Investors Still Aren't Entirely Convinced By Omni-Lite Industries Canada Inc.'s (CVE:OML) Revenues Despite 30% Price Jump

Despite an already strong run, Omni-Lite Industries Canada Inc. (CVE:OML) shares have been powering on, with a gain of 30% in the last thirty days. The last month tops off a massive increase of 175% in the last year.

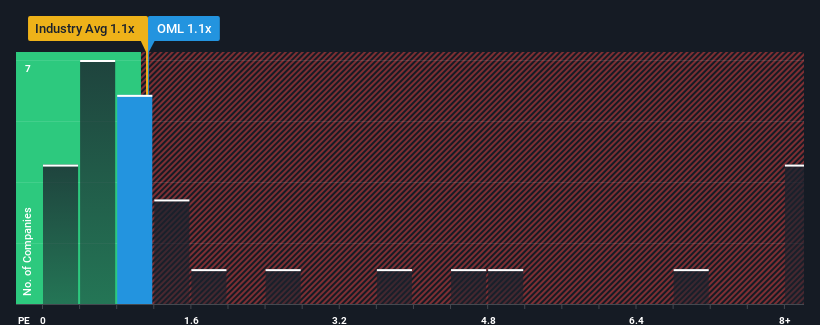

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Omni-Lite Industries Canada's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Canada is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Omni-Lite Industries Canada

How Omni-Lite Industries Canada Has Been Performing

Revenue has risen firmly for Omni-Lite Industries Canada recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Omni-Lite Industries Canada, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Omni-Lite Industries Canada?

The only time you'd be comfortable seeing a P/S like Omni-Lite Industries Canada's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Pleasingly, revenue has also lifted 140% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 8.0% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Omni-Lite Industries Canada is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Omni-Lite Industries Canada's P/S Mean For Investors?

Omni-Lite Industries Canada's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Omni-Lite Industries Canada's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Omni-Lite Industries Canada that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Omni-Lite Industries Canada, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:OML

Omni-Lite Industries Canada

Manufactures metal alloy, composite components, and fastener systems in the United States and Canada.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives