- Canada

- /

- Trade Distributors

- /

- TSXV:ZDC

Why Investors Shouldn't Be Surprised By Zedcor Inc.'s (CVE:ZDC) 27% Share Price Surge

Zedcor Inc. (CVE:ZDC) shares have continued their recent momentum with a 27% gain in the last month alone. This latest share price bounce rounds out a remarkable 413% gain over the last twelve months.

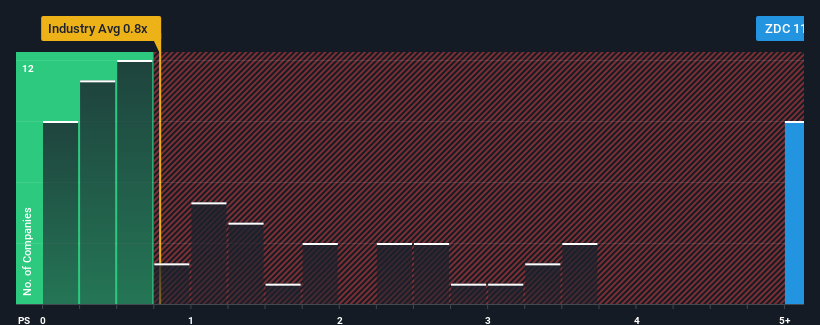

Following the firm bounce in price, given around half the companies in Canada's Trade Distributors industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Zedcor as a stock to avoid entirely with its 11.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Zedcor

How Has Zedcor Performed Recently?

Recent times have been advantageous for Zedcor as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Zedcor will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Zedcor's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. The latest three year period has also seen an excellent 138% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 64% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.2% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Zedcor's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Zedcor's P/S Mean For Investors?

Zedcor's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Zedcor shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 3 warning signs for Zedcor (1 doesn't sit too well with us!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zedcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ZDC

Zedcor

Provides turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives