Market Cool On GreenPower Motor Company Inc.'s (CVE:GPV) Revenues Pushing Shares 27% Lower

GreenPower Motor Company Inc. (CVE:GPV) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

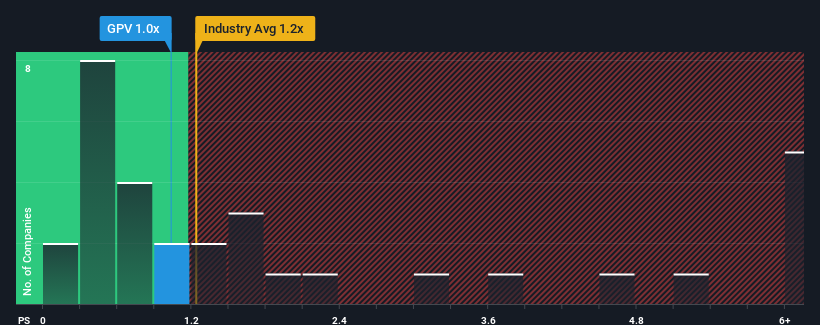

Even after such a large drop in price, it's still not a stretch to say that GreenPower Motor's price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Machinery industry in Canada, where the median P/S ratio is around 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for GreenPower Motor

What Does GreenPower Motor's P/S Mean For Shareholders?

GreenPower Motor certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GreenPower Motor.How Is GreenPower Motor's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like GreenPower Motor's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 72%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 26% as estimated by the three analysts watching the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

In light of this, it's curious that GreenPower Motor's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On GreenPower Motor's P/S

Following GreenPower Motor's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that GreenPower Motor currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 2 warning signs for GreenPower Motor that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GPV

GreenPower Motor

Designs, manufactures, and distributes electric vehicles for commercial markets in the United States and Canada.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives