- Canada

- /

- Commercial Services

- /

- NEOE:BCBN

3 TSX Penny Stocks Under CA$100M Market Cap

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of economic uncertainty, with central banks offering limited forward guidance and investors closely watching for signals on interest rate adjustments, the potential for volatility remains high. Amidst these conditions, penny stocks—often representing smaller or emerging companies—can still present unique growth opportunities when they exhibit strong financial health. While the term "penny stocks" may seem outdated, their relevance persists as we explore three standout options that combine affordability with promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.86 | CA$72.3M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.79 | CA$23.16M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.335 | CA$2.8M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.32 | CA$48.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.18 | CA$785.05M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.41 | CA$389.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.36 | CA$170.54M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.11 | CA$200.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.70 | CA$8.71M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Base Carbon (NEOE:BCBN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Base Carbon Inc., along with its subsidiaries, offers capital, development expertise, and management operating resources, with a market cap of CA$92.66 million.

Operations: The company generates revenue of $17.25 million from the development and deployment of its projects.

Market Cap: CA$92.66M

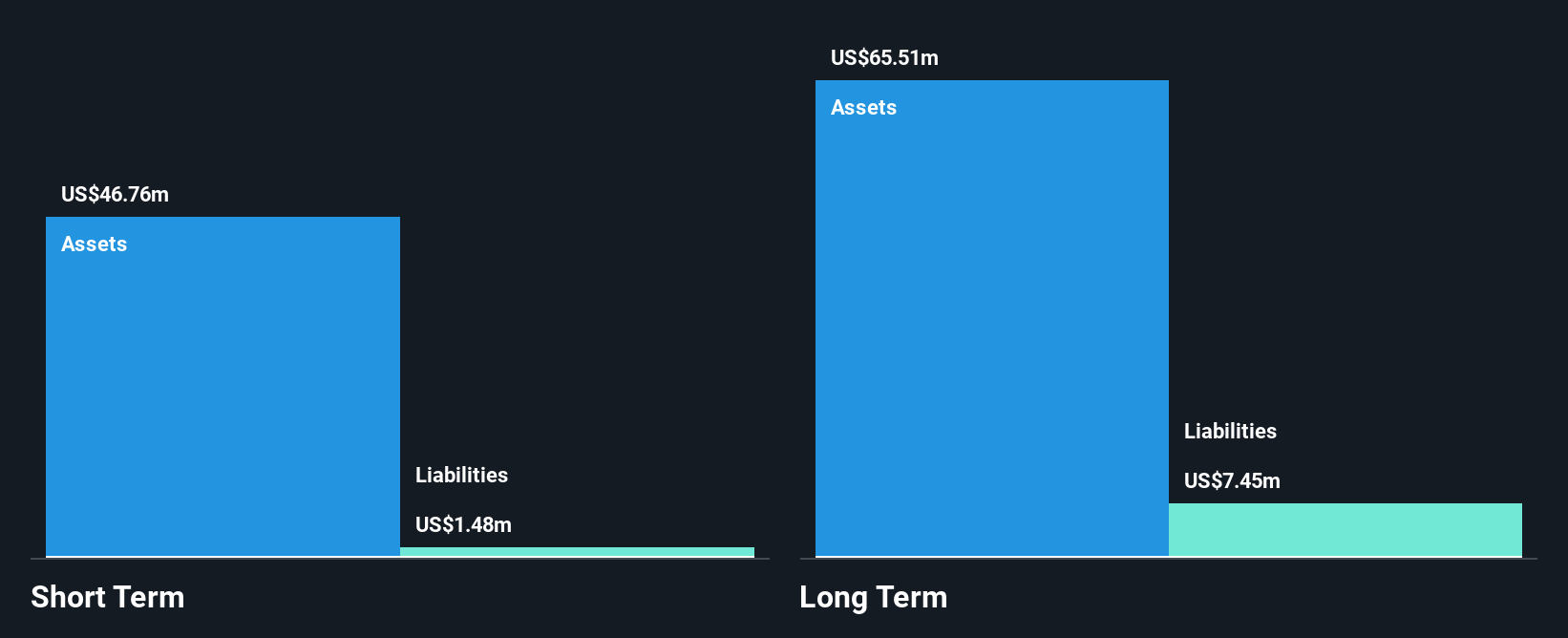

Base Carbon Inc., with a market cap of CA$92.66 million, recently reported improved earnings for the first half of 2025, achieving a net income of US$0.76 million compared to a loss in the previous year. Despite being unprofitable overall and experiencing declining earnings over five years, the company benefits from strong asset coverage with short-term assets significantly exceeding liabilities and no debt on its balance sheet. Trading at 94.3% below estimated fair value suggests potential undervaluation, though volatility remains stable at 9%. The experienced management team and board may provide strategic stability moving forward.

- Click to explore a detailed breakdown of our findings in Base Carbon's financial health report.

- Explore historical data to track Base Carbon's performance over time in our past results report.

Starcore International Mines (TSX:SAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Starcore International Mines Ltd., through its subsidiary Compañia Minera Peña de Bernal, S.A., engages in mining operations with a market cap of CA$26.08 million.

Operations: The company generates revenue from its gold and silver mining operations amounting to CA$31.92 million.

Market Cap: CA$26.08M

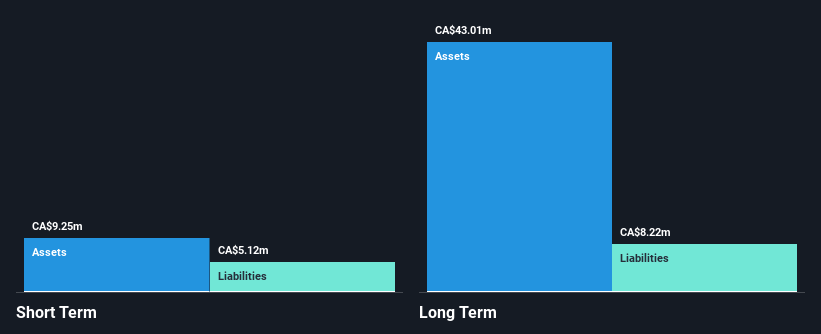

Starcore International Mines Ltd., with a market cap of CA$26.08 million, recently reported first-quarter net income of CA$0.927 million, showing growth from the previous year. Despite this, profit margins have decreased significantly to 2.3% from 12.1%. The company is debt-free and maintains strong asset coverage with short-term assets exceeding both short- and long-term liabilities. However, it faces challenges with high share price volatility and negative earnings growth over the past year. Recent private placements aim to raise CA$1 million for potential expansion opportunities at projects like the San Juan Nepomuceno in Mexico.

- Get an in-depth perspective on Starcore International Mines' performance by reading our balance sheet health report here.

- Learn about Starcore International Mines' historical performance here.

Nevada Lithium Resources (TSXV:NVLH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nevada Lithium Resources Inc. is involved in the acquisition, exploration, and development of mineral properties in the United States and Canada, with a market cap of CA$36.41 million.

Operations: Nevada Lithium Resources Inc. currently does not report any revenue segments.

Market Cap: CA$36.41M

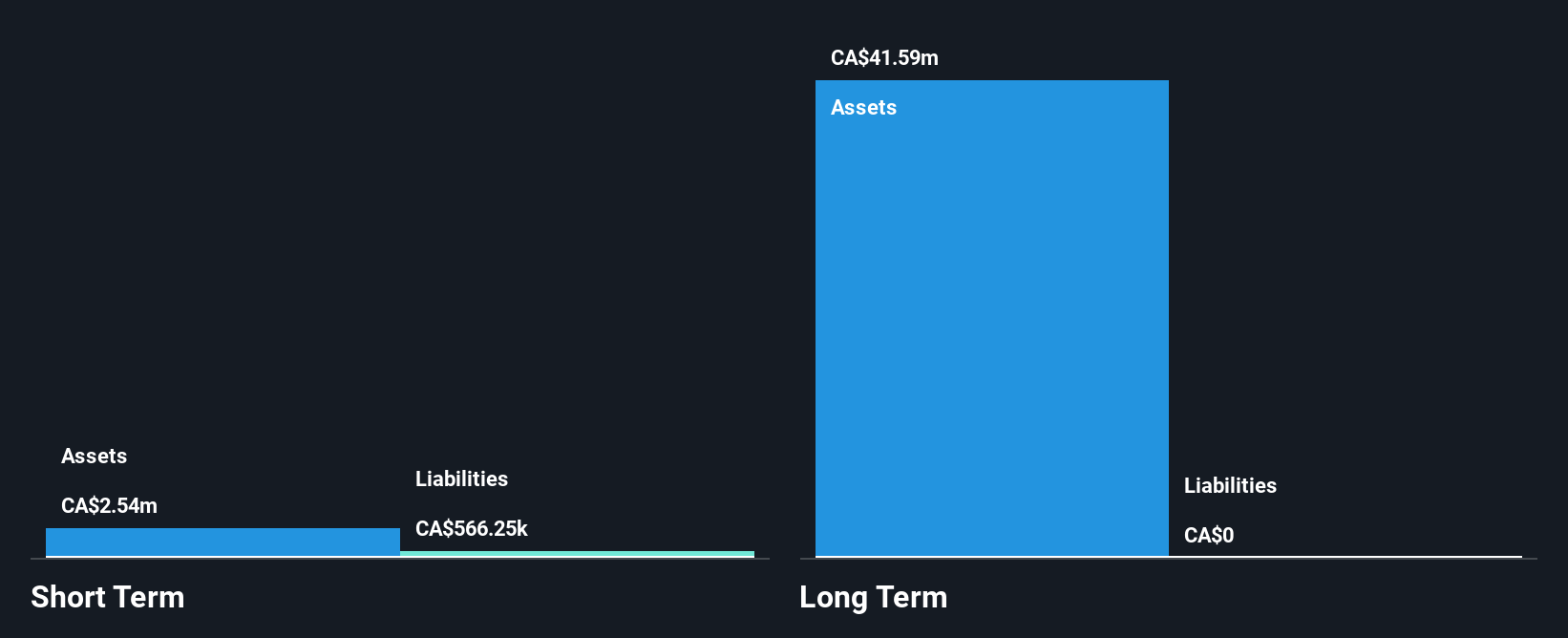

Nevada Lithium Resources Inc., with a market cap of CA$36.41 million, is pre-revenue and debt-free, focusing on mineral exploration. The company's Bonnie Claire lithium project in Nevada has identified significant rubidium and cesium mineralization, potentially enhancing its economic prospects. However, it faces challenges with less than a year of cash runway and an auditor's going concern doubt. Despite this, the recent Preliminary Economic Assessment suggests robust project economics with an after-tax NPV of US$6.83 billion at an 8% discount rate. The management team is experienced but the board lacks tenure stability.

- Unlock comprehensive insights into our analysis of Nevada Lithium Resources stock in this financial health report.

- Gain insights into Nevada Lithium Resources' past trends and performance with our report on the company's historical track record.

Make It Happen

- Get an in-depth perspective on all 411 TSX Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Base Carbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:BCBN

Base Carbon

Provides capital, development expertise, and management operating resources.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives