- Canada

- /

- Commercial Services

- /

- TSXV:KUT

We think RediShred Capital Corp.'s (CVE:KUT) CEO May Struggle To See Much Of A Pay Rise This Year

Share price growth at RediShred Capital Corp. (CVE:KUT) has remained rather flat over the last few years and it may be because earnings has struggled to grow at all. The upcoming AGM on 26 May 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for RediShred Capital

Comparing RediShred Capital Corp.'s CEO Compensation With the industry

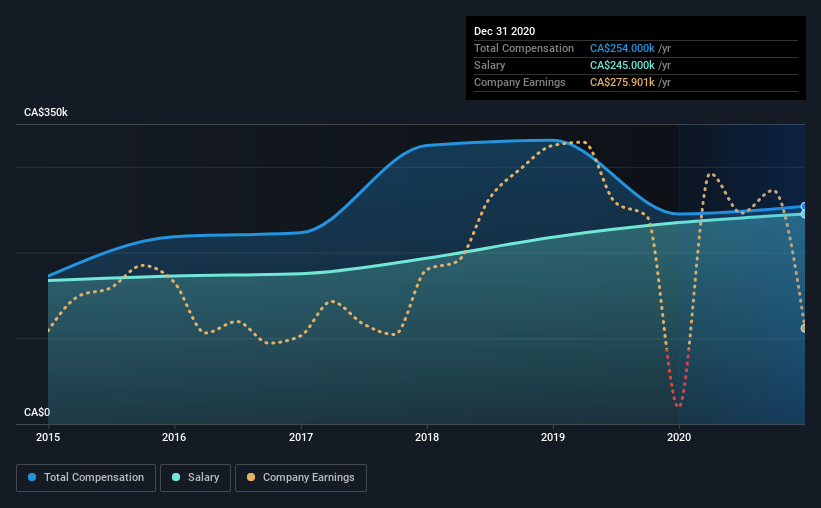

At the time of writing, our data shows that RediShred Capital Corp. has a market capitalization of CA$51m, and reported total annual CEO compensation of CA$254k for the year to December 2020. That's a fairly small increase of 3.6% over the previous year. In particular, the salary of CA$245.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below CA$241m, reported a median total CEO compensation of CA$282k. This suggests that RediShred Capital remunerates its CEO largely in line with the industry average. Furthermore, Jeff Hasham directly owns CA$619k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$245k | CA$235k | 96% |

| Other | CA$9.0k | CA$10k | 4% |

| Total Compensation | CA$254k | CA$245k | 100% |

Speaking on an industry level, nearly 63% of total compensation represents salary, while the remainder of 37% is other remuneration. Investors will find it interesting that RediShred Capital pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at RediShred Capital Corp.'s Growth Numbers

Over the last three years, RediShred Capital Corp. has shrunk its earnings per share by 47% per year. In the last year, its revenue is up 13%.

The decline in EPS is a bit concerning. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has RediShred Capital Corp. Been A Good Investment?

With a total shareholder return of 5.0% over three years, RediShred Capital Corp. has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

RediShred Capital pays its CEO a majority of compensation through a salary. While it's true that the share price growth hasn't been bad, it's hard to overlook the lack of earnings growth and this makes us question whether there will be any strong catalyst for the stock to improve. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for RediShred Capital (1 is a bit concerning!) that you should be aware of before investing here.

Important note: RediShred Capital is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:KUT

RediShred Capital

Operates the Proshred franchise and license business in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives