As the Canadian market benefits from easing monetary policies and solid fundamentals, investors are increasingly looking for opportunities to capitalize on economic growth. Penny stocks, though often considered a niche investment, still hold potential for significant returns when backed by strong financial health and growth prospects. In this article, we explore three promising penny stocks that combine robust balance sheets with potential upside, offering a chance to uncover hidden value in smaller companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.35 | CA$158.19M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.68 | CA$281.86M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$115.5M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.21 | CA$374.78M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$231.56M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.39 | CA$994.26M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.10 | CA$30.36M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$5.18M | ★★★★★★ |

Click here to see the full list of 915 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Oceanic Iron Ore (TSXV:FEO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oceanic Iron Ore Corp. is an exploration stage company focused on acquiring and exploring iron ore properties in Québec, Canada, with a market cap of CA$19.25 million.

Operations: Oceanic Iron Ore Corp. has not reported any revenue segments.

Market Cap: CA$19.25M

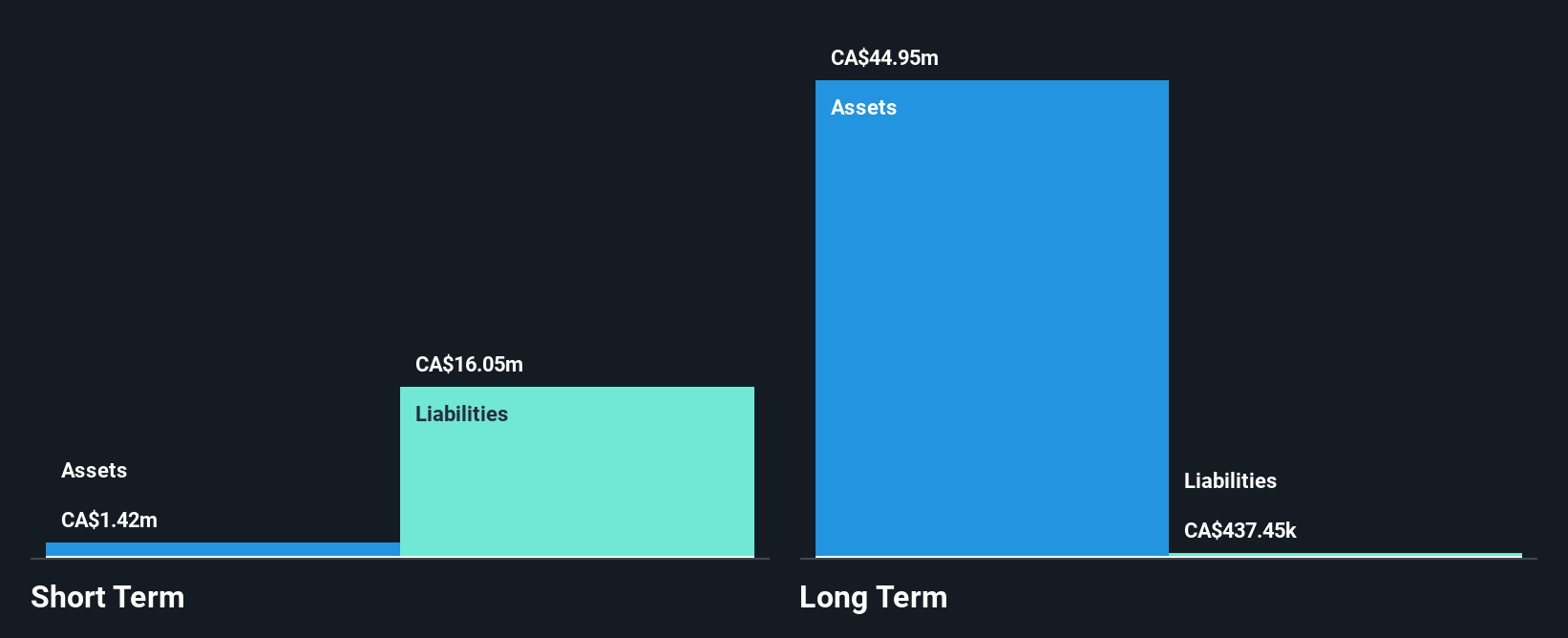

Oceanic Iron Ore Corp., with a market cap of CA$19.25 million, is pre-revenue and has experienced financial challenges, reporting a net loss of CA$3.37 million for Q3 2024. The company recently announced a non-brokered private placement to raise up to CA$2.385 million through convertible debentures, providing potential liquidity but also indicating reliance on external financing. While its weekly volatility remains high compared to most Canadian stocks, Oceanic has sufficient cash runway for over two years if free cash flow grows at historical rates. However, short-term liabilities significantly exceed short-term assets, posing financial risks.

- Unlock comprehensive insights into our analysis of Oceanic Iron Ore stock in this financial health report.

- Learn about Oceanic Iron Ore's historical performance here.

01 Communique Laboratory (TSXV:ONE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 01 Communique Laboratory Inc. and its subsidiaries offer cybersecurity and remote access solutions across the United States, Asia-Pacific, and Canada, with a market cap of CA$7.71 million.

Operations: The company generates revenue of CA$0.46 million from the development and marketing of its communications software.

Market Cap: CA$7.71M

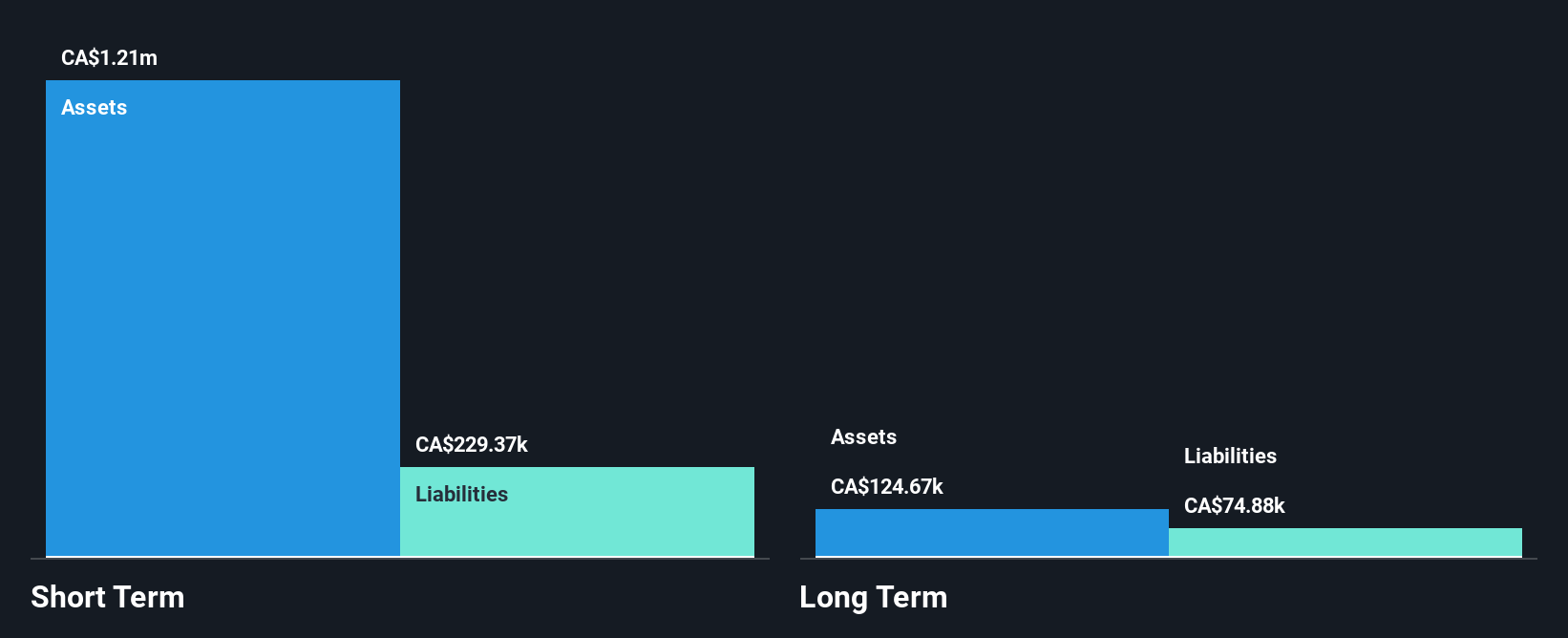

01 Communique Laboratory Inc., with a market cap of CA$7.71 million, is pre-revenue, generating CA$0.46 million annually from its software solutions. The company reported a net loss reduction for Q3 2024 compared to the previous year, indicating some financial improvement despite ongoing unprofitability and negative return on equity (-219.89%). It has no debt and short-term assets (CA$234.4K) exceed liabilities (CA$103.7K), yet it faces less than a year's cash runway based on current free cash flow trends. The stock's volatility remains high relative to most Canadian stocks, reflecting potential investment risk amidst financial instability.

- Take a closer look at 01 Communique Laboratory's potential here in our financial health report.

- Evaluate 01 Communique Laboratory's historical performance by accessing our past performance report.

Thermal Energy International (TSXV:TMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thermal Energy International Inc. develops, engineers, and supplies pollution control products, heat recovery systems, and condensate return solutions across North America, Europe, and internationally with a market cap of CA$31.96 million.

Operations: The company generates revenue from its operations in Ottawa, contributing CA$11.49 million, and Bristol, adding CA$17.67 million.

Market Cap: CA$31.96M

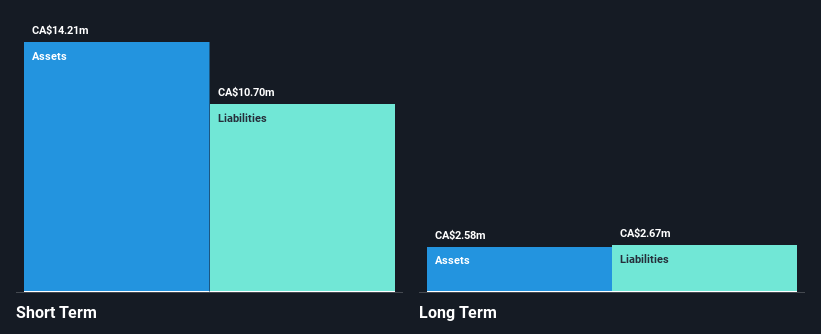

Thermal Energy International Inc., with a market cap of CA$31.96 million, has shown revenue growth, reporting CA$8.47 million in Q1 2025 sales compared to CA$5.18 million the previous year. The company is financially stable with short-term assets exceeding liabilities and debt well-covered by operating cash flow. Recent projects include a significant heat recovery order from a multinational confectionery company and another from a pharmaceutical firm, both contributing to carbon emissions reduction goals and expected to generate revenue within 12 months. However, shareholder dilution occurred over the past year despite profitability improvements over five years.

- Click here to discover the nuances of Thermal Energy International with our detailed analytical financial health report.

- Gain insights into Thermal Energy International's future direction by reviewing our growth report.

Seize The Opportunity

- Investigate our full lineup of 915 TSX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 01 Communique Laboratory might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ONE

01 Communique Laboratory

Provides cyber security and remote access solutions in the United States, Asia-Pacific, and Canada.

Moderate with adequate balance sheet.