- Canada

- /

- Commercial Services

- /

- TSXV:COO

NatureBank Asset Management Inc. (CVE:COO) Insiders Have Been Selling

It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So before you buy or sell NatureBank Asset Management Inc. (CVE:COO), you may well want to know whether insiders have been buying or selling.

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

Check out our latest analysis for NatureBank Asset Management

The Last 12 Months Of Insider Transactions At NatureBank Asset Management

Notably, that recent sale by Guy O’Loughnane is the biggest insider sale of NatureBank Asset Management shares that we've seen in the last year. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The good news is that this large sale was at well above current price of CA$0.11. So it is hard to draw any strong conclusion from it.

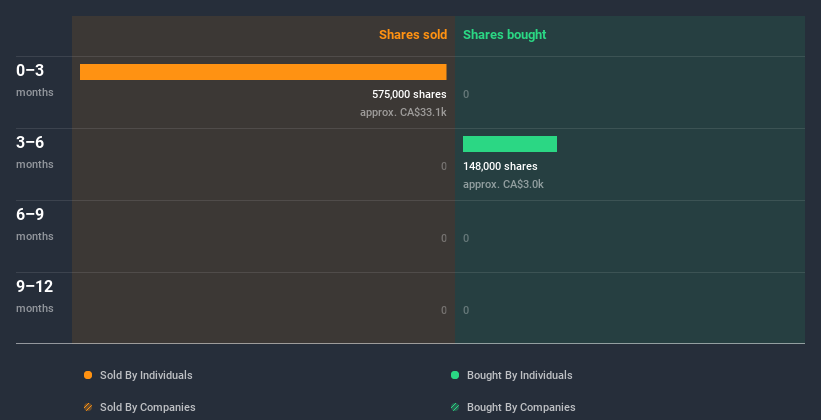

Guy O’Loughnane sold a total of 575.00k shares over the year at an average price of CA$0.17. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like NatureBank Asset Management better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insiders at NatureBank Asset Management Have Sold Stock Recently

The last three months saw significant insider selling at NatureBank Asset Management. In total, Independent Director Guy O’Loughnane sold CA$99k worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. It appears that NatureBank Asset Management insiders own 17% of the company, worth about CA$1.3m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Does This Data Suggest About NatureBank Asset Management Insiders?

An insider sold NatureBank Asset Management shares recently, but they didn't buy any. Despite some insider buying, the longer term picture doesn't make us feel much more positive. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. We're in no rush to buy! So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Case in point: We've spotted 3 warning signs for NatureBank Asset Management you should be aware of, and 2 of these are a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade NatureBank Asset Management, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:COO

Ostrom Climate Solutions

Provides carbon project development and management, climate solutions, and carbon credit marketing services in Canada, Europe, the United States, and internationally.

Medium-low and slightly overvalued.

Market Insights

Community Narratives