- Canada

- /

- Commercial Services

- /

- TSXV:GIP

Green Impact Partners Inc. (CVE:GIP) Analysts Are Pretty Bullish On The Stock After Recent Results

Green Impact Partners Inc. (CVE:GIP) came out with its quarterly results last week, and we wanted to see how the business is performing and what industry forecasters think of the company following this report. Revenues were CA$45m, and Green Impact Partners came in a solid 13% ahead of expectations. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Green Impact Partners

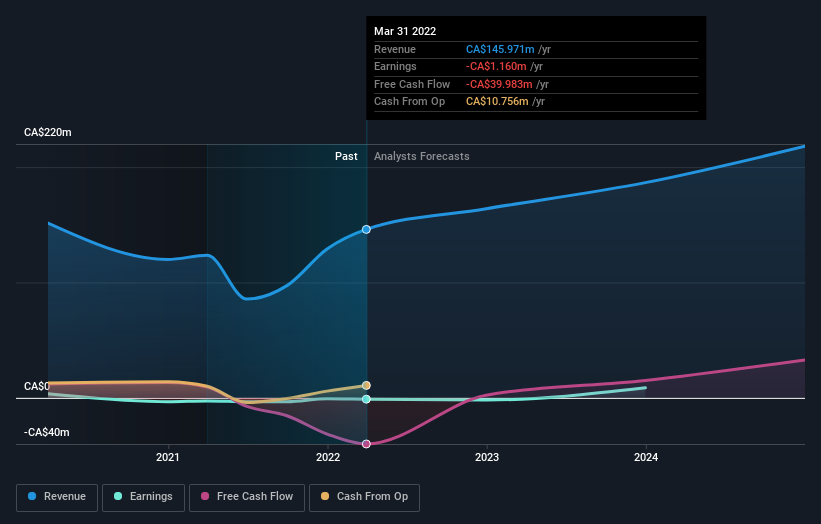

Following the latest results, Green Impact Partners' four analysts are now forecasting revenues of CA$163.9m in 2022. This would be a decent 12% improvement in sales compared to the last 12 months. Losses are forecast to balloon 53% to CA$0.09 per share. Yet prior to the latest earnings, the analysts had been forecasting revenues of CA$159.7m and losses of CA$0.11 per share in 2022. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a cut to loss per share in particular.

It will come as no surprise to learn thatthe analysts have increased their price target for Green Impact Partners 5.1% to CA$12.30on the back of these upgrades. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Green Impact Partners analyst has a price target of CA$14.00 per share, while the most pessimistic values it at CA$11.00. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Green Impact Partners' past performance and to peers in the same industry. The period to the end of 2022 brings more of the same, according to the analysts, with revenue forecast to display 17% growth on an annualised basis. That is in line with its 18% annual growth over the past year. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 10% annually. So although Green Impact Partners is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Green Impact Partners going out to 2024, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Green Impact Partners that you need to be mindful of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GIP

Green Impact Partners

Provides water, waste, and solids treatment and recycling services in Canada and North America.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026