A Quick Analysis On Reko International Group's (CVE:REKO) CEO Compensation

Diane Reko became the CEO of Reko International Group Inc. (CVE:REKO) in 2007, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Reko International Group.

View our latest analysis for Reko International Group

Comparing Reko International Group Inc.'s CEO Compensation With the industry

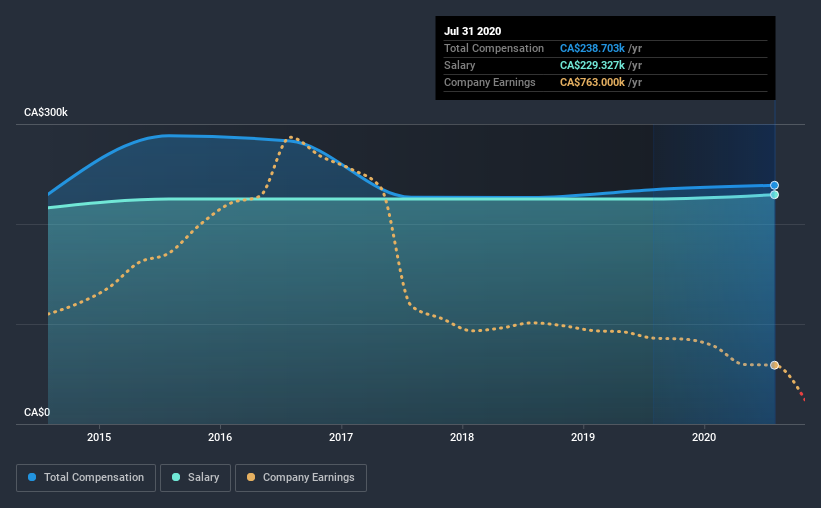

Our data indicates that Reko International Group Inc. has a market capitalization of CA$24m, and total annual CEO compensation was reported as CA$239k for the year to July 2020. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at CA$229.3k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under CA$254m, the reported median total CEO compensation was CA$292k. This suggests that Reko International Group remunerates its CEO largely in line with the industry average. Furthermore, Diane Reko directly owns CA$14m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$229k | CA$225k | 96% |

| Other | CA$9.4k | CA$9.4k | 4% |

| Total Compensation | CA$239k | CA$234k | 100% |

Speaking on an industry level, nearly 60% of total compensation represents salary, while the remainder of 40% is other remuneration. Reko International Group pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Reko International Group Inc.'s Growth

Over the last three years, Reko International Group Inc. has shrunk its earnings per share by 39% per year. In the last year, its revenue is down 18%.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Reko International Group Inc. Been A Good Investment?

Reko International Group Inc. has generated a total shareholder return of 11% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Reko International Group pays its CEO a majority of compensation through a salary. As we noted earlier, Reko International Group pays its CEO in line with similar-sized companies belonging to the same industry. According to our analysis, Reko International Group is suffering from uninspiring EPS growth, and even though shareholder returns are stable, they are hardly impressive. These figures do not go well against CEO compensation, which is more or less equal to the industry median. We wouldn't go as far as saying CEO compensation is inappropriate, but we don't think the executive is underpaid.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Reko International Group (of which 1 doesn't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Reko International Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:REKO

Reko International Group

Designs and manufactures various engineered products and solutions for original equipment manufacturers and other industrial manufacturers and contractors in Canada and the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.