- Canada

- /

- Metals and Mining

- /

- TSXV:GT

3 Promising TSX Penny Stocks With Over CA$10M Market Cap

Reviewed by Simply Wall St

As the Canadian market benefits from easing monetary policies and robust economic fundamentals, investors are increasingly exploring diverse opportunities. Penny stocks, though often seen as a vestige of earlier market days, continue to attract attention for their potential to deliver growth alongside affordability. By focusing on companies with solid financial foundations, investors can uncover promising prospects within this category.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.36 | CA$159.29M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$283.52M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.47 | CA$13.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$118.56M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.61 | CA$339.15M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.13 | CA$210.78M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.60 | CA$1B | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$5.18M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$183.36M | ★★★★★☆ |

Click here to see the full list of 915 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Full Circle Lithium (TSXV:FCLI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Full Circle Lithium Corp. is a specialty chemical recycling and processing company operating in the United States and Canada, with a market cap of CA$19.39 million.

Operations: Currently, there are no specific revenue segments reported for the specialty chemical recycling and processing company operating in the United States and Canada.

Market Cap: CA$19.39M

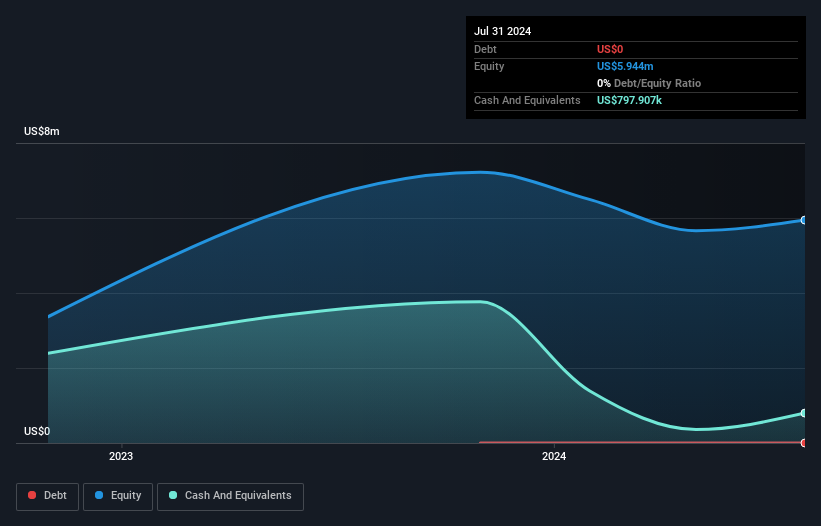

Full Circle Lithium Corp., with a market cap of CA$19.39 million, is currently pre-revenue, reporting minimal sales of US$10K and a net loss in its recent earnings. Despite being debt-free and having short-term assets exceeding liabilities, the company faces high volatility and shareholder dilution. Recent executive changes may impact stability; however, the successful demonstration of its FCL-X™ firefighting agent for lithium-ion battery fires marks a significant step towards commercial viability. A distribution agreement with AEST Fire & Safety could enhance market penetration, but limited cash runway remains a concern for future operations.

- Take a closer look at Full Circle Lithium's potential here in our financial health report.

- Learn about Full Circle Lithium's future growth trajectory here.

GT Resources (TSXV:GT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GT Resources Inc. is involved in the exploration and development of mineral resource properties, with a market cap of CA$11.65 million.

Operations: GT Resources Inc. currently has no reported revenue segments.

Market Cap: CA$11.65M

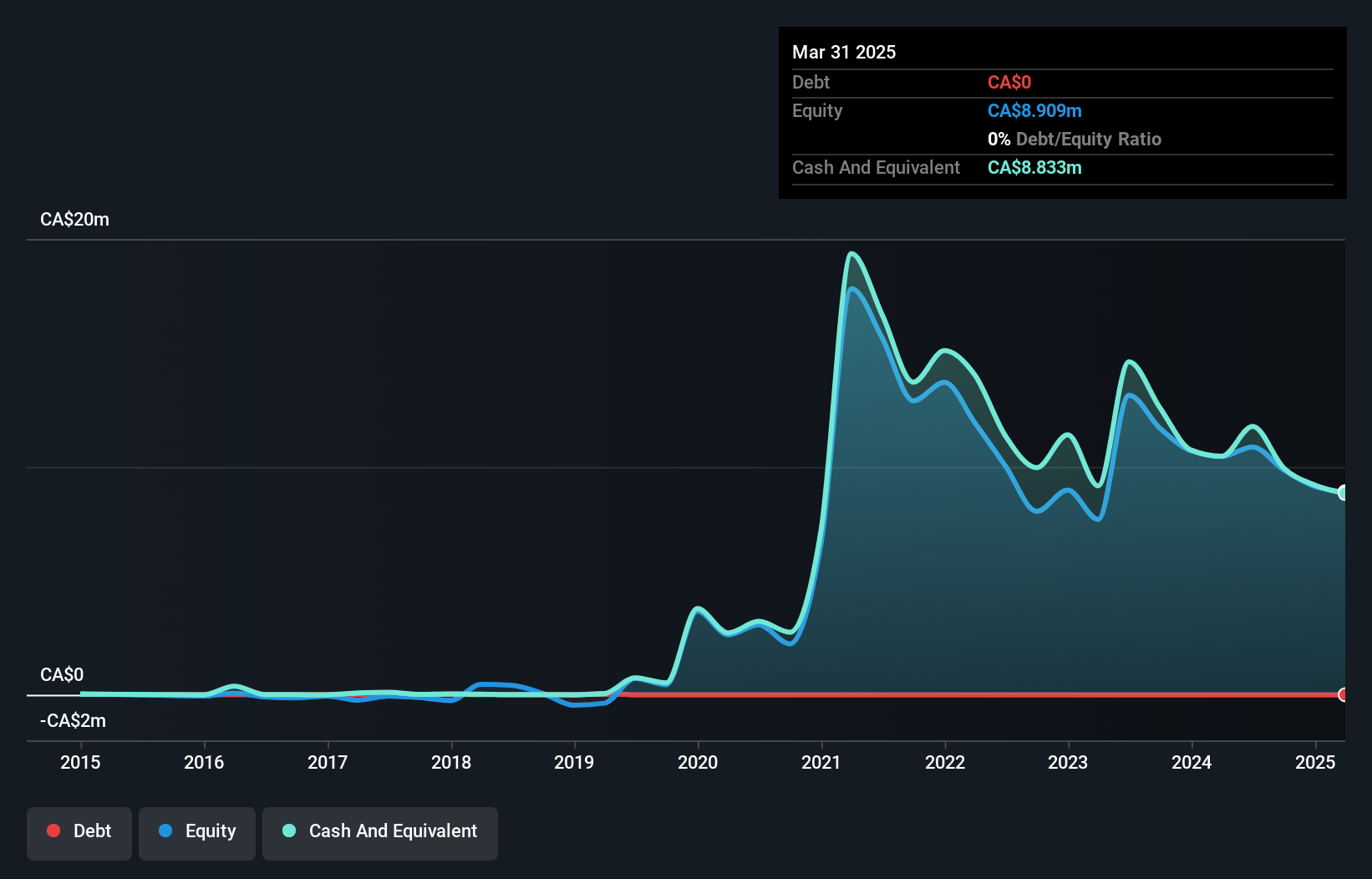

GT Resources Inc., with a market cap of CA$11.65 million, is pre-revenue and has experienced shareholder dilution. Despite high volatility, its seasoned management and board bring stability. The company remains debt-free with short-term assets covering liabilities, providing some financial cushion. Recent exploration activities at the North Rock copper-nickel-platinum project in Ontario and Canalask Nickel-Copper Project in Yukon highlight potential resource development opportunities but are still in early stages without current mineral resources confirmed. Although losses have narrowed recently, GT Resources faces challenges typical of early-stage mining ventures as it seeks to advance its projects toward commercial viability.

- Unlock comprehensive insights into our analysis of GT Resources stock in this financial health report.

- Evaluate GT Resources' prospects by accessing our earnings growth report.

Labrador Gold (TSXV:LAB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Labrador Gold Corp. is involved in acquiring and exploring gold properties across the Americas, with a market cap of CA$11.90 million.

Operations: Labrador Gold Corp. does not report any revenue segments as it focuses on acquiring and exploring gold properties across the Americas.

Market Cap: CA$11.9M

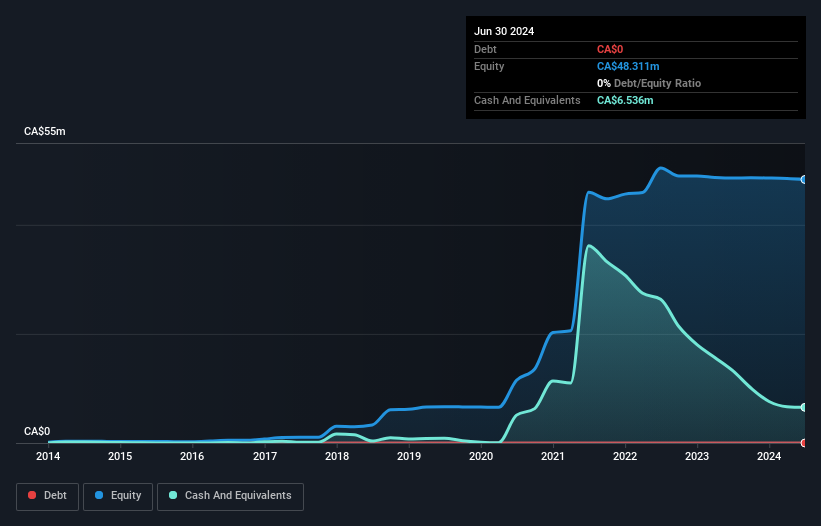

Labrador Gold Corp., with a market cap of CA$11.90 million, is pre-revenue and debt-free, maintaining financial stability with short-term assets covering liabilities. The board and management team are experienced, providing strategic guidance amid exploration activities. Recent results from the Hopedale Project highlight significant gold potential across multiple occurrences within the Archean-age Florence Lake greenstone belt. Noteworthy findings include high-grade samples at Thurber North and Fire Ant gold occurrences, indicating promising mineralization trends. However, limited cash runway poses a challenge as Labrador Gold continues to explore its properties without generating revenue yet.

- Dive into the specifics of Labrador Gold here with our thorough balance sheet health report.

- Examine Labrador Gold's past performance report to understand how it has performed in prior years.

Taking Advantage

- Dive into all 915 of the TSX Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GT

GT Resources

Engages in the exploration and development of mineral resource properties.

Flawless balance sheet moderate.