- Canada

- /

- Commercial Services

- /

- TSX:EFN

How a Dividend Hike and Buyback at Element Fleet (TSX:EFN) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In November 2024, Element Fleet Management increased its annual dividend by 8% and maintained an active share buyback program, reinforcing its focus on returning capital to shareholders.

- This growing commitment to shareholder distributions reflects management’s confidence in Element’s financial health and capacity to generate sustainable free cash flow.

- We'll explore how Element Fleet Management’s stronger dividend growth outlook shapes the company’s investment narrative moving forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Element Fleet Management Investment Narrative Recap

Shareholders in Element Fleet Management must believe in the company’s ability to maintain service revenue growth by winning new clients and capitalizing on technology-driven fleet solutions. The recent 8% dividend increase and continued buybacks support confidence but do not materially change the near-term catalyst of growing new client conversions or the risk posed by high debt and potential funding cost increases.

Of the many company updates, Element’s launch of Element Mobility in July 2025 speaks directly to the investment narrative. This focus on scalable, tech-based fleet services ties back to long-term service revenue expansion and operational resilience, central to overcoming potential market maturity risks while supporting management’s conviction in ongoing shareholder returns.

However, investors should also recognize that despite increased shareholder payouts, the risk of higher funding costs in a changing interest rate environment...

Read the full narrative on Element Fleet Management (it's free!)

Element Fleet Management's outlook forecasts $1.2 billion in revenue and $572.4 million in earnings by 2028. This projection assumes a 10.9% annual revenue decline and an earnings increase of $168.6 million from the current $403.8 million.

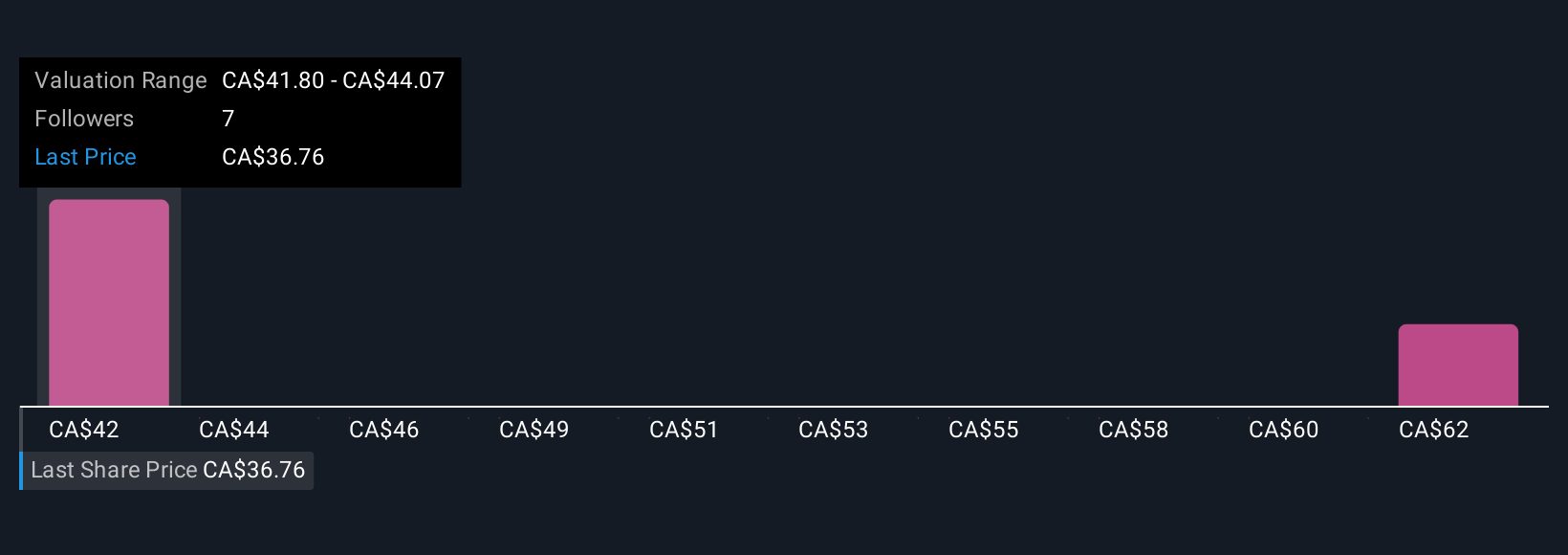

Uncover how Element Fleet Management's forecasts yield a CA$41.80 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Individual fair value estimates from the Simply Wall St Community range between C$41.80 and C$64.20, with two unique perspectives submitted. While some see significant upside, others are more conservative, emphasizing that the company’s strong recent dividend growth does not remove the importance of managing debt and funding costs. Explore how these differences can influence your own viewpoint.

Explore 2 other fair value estimates on Element Fleet Management - why the stock might be worth just CA$41.80!

Build Your Own Element Fleet Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Element Fleet Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Element Fleet Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Element Fleet Management's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Element Fleet Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFN

Element Fleet Management

Operates as a fleet management company primarily in Canada, the United States, Mexico, Australia, and New Zealand.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026