- Canada

- /

- Professional Services

- /

- TSX:CWL

Does Caldwell Partners International (TSE:CWL) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Caldwell Partners International (TSE:CWL). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Caldwell Partners International

How Quickly Is Caldwell Partners International Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. It certainly is nice to see that Caldwell Partners International has managed to grow EPS by 26% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

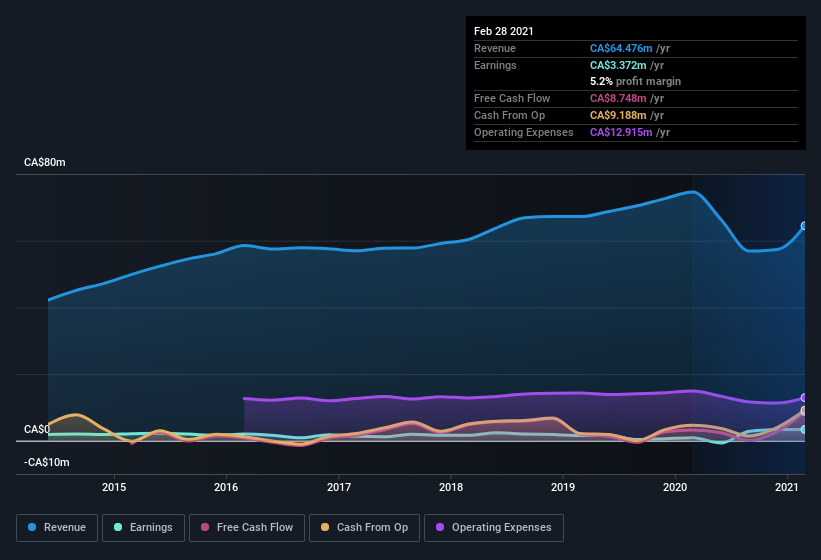

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Caldwell Partners International's EBIT margins are flat but, of some concern, its revenue is actually down. And that does make me a little more cautious of the stock.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Caldwell Partners International is no giant, with a market capitalization of CA$39m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Caldwell Partners International Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that Caldwell Partners International insiders spent a whopping CA$4.7m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the Director, David Windley, who made the biggest single acquisition, paying CA$1.6m for shares at about CA$0.91 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Caldwell Partners International insiders own more than a third of the company. Actually, with 37% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Of course, Caldwell Partners International is a very small company, with a market cap of only CA$39m. So despite a large proportional holding, insiders only have CA$14m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Should You Add Caldwell Partners International To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Caldwell Partners International's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Caldwell Partners International that you should be aware of.

As a growth investor I do like to see insider buying. But Caldwell Partners International isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CWL

Caldwell Partners International

Provides candidate research and sourcing services in Canada, the United States, and Europe.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.