As the Canadian market navigates through shifting expectations around U.S. Federal Reserve policies and global economic trends, investors are keenly observing how these factors influence domestic opportunities. Amidst this backdrop, penny stocks—despite their somewhat antiquated name—remain a notable area of interest for those seeking to invest in smaller or newer companies with potential upside. By focusing on financial strength and growth potential, these stocks can offer surprising value, and we've identified three such examples on the TSX that may present intriguing prospects for discerning investors.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.66 | CA$611.6M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$183.79M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$119.12M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.40 | CA$12.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.48 | CA$315.84M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.76 | CA$288.49M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$2.12 | CA$131.04M | ★★★★☆☆ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Nano One Materials (TSX:NANO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nano One Materials Corp. focuses on producing and selling cathode active materials for lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics, with a market cap of CA$117.94 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$117.94M

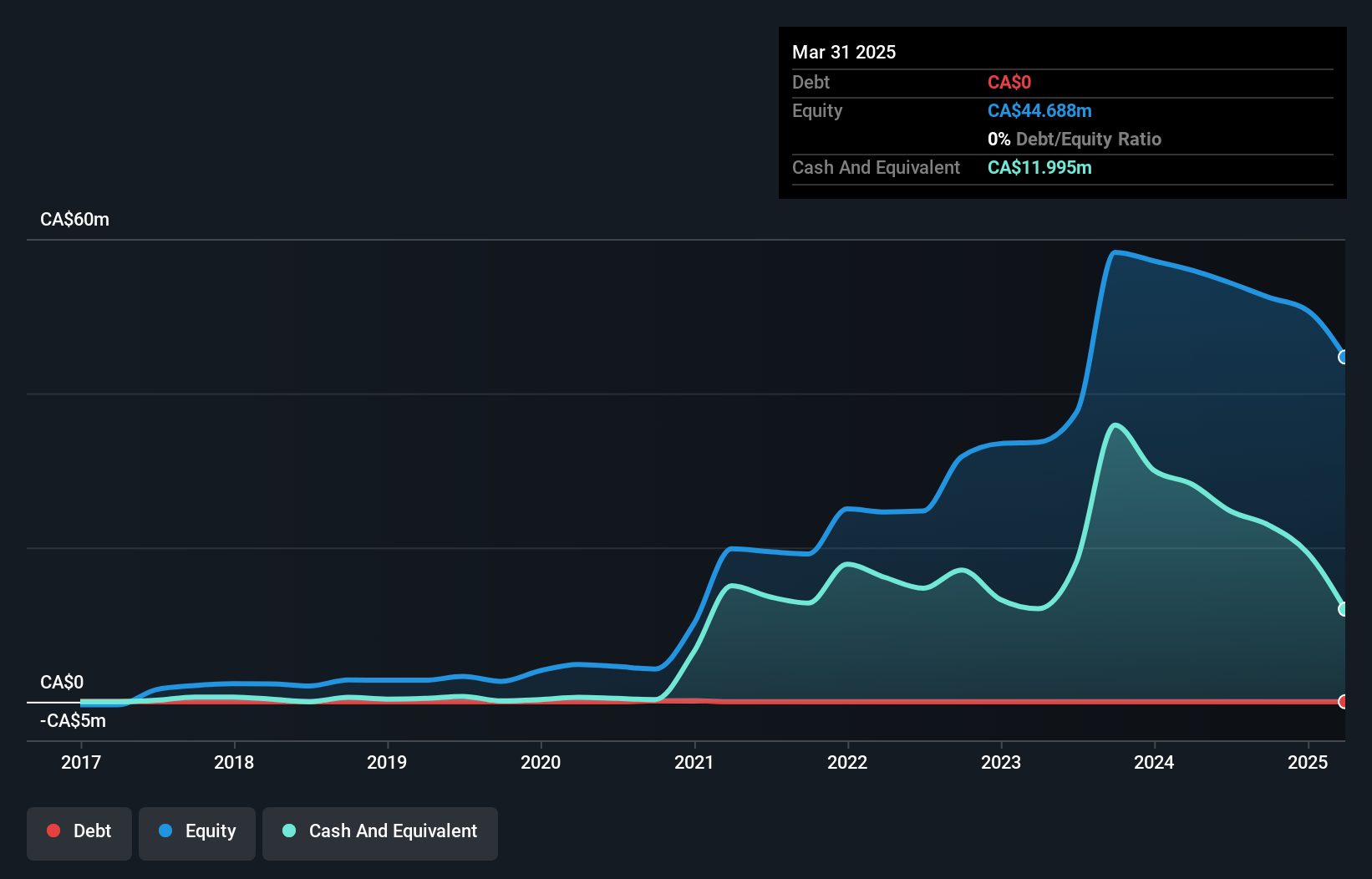

Nano One Materials Corp., with a market cap of CA$117.94 million, remains pre-revenue, focusing on its innovative cathode materials production for lithium-ion batteries. Despite being unprofitable and experiencing increased losses, the company has no debt and maintains short-term assets exceeding liabilities. Recent strategic moves include a CA$17.8 million award to expand production capabilities in Candiac, Quebec, enhancing its competitive edge in North America against China's LFP dominance. Leadership changes bring Anthony Tse as Chair of the Board, whose extensive experience in high-growth technology sectors may support Nano One's strategic and financial objectives moving forward.

- Get an in-depth perspective on Nano One Materials' performance by reading our balance sheet health report here.

- Examine Nano One Materials' earnings growth report to understand how analysts expect it to perform.

E3 Lithium (TSXV:ETL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E3 Lithium Limited focuses on the development and extraction of lithium resources in Alberta, with a market cap of CA$89.57 million.

Operations: E3 Lithium Limited does not currently report any revenue segments.

