The board of LifeWorks Inc. (TSE:LWRK) has announced that it will pay a dividend of CA$0.065 per share on the 15th of July. The dividend yield will be 2.4% based on this payment which is still above the industry average.

Check out our latest analysis for LifeWorks

LifeWorks Doesn't Earn Enough To Cover Its Payments

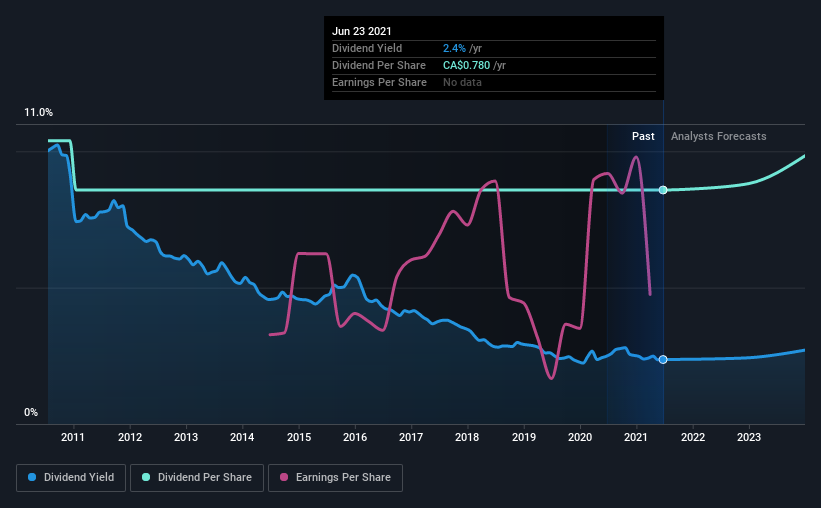

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, LifeWorks' dividend was higher than its profits, but the free cash flows quite comfortably covered it. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Earnings per share is forecast to rise by 89.8% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could reach 106%, which probably can't continue putting some pressure on the balance sheet.

LifeWorks Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2011, the first annual payment was CA$0.94, compared to the most recent full-year payment of CA$0.78. The dividend has shrunk at around 1.9% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend's Growth Prospects Are Limited

The company's investors will be pleased to have been receiving dividend income for some time. Earnings has been rising at 4.8% per annum over the last five years, which admittedly is a bit slow. With such low earnings growth, paying out more than double what it is earning is setting up LifeWorks to have to cut earnings in the future.

Our Thoughts On LifeWorks' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 4 warning signs for LifeWorks (of which 1 is a bit unpleasant!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:LWRK

LifeWorks

LifeWorks Inc. provides digital and in-person solutions for wellbeing of individuals in Canada, the United States and internationally.

Moderate growth potential unattractive dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026