- Canada

- /

- Metals and Mining

- /

- TSXV:VLC

EnWave And 2 Other TSX Penny Stocks Worth Watching

Reviewed by Simply Wall St

The Canadian market is navigating a period of political uncertainty and economic shifts, with higher government bond yields impacting stock valuations. Amidst these conditions, investors are reminded that fundamentals drive financial markets more than politics. Penny stocks, though an older term, remain relevant as they offer opportunities in smaller or newer companies with solid financials that may lead to significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$397.24M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.41 | CA$122.52M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.55 | CA$989.91M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$647.54M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$226.4M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.14 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.01 | CA$138.93M | ★★★★★☆ |

Click here to see the full list of 929 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

EnWave (TSXV:ENW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EnWave Corporation designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries in Canada, the United States, and internationally with a market cap of CA$23.83 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: CA$23.83M

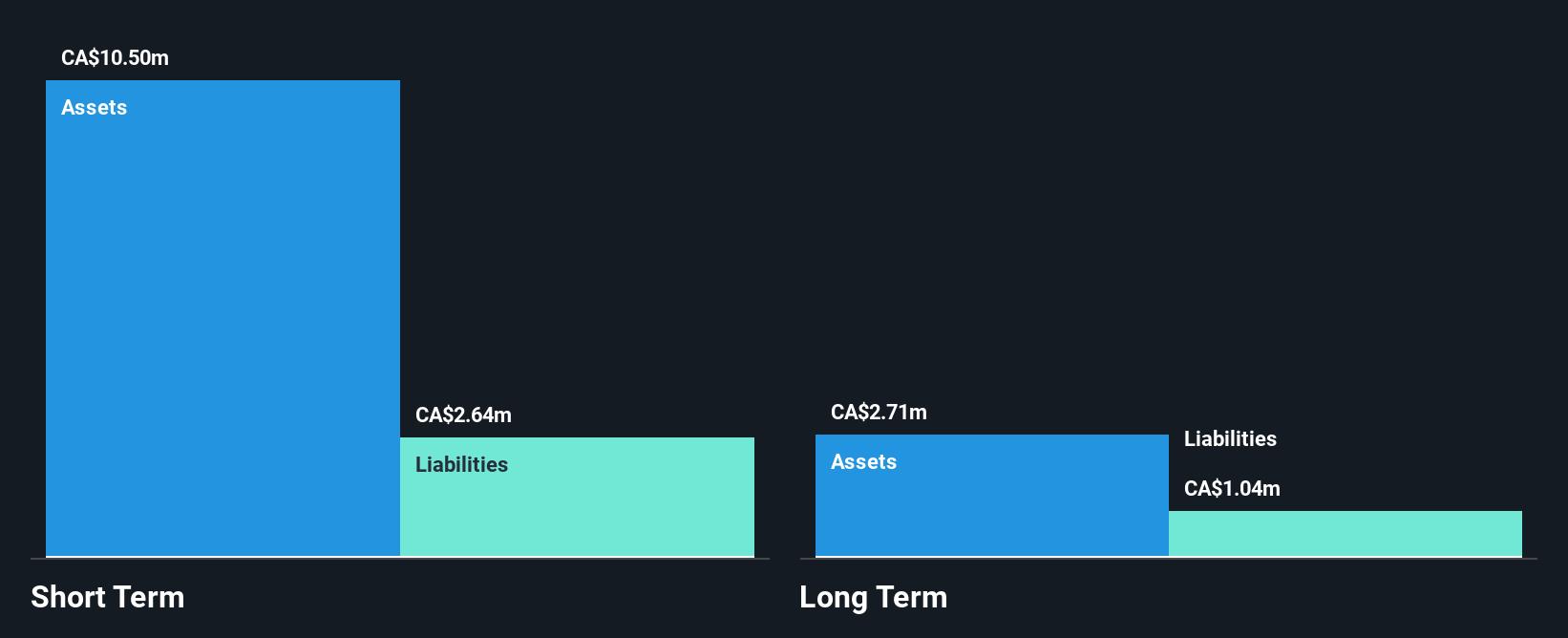

EnWave Corporation, with a market cap of CA$23.83 million, has been actively signing agreements to expand its Radiant Energy Vacuum technology's reach. Recent collaborations include a Technology Evaluation and License Option Agreement with Brazil's Solve Solutions LTDA and an R&D license with ELEA Technology GmbH in Germany. Despite being unprofitable, EnWave has reduced losses over the past five years and maintains a strong cash runway exceeding three years due to positive free cash flow. The company is debt-free, with short-term assets covering liabilities comfortably, indicating financial stability amid ongoing strategic expansions.

- Click here and access our complete financial health analysis report to understand the dynamics of EnWave.

- Assess EnWave's previous results with our detailed historical performance reports.

Velocity Minerals (TSXV:VLC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Velocity Minerals Ltd. is involved in the acquisition, exploration, evaluation, development, and investment in mineral resource properties in Bulgaria with a market cap of CA$30.43 million.

Operations: There are no reported revenue segments for Velocity Minerals Ltd.

Market Cap: CA$30.43M

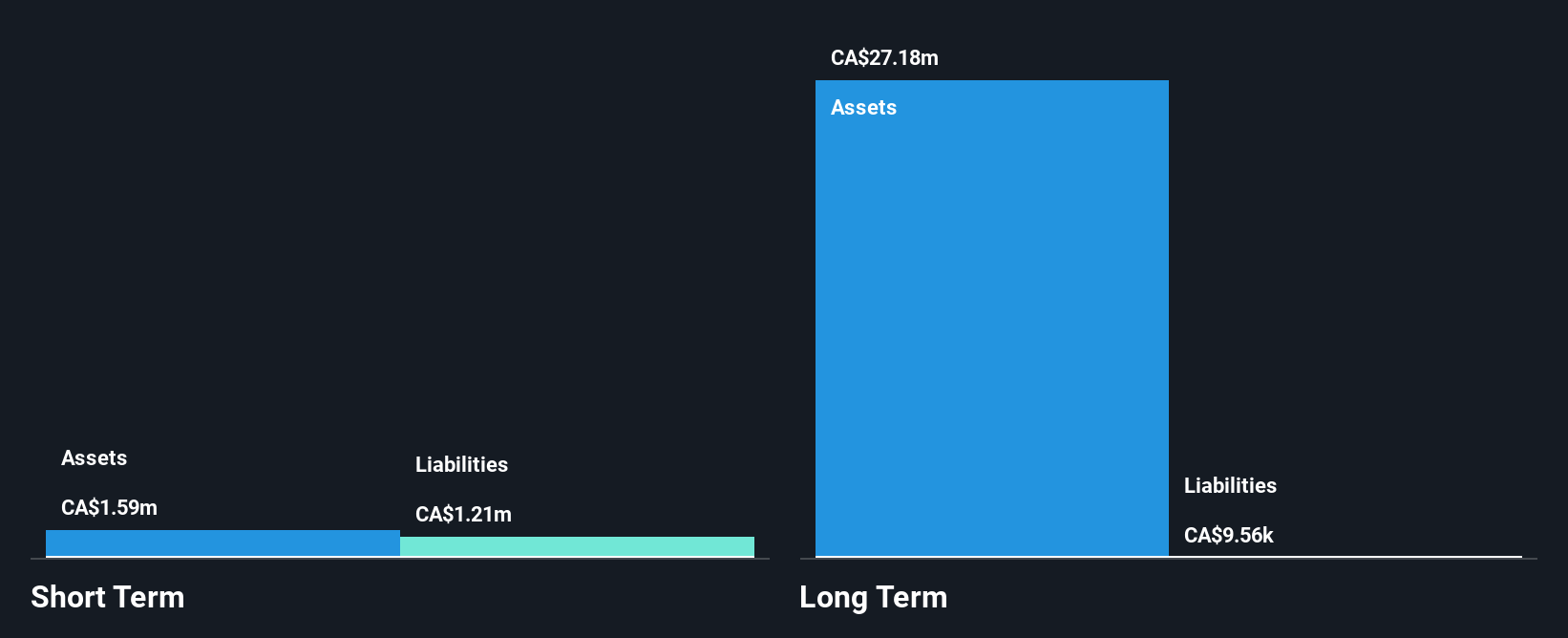

Velocity Minerals Ltd., with a market cap of CA$30.43 million, operates as a pre-revenue entity focused on mineral resource properties in Bulgaria. The company recently reported increased net losses for the third quarter and nine months ending September 2024, highlighting its ongoing unprofitability. Despite this, Velocity maintains financial stability with short-term assets of CA$1.6 million comfortably exceeding short-term liabilities of CA$543.4K and long-term liabilities of CA$23.5K, while being debt-free compared to five years ago when it had a significant debt-to-equity ratio. However, its cash runway is limited to less than one year without revenue growth or additional funding sources.

- Click to explore a detailed breakdown of our findings in Velocity Minerals' financial health report.

- Examine Velocity Minerals' past performance report to understand how it has performed in prior years.

Wishpond Technologies (TSXV:WISH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wishpond Technologies Ltd. offers marketing-focused online business solutions across the United States, Canada, and internationally, with a market cap of CA$17.37 million.

Operations: The company generates CA$23.00 million in revenue from its Internet Software & Services segment.

Market Cap: CA$17.37M

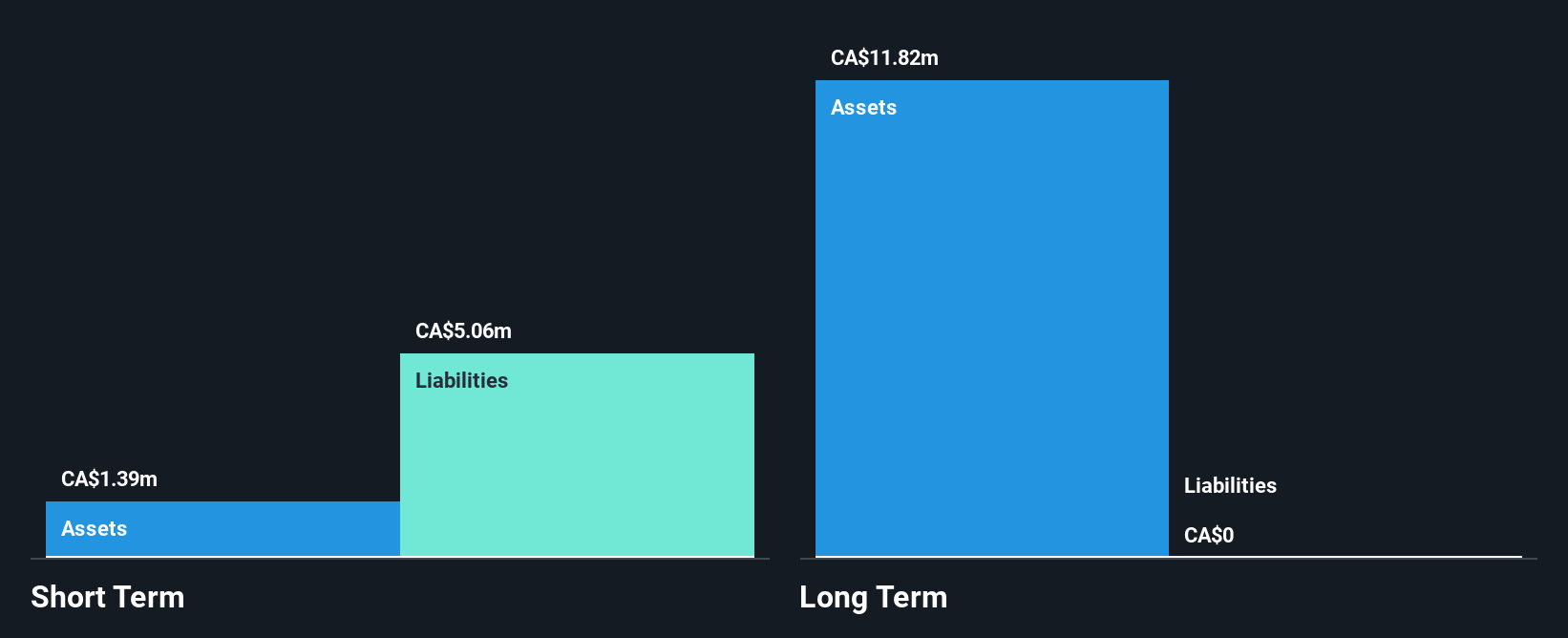

Wishpond Technologies Ltd., with a market cap of CA$17.37 million, is focused on enhancing its AI-driven solutions, recently filing a patent for its SalesCloser AI's enhanced state manager. Despite being unprofitable, Wishpond has shown financial improvement by reducing net losses over the past five years and maintaining sufficient cash runway for over three years. The company reported third-quarter sales of CA$5.06 million in 2024, slightly down from the previous year but improved net income figures indicate progress towards profitability. Analysts suggest potential stock price growth, though short-term liabilities exceed short-term assets by CA$3.1 million.

- Take a closer look at Wishpond Technologies' potential here in our financial health report.

- Explore Wishpond Technologies' analyst forecasts in our growth report.

Summing It All Up

- Investigate our full lineup of 929 TSX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:VLC

Velocity Minerals

Engages in the acquisition, exploration, evaluation, development, and investment in mineral resource properties in Bulgaria.

Adequate balance sheet low.