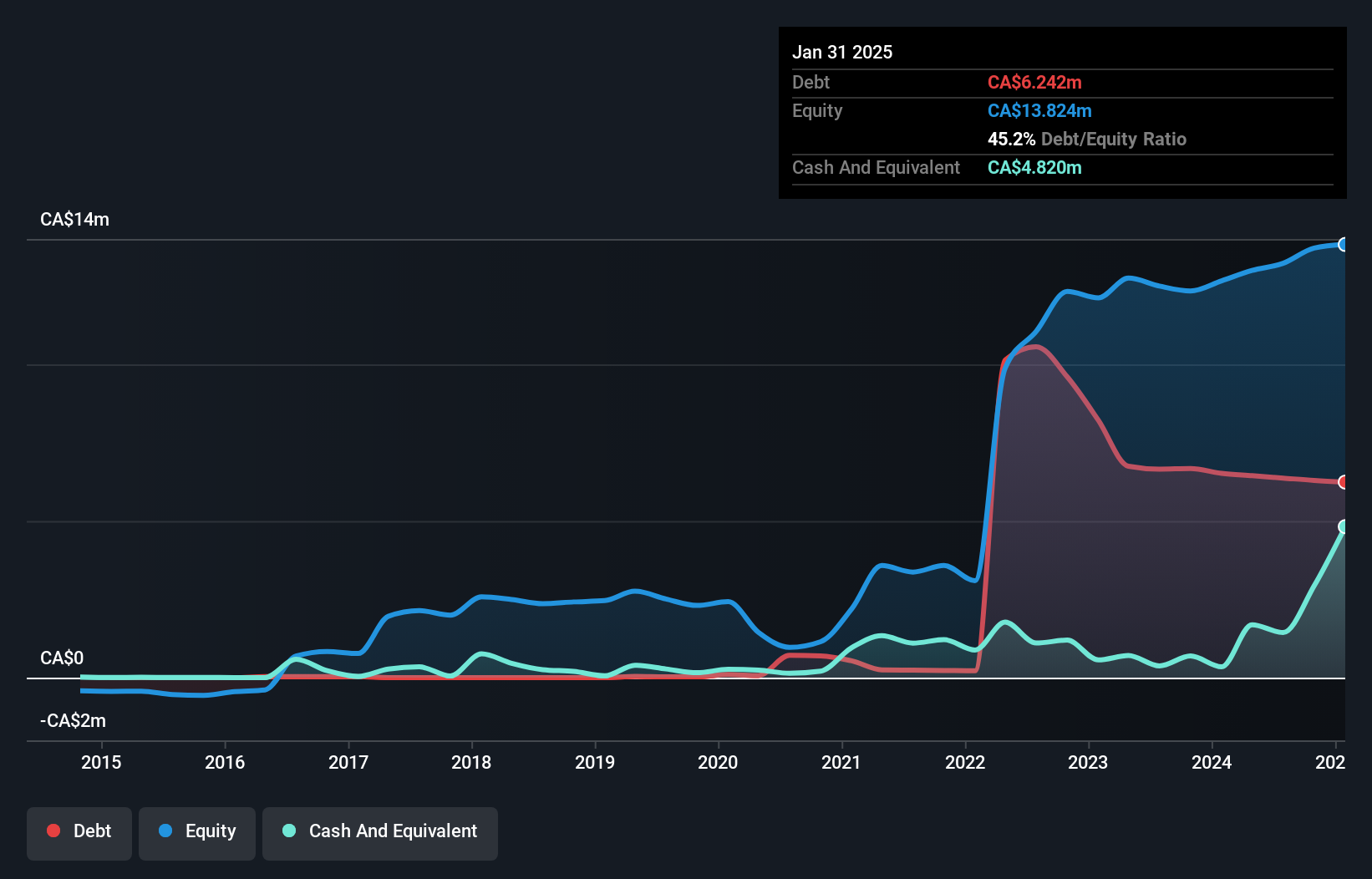

Bri-Chem Corp., with a market cap of CA$7.27 million, operates in the North American oilfield chemicals sector. While unprofitable, it has reduced losses by 37.1% annually over five years and maintains a high net debt to equity ratio of 102.3%. Its short-term assets exceed both short and long-term liabilities, indicating liquidity strength despite recent revenue declines (CA$62.45 million for nine months ending September 2024). The company renewed its credit facilities with CIBC until April 2026, ensuring financial flexibility amid volatile share prices and increased weekly volatility from 17% to 23%.

- Click here and access our complete financial health analysis report to understand the dynamics of Bri-Chem.

- Assess Bri-Chem's previous results with our detailed historical performance reports.

Progressive Planet Solutions (TSXV:PLAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Progressive Planet Solutions Inc., along with its subsidiaries, focuses on acquiring and exploring mineral properties in Canada and the United States, with a market cap of CA$20.43 million.

Operations: There are no reported revenue segments for this company.

Market Cap: CA$20.43M

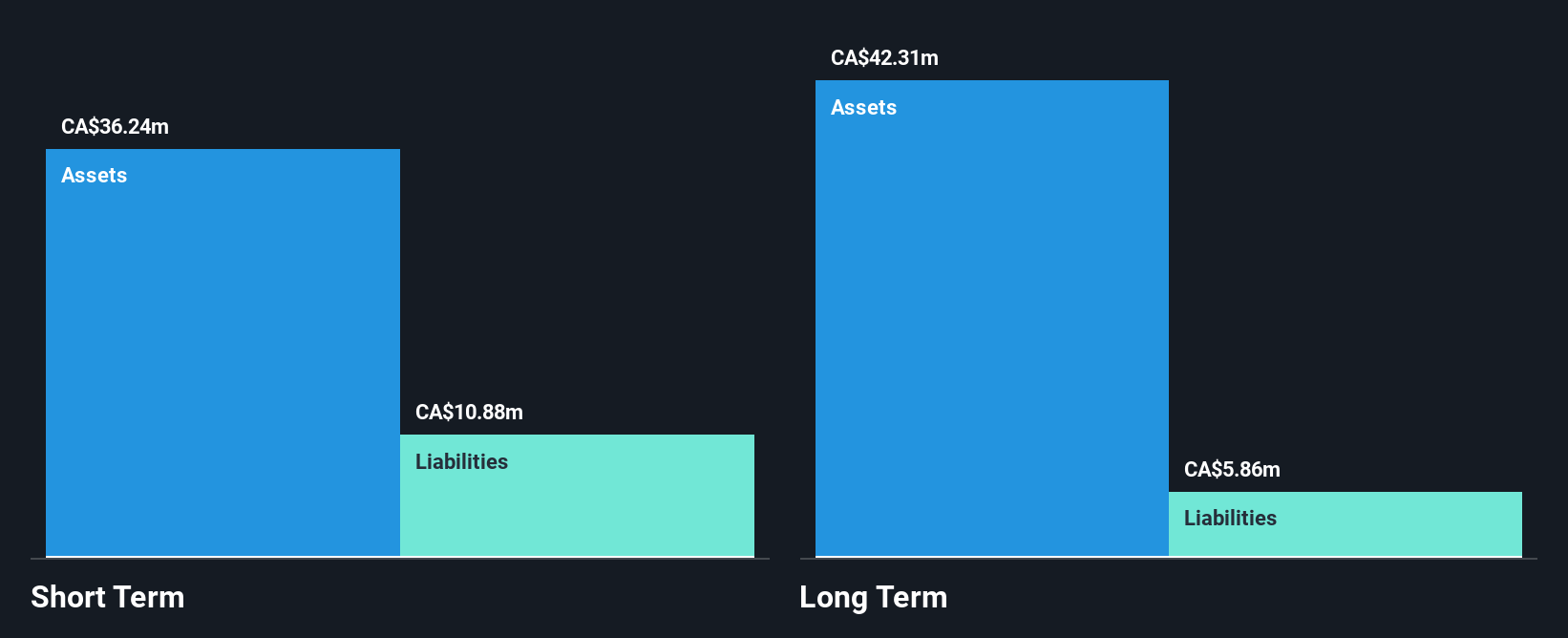

Progressive Planet Solutions Inc., with a market cap of CA$20.43 million, has recently transitioned to profitability, reporting net income of CA$0.623 million for the second quarter ended October 31, 2024. Despite its high volatility compared to Canadian stocks and low return on equity at 9.3%, the company maintains satisfactory debt levels with operating cash flow covering over half its debt. Its management and board are experienced, averaging tenures of 2.5 and 6.8 years respectively, which may provide stability as it navigates financial challenges like short-term asset coverage issues for long-term liabilities totaling CA$10.3 million.

- Click to explore a detailed breakdown of our findings in Progressive Planet Solutions' financial health report.

- Review our historical performance report to gain insights into Progressive Planet Solutions' track record.

SSC Security Services (TSXV:SECU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SSC Security Services Corp. offers physical and cyber security services to corporate and public sector clients in Canada, with a market cap of CA$49.56 million.

Operations: The company generates revenue primarily from its Security segment, which accounts for CA$120.48 million, and a smaller portion from its Corporate segment at CA$4.18 million.

Market Cap: CA$49.56M

SSC Security Services Corp., with a market cap of CA$49.56 million, has recently turned profitable, marking a significant milestone in its financial journey. The company generates substantial revenue from its Security segment at CA$120.48 million, supported by a strong balance sheet with no debt and short-term assets exceeding both short-term and long-term liabilities. Despite trading significantly below estimated fair value, SSC's return on equity remains low at 0.9%. The board's extensive experience enhances governance stability, although the management team's tenure data is insufficient for assessment. A dividend yield of 4.41% raises sustainability concerns due to inadequate earnings coverage.

- Dive into the specifics of SSC Security Services here with our thorough balance sheet health report.

- Explore historical data to track SSC Security Services' performance over time in our past results report.

Next Steps

- Click through to start exploring the rest of the 912 TSX Penny Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bri-Chem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BRY

Bri-Chem

Engages in the wholesale distribution of oilfield chemicals for the oil and gas industry in North America.

Excellent balance sheet and good value.