- Canada

- /

- Professional Services

- /

- TSX:CWL

Caldwell Partners International's (TSE:CWL) Shareholders May Want To Dig Deeper Than Statutory Profit

The recent earnings posted by The Caldwell Partners International Inc. (TSE:CWL) were solid, but the stock didn't move as much as we expected. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

Check out our latest analysis for Caldwell Partners International

Examining Cashflow Against Caldwell Partners International's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

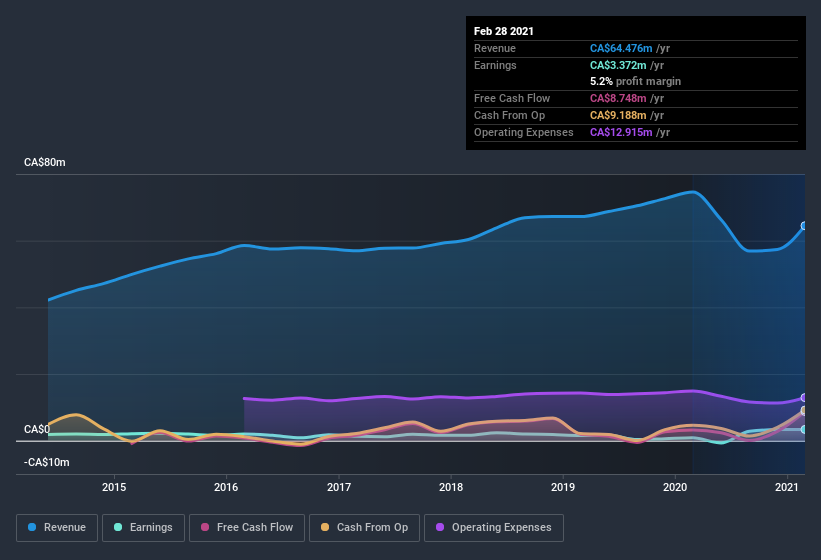

Over the twelve months to February 2021, Caldwell Partners International recorded an accrual ratio of -0.65. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of CA$8.7m during the period, dwarfing its reported profit of CA$3.37m. Caldwell Partners International shareholders are no doubt pleased that free cash flow improved over the last twelve months. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Caldwell Partners International.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Caldwell Partners International increased the number of shares on issue by 25% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Caldwell Partners International's EPS by clicking here.

How Is Dilution Impacting Caldwell Partners International's Earnings Per Share? (EPS)

As you can see above, Caldwell Partners International has been growing its net income over the last few years, with an annualized gain of 109% over three years. And the 293% profit boost in the last year certainly seems impressive at first glance. But in comparison, EPS only increased by 277% over the same period. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Caldwell Partners International can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

The Impact Of Unusual Items On Profit

While the accrual ratio might bode well, we also note that Caldwell Partners International's profit was boosted by unusual items worth CA$1.6m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Caldwell Partners International had a rather significant contribution from unusual items relative to its profit to February 2021. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Caldwell Partners International's Profit Performance

Summing up, Caldwell Partners International's accrual ratio suggests that its statutory earnings are well matched by cash flow while its unusual items boosted the profit in a way that might not be repeated. Meanwhile, the dilution was a negative for shareholders. Based on these factors, we think that Caldwell Partners International's statutory profits probably make it seem better than it is on an underlying level. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 4 warning signs with Caldwell Partners International, and understanding these bad boys should be part of your investment process.

Our examination of Caldwell Partners International has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Caldwell Partners International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CWL

Caldwell Partners International

Provides candidate research and sourcing services in Canada, the United States, and Europe.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.