- Canada

- /

- Consumer Finance

- /

- TSX:GSY

TSX Growth Companies With High Insider Ownership November 2025

Reviewed by Simply Wall St

Amid a subdued short-term growth outlook for Canada, influenced by slower consumer spending and population growth, the market anticipates improvements in 2026 as interest-rate cuts and fiscal stimulus take effect. In this context, identifying growth companies with high insider ownership on the TSX can be advantageous, as these firms often signal confidence from those who know them best and may offer resilience during economic fluctuations.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.8% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.1% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 35.6% | 33.8% |

| Colliers International Group (TSX:CIGI) | 14.0% | 28.7% |

| CEMATRIX (TSX:CEMX) | 10.5% | 58.3% |

| Almonty Industries (TSX:AII) | 12.3% | 65.2% |

We'll examine a selection from our screener results.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★★

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market cap of CA$1.99 billion.

Operations: The company's revenue segments include CA$149.89 million from Easyhome and CA$1.51 billion from Easyfinancial.

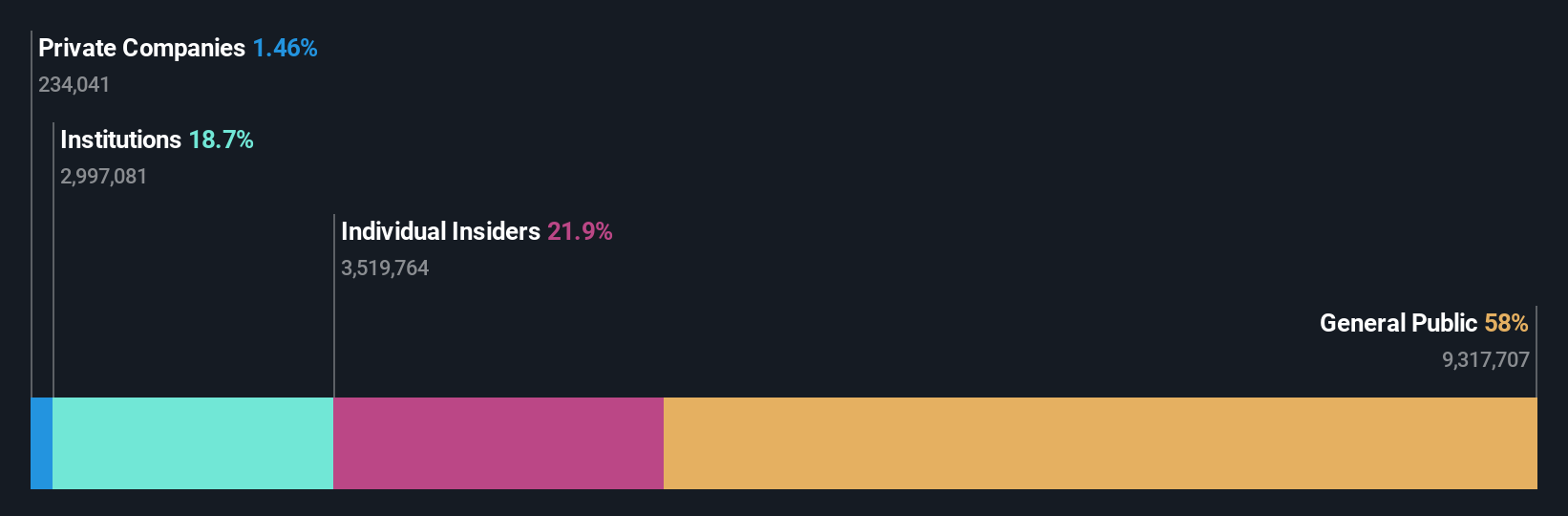

Insider Ownership: 21.7%

Earnings Growth Forecast: 27.3% p.a.

goeasy demonstrates strong growth potential, with revenue and earnings expected to grow significantly faster than the Canadian market. Despite a recent dip in quarterly net income, revenue has increased year-over-year. The company maintains a robust financial position with renewed debt facilities and insider ownership remains stable. However, its dividend is not well covered by free cash flows, which could be a concern for investors prioritizing dividend sustainability.

- Delve into the full analysis future growth report here for a deeper understanding of goeasy.

- Insights from our recent valuation report point to the potential undervaluation of goeasy shares in the market.

Orla Mining (TSX:OLA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orla Mining Ltd. is involved in the acquisition, exploration, development, and exploitation of mineral properties with a market cap of CA$5.55 billion.

Operations: Orla Mining Ltd. generates revenue through its activities in acquiring, exploring, developing, and exploiting mineral properties.

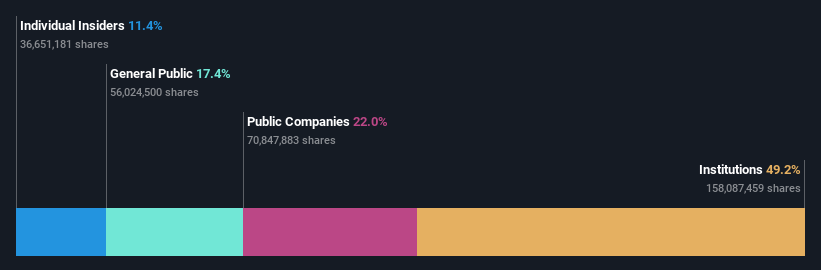

Insider Ownership: 10.3%

Earnings Growth Forecast: 30.3% p.a.

Orla Mining has demonstrated substantial growth, with recent quarterly earnings and revenue showing significant year-on-year increases. Despite no substantial insider buying in the past three months, the company's earnings are forecast to grow significantly faster than the Canadian market. Orla's exploration success at Musselwhite Mine suggests potential for extended mine life and increased production. However, notable insider selling has occurred recently, which may warrant investor attention regarding future ownership dynamics.

- Navigate through the intricacies of Orla Mining with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Orla Mining's share price might be on the expensive side.

Zedcor (TSXV:ZDC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zedcor Inc. offers turnkey and customized mobile surveillance and live monitoring solutions across Canada and the United States, with a market cap of CA$618.60 million.

Operations: The company's revenue segment consists of Security & Surveillance, generating CA$51.37 million.

Insider Ownership: 19.2%

Earnings Growth Forecast: 122.6% p.a.

Zedcor's revenue and earnings are forecast to grow significantly faster than the Canadian market, with revenue expected to rise by 35.4% annually. Despite high-quality earnings, recent results show a mixed net income trend. The company recently secured a $50 million credit facility from National Bank of Canada, enhancing financial flexibility for growth initiatives. While more shares have been bought than sold by insiders recently, notable insider selling occurred over the past quarter.

- Dive into the specifics of Zedcor here with our thorough growth forecast report.

- Our valuation report unveils the possibility Zedcor's shares may be trading at a premium.

Taking Advantage

- Embark on your investment journey to our 46 Fast Growing TSX Companies With High Insider Ownership selection here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Exceptional growth potential, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives