This article will reflect on the compensation paid to Derek Webb who has served as CEO of BIOREM Inc. (CVE:BRM) since 2014. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for BIOREM.

Check out our latest analysis for BIOREM

Comparing BIOREM Inc.'s CEO Compensation With the industry

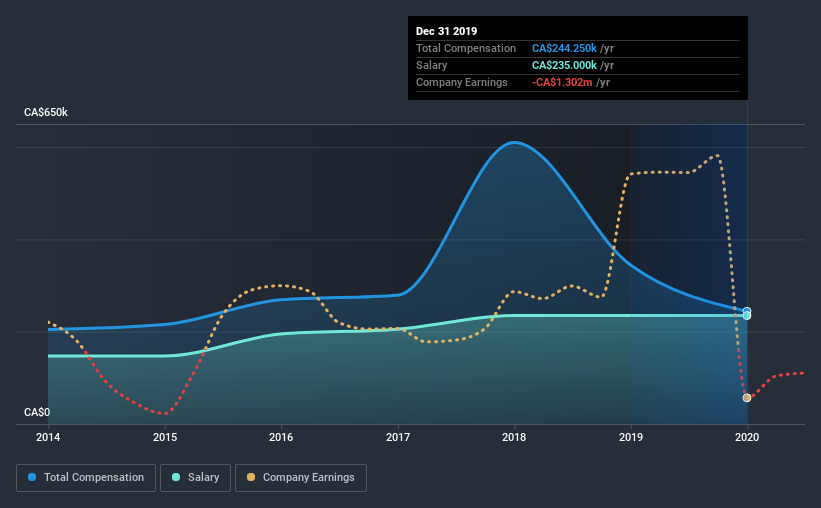

At the time of writing, our data shows that BIOREM Inc. has a market capitalization of CA$15m, and reported total annual CEO compensation of CA$244k for the year to December 2019. Notably, that's a decrease of 29% over the year before. In particular, the salary of CA$235.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$261m, we found that the median total CEO compensation was CA$284k. This suggests that BIOREM remunerates its CEO largely in line with the industry average. Moreover, Derek Webb also holds CA$120k worth of BIOREM stock directly under their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$235k | CA$235k | 96% |

| Other | CA$9.3k | CA$109k | 4% |

| Total Compensation | CA$244k | CA$344k | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. BIOREM pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

BIOREM Inc.'s Growth

Over the last three years, BIOREM Inc. has shrunk its earnings per share by 3.0% per year. In the last year, its revenue is down 7.1%.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has BIOREM Inc. Been A Good Investment?

With a total shareholder return of 5.3% over three years, BIOREM Inc. has done okay by shareholders. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Derek receives almost all of their compensation through a salary. As we noted earlier, BIOREM pays its CEO in line with similar-sized companies belonging to the same industry. BIOREM has had a poor showing when it comes to EPS growth, and it's tough to say that shareholder returns have done much to excite us. This doesn't compare well with CEO compensation, which is largely in line with the industry median. We wouldn't go as far as saying CEO compensation is inappropriate, but we don't think the executive is underpaid.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for BIOREM that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade BIOREM, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BioRem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:BRM

BioRem

A clean technology engineering company, designs, manufactures, distributes, and sells air pollution control systems that are used to eliminate odors, volatile organic compounds, and hazardous air pollutants.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026