- Canada

- /

- Commercial Services

- /

- TSX:DCM

Auditors Have Doubts About DATA Communications Management (TSE:DCM)

Unfortunately for shareholders, when DATA Communications Management Corp. (TSE:DCM) reported results for the period to December 2020, its auditors, PricewaterhouseCoopers LLP, expressed uncertainty about whether it can continue as a going concern. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Given its situation, it may not be in a good position to raise capital on favorable terms. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

See our latest analysis for DATA Communications Management

What Is DATA Communications Management's Net Debt?

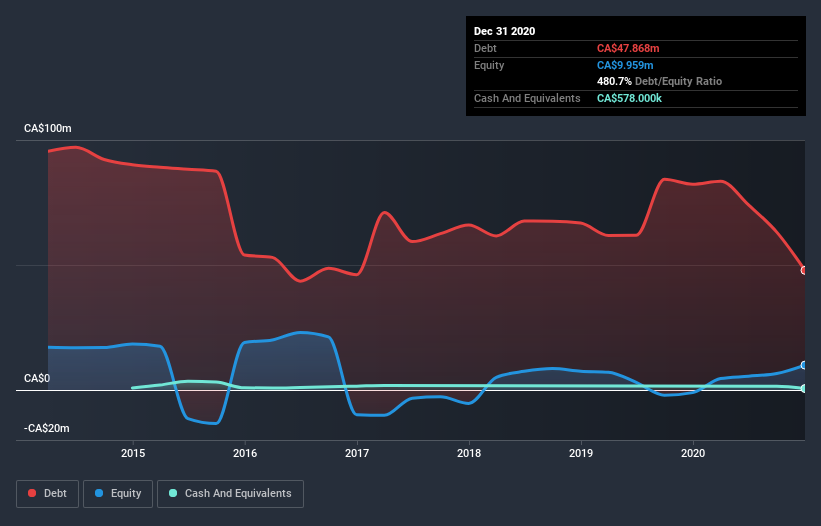

The image below, which you can click on for greater detail, shows that DATA Communications Management had debt of CA$47.9m at the end of December 2020, a reduction from CA$82.3m over a year. Net debt is about the same, since the it doesn't have much cash.

How Strong Is DATA Communications Management's Balance Sheet?

The latest balance sheet data shows that DATA Communications Management had liabilities of CA$60.9m due within a year, and liabilities of CA$93.0m falling due after that. Offsetting this, it had CA$578.0k in cash and CA$65.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$88.1m.

The deficiency here weighs heavily on the CA$30.7m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, DATA Communications Management would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though DATA Communications Management's debt is only 2.5, its interest cover is really very low at 2.2. This does suggest the company is paying fairly high interest rates. Either way there's no doubt the stock is using meaningful leverage. Notably, DATA Communications Management's EBIT launched higher than Elon Musk, gaining a whopping 634% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since DATA Communications Management will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, DATA Communications Management actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

We feel some trepidation about DATA Communications Management's difficulty level of total liabilities, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. We think that DATA Communications Management's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for DATA Communications Management you should be aware of, and 2 of them are potentially serious.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade DATA Communications Management, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:DCM

DATA Communications Management

Provides print and digital solution to simplify complex marketing communication and operations workflows in the United States and Canada.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives