- Canada

- /

- Professional Services

- /

- TSX:LWRK

Here's Why We Think Morneau Shepell (TSE:MSI) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Morneau Shepell (TSE:MSI). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Morneau Shepell

How Fast Is Morneau Shepell Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Morneau Shepell has grown EPS by 10% per year. That's a good rate of growth, if it can be sustained.

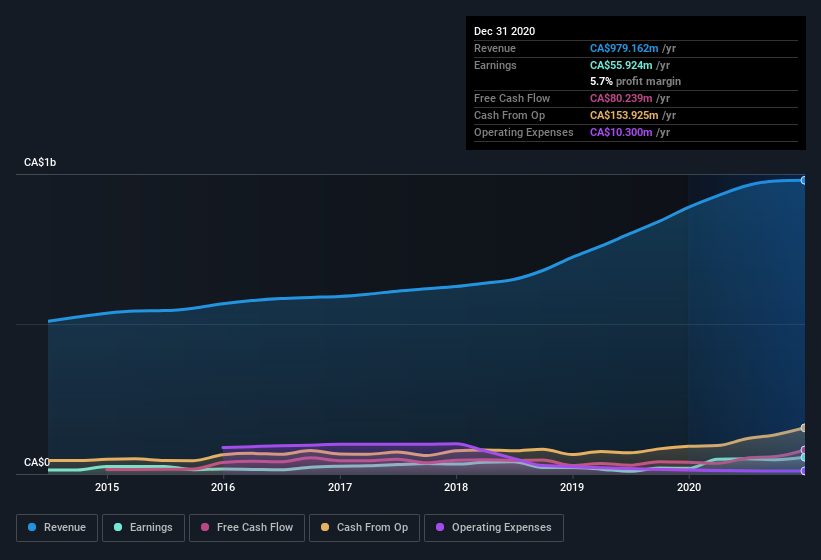

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Morneau Shepell maintained stable EBIT margins over the last year, all while growing revenue 10% to CA$979m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Morneau Shepell's future profits.

Are Morneau Shepell Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Over the last 12 months Morneau Shepell insiders spent CA$154k more buying shares than they received from selling them. On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by Independent Director Luc Bachand for CA$113k worth of shares, at about CA$28.23 per share.

Does Morneau Shepell Deserve A Spot On Your Watchlist?

As I already mentioned, Morneau Shepell is a growing business, which is what I like to see. Not every business can grow its EPS, but Morneau Shepell certainly can. The gravy on the mushroom pie is the insider buying, which has me tasting potential opportunity; one for the watchlist, I'd posit. However, before you get too excited we've discovered 3 warning signs for Morneau Shepell (1 is concerning!) that you should be aware of.

As a growth investor I do like to see insider buying. But Morneau Shepell isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:LWRK

LifeWorks

LifeWorks Inc. provides digital and in-person solutions for wellbeing of individuals in Canada, the United States and internationally.

Moderate growth potential unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives