- Canada

- /

- Commercial Services

- /

- TSX:GFL

TSX Value Stock Picks That May Be Undervalued In October 2024

Reviewed by Simply Wall St

As the Canadian TSX has experienced a solid 14% rise over the first three quarters of the year, recent volatility has emerged due to uncertainties surrounding the U.S. labor market, geopolitical tensions in the Middle East, and an impending U.S. presidential election. Despite these challenges, with economic fundamentals remaining robust and interest rates potentially on a downward trend through 2025, investors may find opportunities in stocks that appear undervalued relative to their intrinsic worth amidst these fluctuating conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$183.64 | CA$360.85 | 49.1% |

| Computer Modelling Group (TSX:CMG) | CA$11.86 | CA$21.92 | 45.9% |

| Endeavour Mining (TSX:EDV) | CA$30.20 | CA$55.71 | 45.8% |

| Kinaxis (TSX:KXS) | CA$165.00 | CA$283.17 | 41.7% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Bragg Gaming Group (TSX:BRAG) | CA$6.74 | CA$10.61 | 36.5% |

| Lithium Royalty (TSX:LIRC) | CA$6.10 | CA$8.91 | 31.5% |

| Blackline Safety (TSX:BLN) | CA$6.28 | CA$11.00 | 42.9% |

| Boyd Group Services (TSX:BYD) | CA$212.81 | CA$342.27 | 37.8% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Let's explore several standout options from the results in the screener.

AtkinsRéalis Group (TSX:ATRL)

Overview: AtkinsRéalis is an integrated professional services and project management company operating globally, with a market cap of CA$10.45 billion.

Operations: The company's revenue segments include Capital at CA$127.40 million, Nuclear at CA$1.20 billion, and LSTK Projects at CA$318.44 million.

Estimated Discount To Fair Value: 22.9%

AtkinsRéalis Group is trading at CA$59.52, below its estimated fair value of CA$77.15, suggesting it may be undervalued based on cash flows. Despite a low forecasted return on equity of 13.5%, the company anticipates significant annual earnings growth of 26.3% over the next three years, outpacing Canadian market expectations. However, its debt coverage by operating cash flow remains inadequate, which could pose financial challenges despite strong project engagements and strategic expansions in infrastructure and engineering sectors globally.

- Our growth report here indicates AtkinsRéalis Group may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of AtkinsRéalis Group stock in this financial health report.

Boyd Group Services (TSX:BYD)

Overview: Boyd Group Services Inc. operates non-franchised collision repair centers across North America and has a market cap of approximately CA$4.54 billion.

Operations: The company generates revenue of $3.04 billion from its automotive collision repair and related services in North America.

