3 Canadian Penny Stocks On TSX With Under CA$200M Market Cap

Reviewed by Simply Wall St

The Canadian stock market is currently experiencing strong momentum, with stocks on track to finish the year robustly, supported by resilient consumer spending and rising corporate profits. Amid this optimistic backdrop, penny stocks—often representing smaller or newer companies—continue to hold appeal for investors seeking affordability and growth potential. Despite their vintage name, these stocks can offer surprising value when backed by solid financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.33 | CA$154.9M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$120.08M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.45 | CA$324.12M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.73 | CA$187.19M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.11 | CA$212.76M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.03M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.57 | CA$1.02B | ★★★★★★ |

Click here to see the full list of 959 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

E3 Lithium (TSXV:ETL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E3 Lithium Limited focuses on developing and extracting lithium resources in Alberta, with a market cap of CA$88.82 million.

Operations: E3 Lithium Limited does not have any reported revenue segments.

Market Cap: CA$88.82M

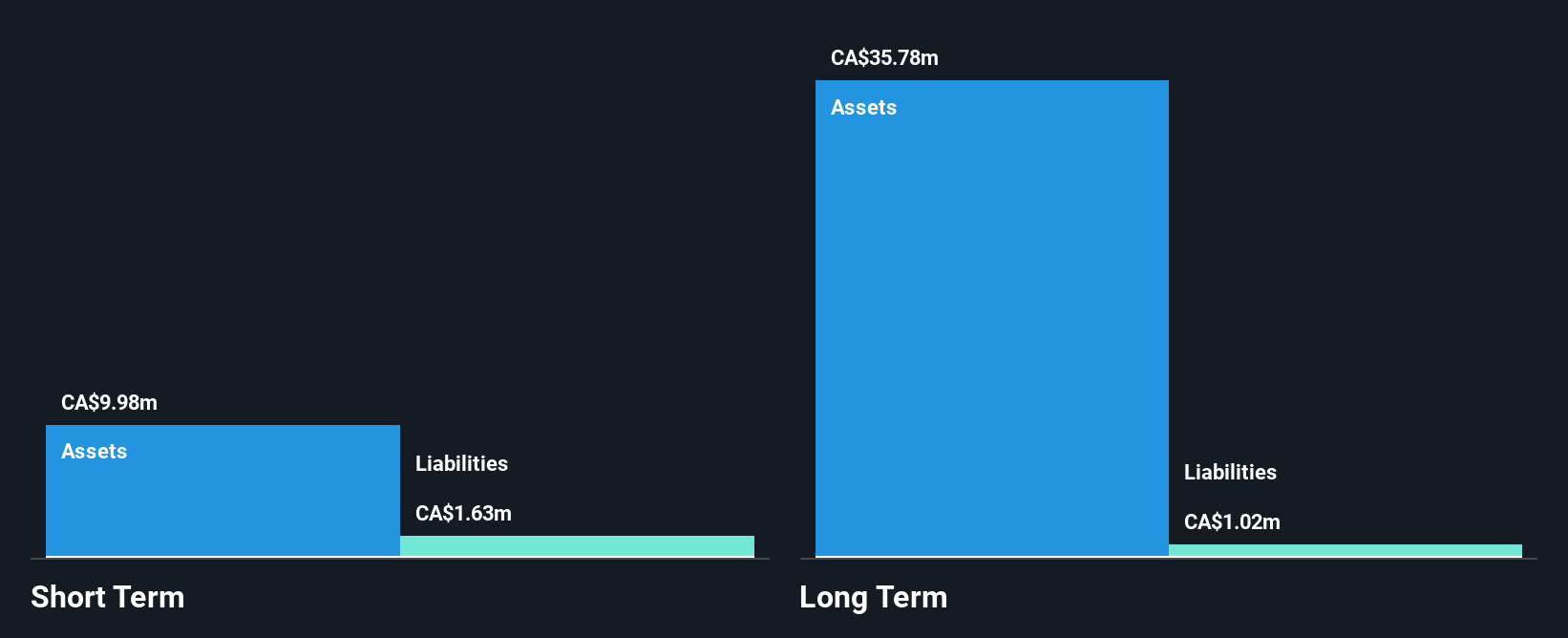

E3 Lithium Limited, with a market cap of CA$88.82 million, is pre-revenue and currently unprofitable. The company has no debt and sufficient cash runway for over a year based on current free cash flow trends. Recent developments include the advancement of its Demonstration Facility in Alberta, supported by CA$5 million from Emissions Reduction Alberta, aiming to produce battery-grade lithium carbonate by mid-2025. Despite stable weekly volatility and experienced management, E3 faces challenges in achieving profitability soon but remains focused on leveraging its Direct Lithium Extraction technology for future growth prospects in the lithium sector.

- Navigate through the intricacies of E3 Lithium with our comprehensive balance sheet health report here.

- Assess E3 Lithium's future earnings estimates with our detailed growth reports.

NEO Battery Materials (TSXV:NBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NEO Battery Materials Ltd. specializes in producing silicon anode materials for lithium-ion batteries used in electric vehicles, electronics, and energy storage systems in Canada, with a market cap of CA$100.18 million.

Operations: NEO Battery Materials Ltd. does not have reported revenue segments at this time.

Market Cap: CA$100.18M

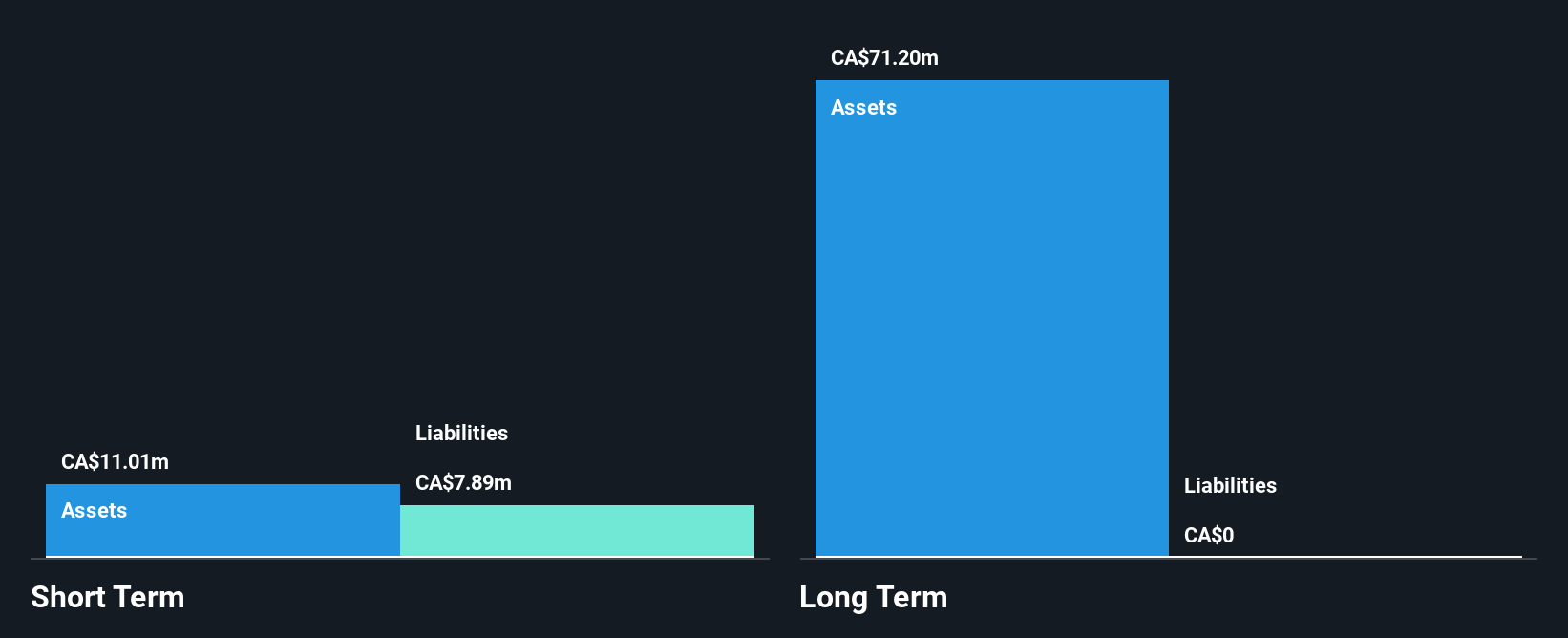

NEO Battery Materials Ltd., with a market cap of CA$100.18 million, is pre-revenue and currently unprofitable, facing challenges like high volatility and shareholder dilution. The company has no debt but limited cash runway, although it recently raised additional capital through private placements. NEO's strategic initiatives include a CAD 20 million recycled silicon battery project in South Korea and plans for a commercial manufacturing facility in Canada to enhance its silicon anode production capacity. Recent board changes aim to align governance with these expansion efforts, potentially strengthening its position in the lithium-ion battery sector.

- Dive into the specifics of NEO Battery Materials here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into NEO Battery Materials' track record.

Neptune Digital Assets (TSXV:NDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neptune Digital Assets Corp. is a Canadian company that builds, owns, and operates digital currency infrastructure assets with a market cap of CA$108.16 million.

Operations: The company's revenue is primarily derived from its data processing segment, which generated CA$2.01 million.

Market Cap: CA$108.16M

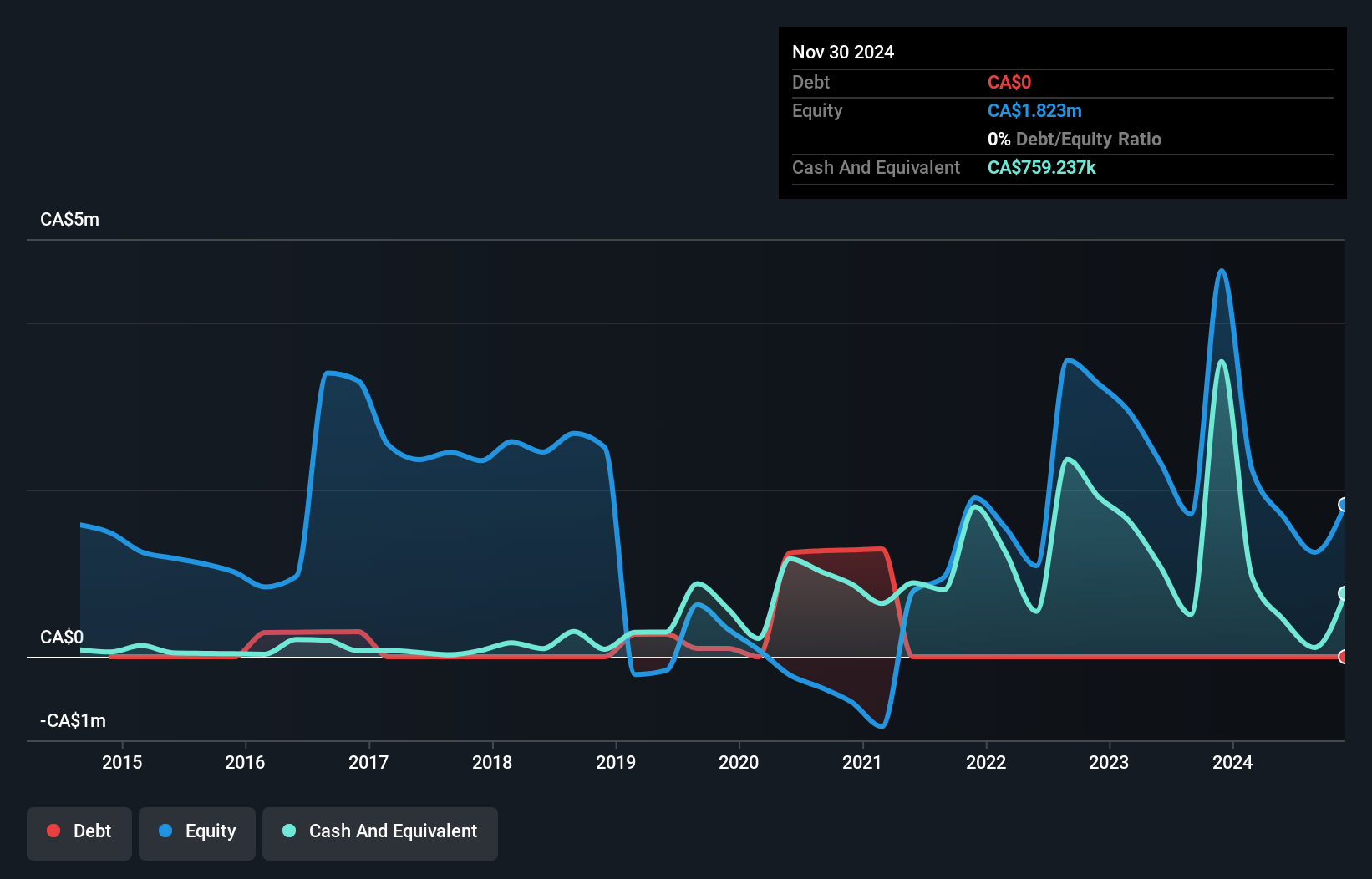

Neptune Digital Assets Corp., with a market cap of CA$108.16 million, operates in the digital currency space but remains unprofitable and lacks substantial revenue, generating only CA$2.01 million from data processing. Despite this, Neptune is debt-free and has a robust cash runway exceeding three years, supporting its strategic initiatives like expanding Fantom (FTM) holdings amidst blockchain advancements. The company employs innovative financial strategies such as dollar-cost-averaging derivatives to optimize returns, though it faces high share price volatility and declining earnings forecasts over the next three years. Management's experience may aid in navigating these challenges.

- Click here to discover the nuances of Neptune Digital Assets with our detailed analytical financial health report.

- Examine Neptune Digital Assets' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Jump into our full catalog of 959 TSX Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neptune Digital Assets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NDA

Neptune Digital Assets

Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada.

Flawless balance sheet slight.

Market Insights

Community Narratives