Market Cap: CA$89.57M

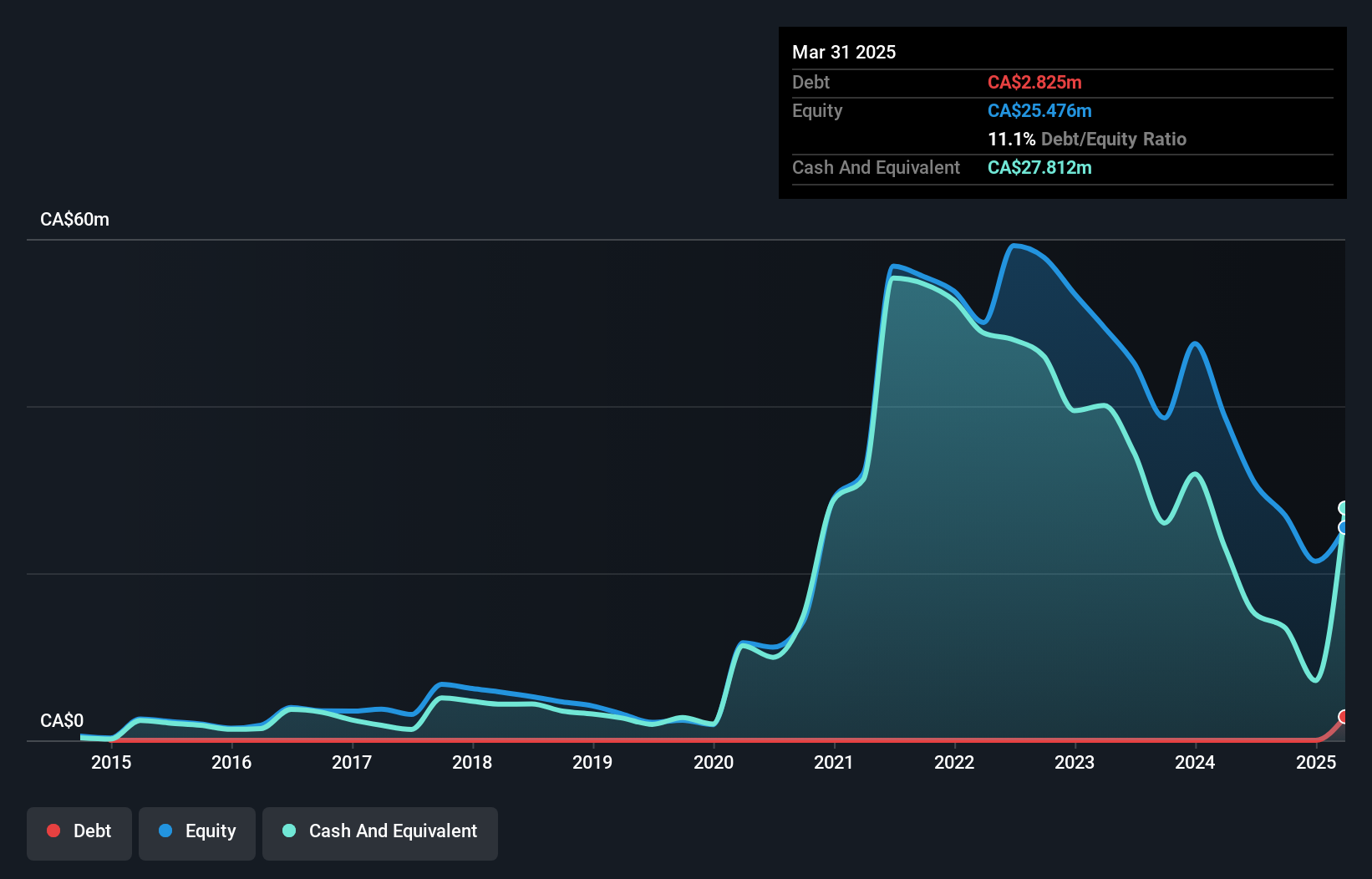

E3 Lithium Limited, with a market cap of CA$89.57 million, is currently pre-revenue and unprofitable, experiencing increased losses over the past five years. The company has no debt and maintains short-term assets exceeding liabilities, providing some financial stability. Recent developments include advancing its strategic plan to construct a Demonstration Facility for producing battery-grade lithium carbonate in Alberta. Successful completion of the Pilot Project funded by NRCan demonstrated high lithium recovery using Direct Lithium Extraction technology, supporting economic viability in their Pre-Feasibility Study. These initiatives position E3 as an emerging contributor to Western Canada's lithium industry growth.

- Click here to discover the nuances of E3 Lithium with our detailed analytical financial health report.

- Review our growth performance report to gain insights into E3 Lithium's future.

Thermal Energy International (TSXV:TMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thermal Energy International Inc. develops, engineers, and supplies pollution control products, heat recovery systems, and condensate return solutions globally with a market cap of CA$38.00 million.

Operations: The company generates revenue from its operations in Ottawa and Bristol, amounting to CA$11.81 million and CA$14.07 million respectively.

Market Cap: CA$38M

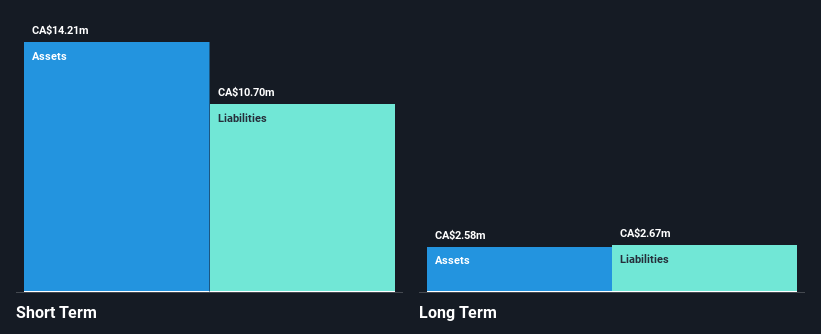

Thermal Energy International Inc., with a market cap of CA$38 million, has shown financial resilience and growth. The company reported sales of CA$25.88 million for the year ending May 31, 2024, up from CA$21.09 million the previous year, alongside net income growth to CA$0.93 million. Its earnings have improved with a current net profit margin of 3.6%, supported by strong interest coverage and reduced debt levels over time. Additionally, Thermal Energy secured a significant heat recovery project worth approximately CAD 2.2 million from a major pharmaceutical client, expected to deliver substantial fuel savings and CO2 emission reductions within a year.

- Click here and access our complete financial health analysis report to understand the dynamics of Thermal Energy International.

- Evaluate Thermal Energy International's prospects by accessing our earnings growth report.

Summing It All Up

- Embark on your investment journey to our 954 TSX Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermal Energy International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TMG

Thermal Energy International

Engages in the development, engineering, and supply of pollution control products, heat recovery systems, and condensate return solutions in North America, Europe, and internationally.

Flawless balance sheet and fair value.