- Canada

- /

- Commercial Services

- /

- TSX:CGY

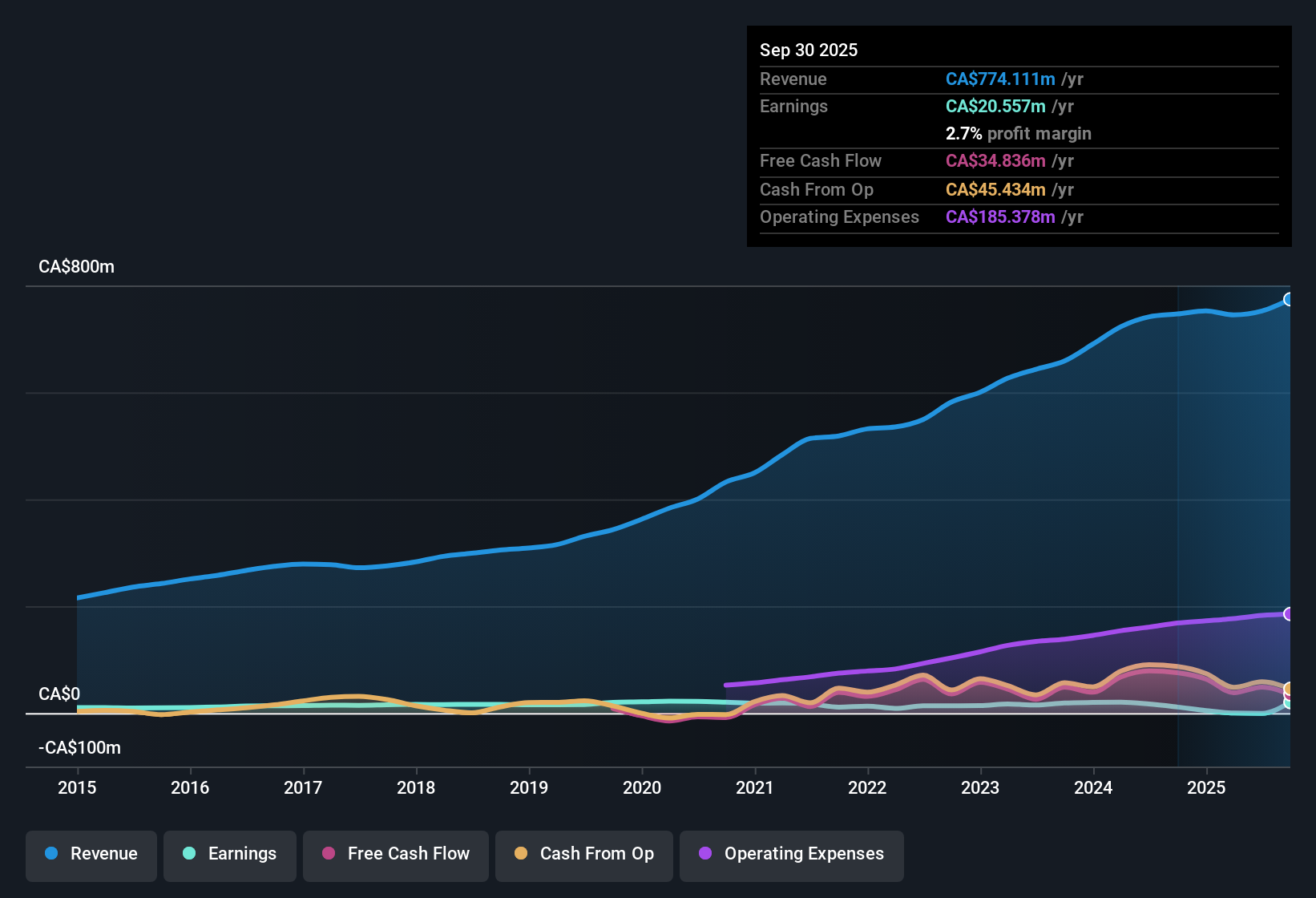

Calian Group (TSX:CGY) Margins Surge to 2.7%, Challenging Profit Sustainability Narratives

Reviewed by Simply Wall St

Calian Group (TSX:CGY) has just unveiled its FY 2025 results, reporting fourth quarter revenue of CA$203.2 million and basic EPS of CA$1.82, with net income excluding extra items at CA$20.6 million. The company has seen revenue climb from CA$184.0 million in Q3 to CA$203.2 million in Q4, while EPS improved sharply from CA$0.05 in the previous quarter. Profit margins expanded alongside strong TTM earnings growth, putting the spotlight on the latest surge in profitability.

See our full analysis for Calian Group.Next up, we take these headline results and compare them to the broader market narrative as we challenge some consensus views and reaffirm others, putting the numbers in context.

See what the community is saying about Calian Group

Profit Margins Jump to 2.7%

- Trailing twelve-month net profit margins increased to 2.7%, up from 1.5% the year before, and annual earnings grew sharply by 83.9% over that stretch.

- The analysts' consensus narrative points out that this improvement is driven not just by core operating gains but also by a CA$6.5 million one-off item.

- This raises a lingering question about how sustainable the higher margins and earnings are, as investors look past temporary boosts to recurring profitability.

- Still, consensus sees consistent margin expansion potential built on higher-value contracts in defense and healthcare. Potential future volatility remains due to segment risk and acquisition integration.

Don't miss how this margin surge fits into the deeper consensus on where Calian goes next. Analysts are split on whether one-off gains or real momentum is driving these results. 📊 Read the full Calian Group Consensus Narrative.

DCF Fair Value Sits Far Above Market

- Shares trade at CA$51.86, which is 53.5% below a DCF fair value estimate of CA$111.55, despite a relatively high P/E ratio of 28.6x compared to peers.

- Analysts' consensus narrative argues this disconnect signals a value opportunity, especially if the company can deliver on forecasts of 26.3% annual profit growth.

- Still, consensus notes the valuation premium versus industry averages means the market may be factoring in the risks of recent earnings volatility and heavy reliance on defense contracts.

- Share price upside could materialize if Calian’s projected margin and revenue growth develop as predicted, closing the discount to fair value.

Dividend Yield Not Fully Covered

- The company’s dividend yield stands at 2.16%, but reported earnings did not fully cover this payout over the past year.

- Consensus narrative highlights that while recurring healthcare contracts support stable cash flows, caution is warranted as ongoing shortfalls in earnings coverage could pressure future payouts.

- Positive cash flow and a healthy balance sheet might mitigate immediate risk, but persistent coverage gaps, if not addressed by higher recurring earnings, could force a reassessment of dividend sustainability.

- Sustained profit growth, rather than reliance on non-recurring items, will be key for maintaining or increasing shareholder returns in the future.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Calian Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on these results? Share your perspective and build your narrative in just a few minutes. Do it your way

A great starting point for your Calian Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Calian Group’s recent results highlight lingering concerns around dividend coverage, as recurring earnings have not fully supported shareholder payouts over the past year.

If dependable income matters to you, check out these 1948 dividend stocks with yields > 3% to find companies offering more reliable, well-supported yields and stronger dividend track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGY

Calian Group

Provides business products and solutions in Canada and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success