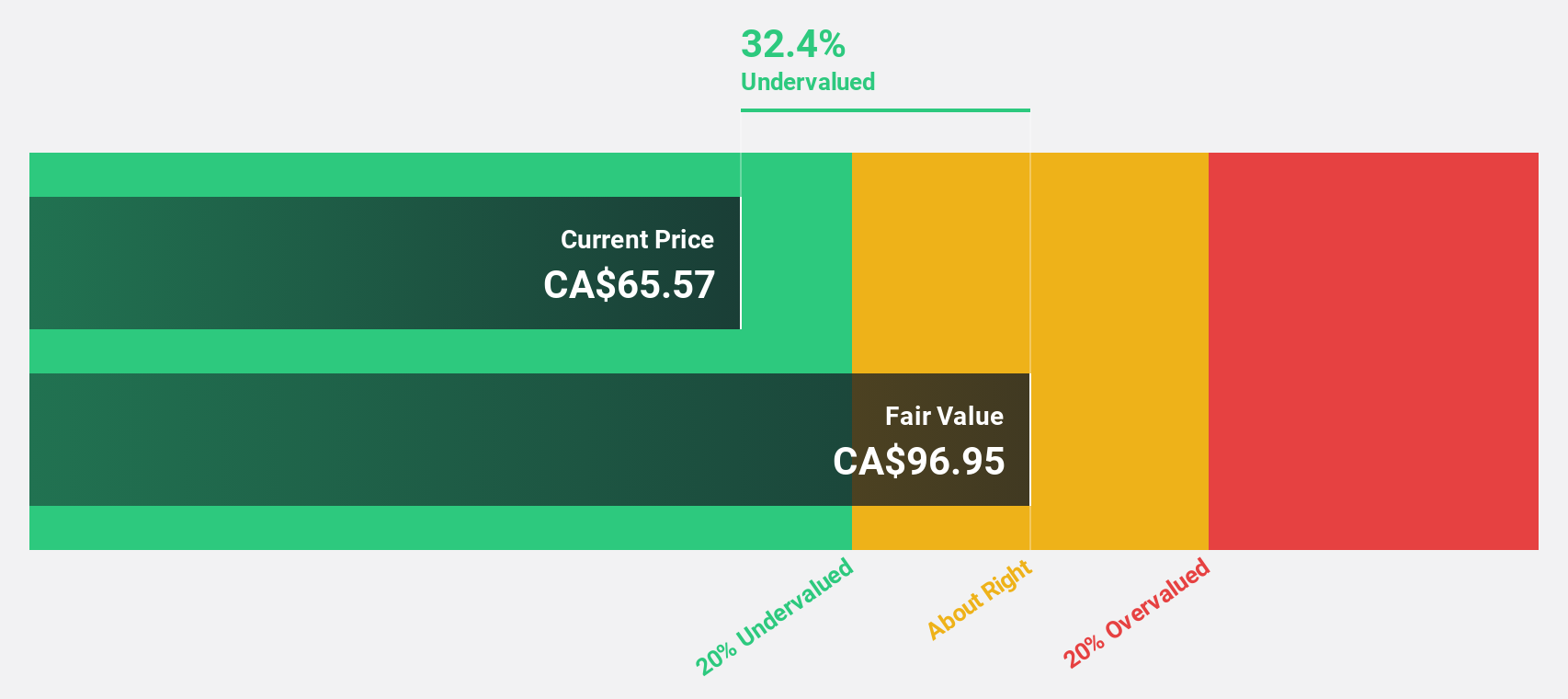

Estimated Discount To Fair Value: 37.8%

Boyd Group Services is trading at CA$212.81, below its estimated fair value of CA$342.27, highlighting its potential undervaluation based on cash flows. Earnings are expected to grow significantly at 44.6% annually over the next three years, surpassing Canadian market growth forecasts. Despite this robust earnings outlook, Boyd's interest payments are not well covered by earnings, which could affect financial stability. Recent leadership changes and consistent dividend payouts may influence future performance dynamics.

- Insights from our recent growth report point to a promising forecast for Boyd Group Services' business outlook.

- Dive into the specifics of Boyd Group Services here with our thorough financial health report.

GFL Environmental (TSX:GFL)

Overview: GFL Environmental Inc. provides non-hazardous solid waste management and environmental services across Canada and the United States, with a market cap of CA$21.79 billion.

Operations: The company's revenue segments include CA$4.79 billion from U.S. solid waste, CA$2.16 billion from Canadian solid waste, and CA$1.67 billion from environmental services.

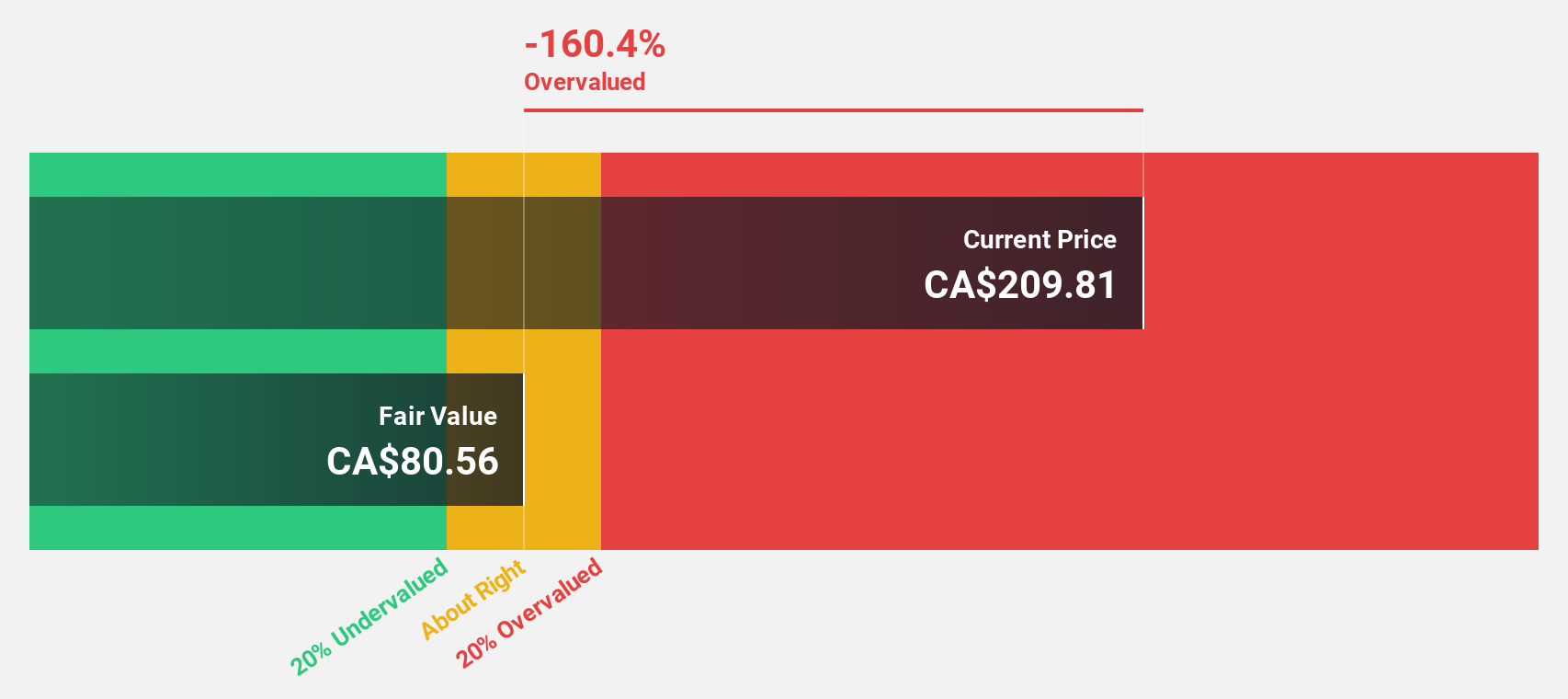

Estimated Discount To Fair Value: 30.3%

GFL Environmental, trading at CA$56.12, is significantly undervalued with an estimated fair value of CA$80.56. Despite recent net losses, GFL's revenue growth is projected to outpace the Canadian market, and profitability is expected within three years. The company's strategic debt refinancing through a US$210 million bond issue aims to enhance financial flexibility by transitioning from secured to unsecured debt. However, shareholder dilution remains a concern amidst these positive cash flow prospects.

- The analysis detailed in our GFL Environmental growth report hints at robust future financial performance.

- Get an in-depth perspective on GFL Environmental's balance sheet by reading our health report here.

Make It Happen

- Dive into all 24 of the Undervalued TSX Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GFL

GFL Environmental

Offers non-hazardous solid waste management and environmental services in Canada and the United States.

Reasonable growth potential and fair value.