- Canada

- /

- Commercial Services

- /

- TSX:CGY

These Factors Make Calian Group Ltd. (TSE:CGY) An Interesting Investment

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As an investor, I look for investments which does not compromise one fundamental factor for another. By this I mean, I look at stocks holistically, from their financial health to their future outlook. In the case of Calian Group Ltd. (TSE:CGY), it is a well-regarded dividend-paying company that has been able to sustain great financial health over the past. Below, I've touched on some key aspects you should know on a high level. For those interested in understanding where the figures come from and want to see the analysis, take a look at the report on Calian Group here.

Excellent balance sheet established dividend payer

CGY's strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This implies that CGY manages its cash and cost levels well, which is a crucial insight into the health of the company. CGY seems to have put its debt to good use, generating operating cash levels of 1.17x total debt in the most recent year. This is also a good indication as to whether debt is properly covered by the company’s cash flows.

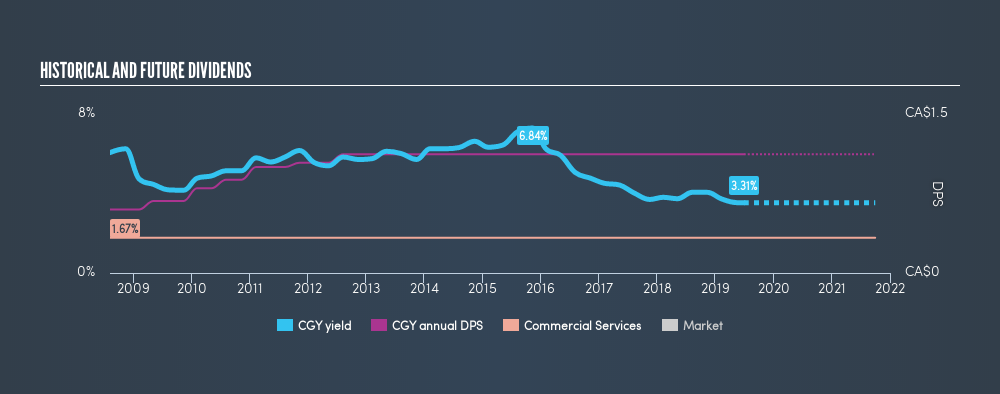

For those seeking income streams from their portfolio, CGY is a robust dividend payer as well. Over the past decade, the company has consistently increased its dividend payout, reaching a yield of 3.3%.

Next Steps:

For Calian Group, I've compiled three relevant factors you should further examine:

- Future Outlook: What are well-informed industry analysts predicting for CGY’s future growth? Take a look at our free research report of analyst consensus for CGY’s outlook.

- Historical Performance: What has CGY's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of CGY? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:CGY

Calian Group

Provides business products and solutions in Canada and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives