This Is The Reason Why We Think Inventronics Limited's (CVE:IVX) CEO Deserves A Bump Up To Their Compensation

Shareholders will be pleased by the impressive results for Inventronics Limited (CVE:IVX) recently and CEO Dan Stearne has played a key role. At the upcoming AGM on 18 August 2021, they will get a chance to hear the board review the company results, discuss future strategy and cast their vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

View our latest analysis for Inventronics

How Does Total Compensation For Dan Stearne Compare With Other Companies In The Industry?

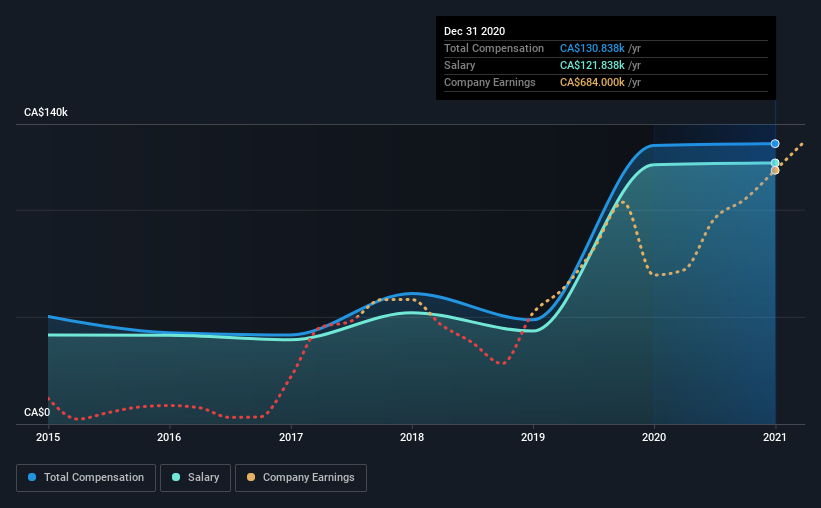

At the time of writing, our data shows that Inventronics Limited has a market capitalization of CA$2.0m, and reported total annual CEO compensation of CA$131k for the year to December 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of CA$121.8k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$250m, we found that the median total CEO compensation was CA$493k. In other words, Inventronics pays its CEO lower than the industry median. Furthermore, Dan Stearne directly owns CA$69k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$122k | CA$121k | 93% |

| Other | CA$9.0k | CA$9.0k | 7% |

| Total Compensation | CA$131k | CA$130k | 100% |

Speaking on an industry level, nearly 16% of total compensation represents salary, while the remainder of 84% is other remuneration. Inventronics is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Inventronics Limited's Growth Numbers

Inventronics Limited's earnings per share (EPS) grew 91% per year over the last three years. In the last year, its revenue is up 15%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Inventronics Limited Been A Good Investment?

We think that the total shareholder return of 394%, over three years, would leave most Inventronics Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for Inventronics you should be aware of, and 1 of them can't be ignored.

Important note: Inventronics is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:IVX

Inventronics

Designs, manufactures, and sells protective enclosures and related products for the telecommunications, electric transmission, cable, energy, and other industries in Canada and the United States.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion