- Canada

- /

- Metals and Mining

- /

- TSX:ARG

Amerigo Resources Leads 3 TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As we enter the year, Canadian markets are navigating a complex landscape of inflationary pressures and economic shifts, with the Bank of Canada focusing on potential downside risks to growth. In this context, identifying promising investment opportunities requires looking beyond headlines to find stocks with solid fundamentals. Penny stocks, though often associated with smaller or newer companies, can offer significant value and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.92 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.71 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$1.86 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.16 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., with a market cap of CA$301.10 million, operates through its subsidiary Minera Valle Central S.A. to produce and sell copper and molybdenum concentrates from Codelco's El Teniente underground mine in Chile.

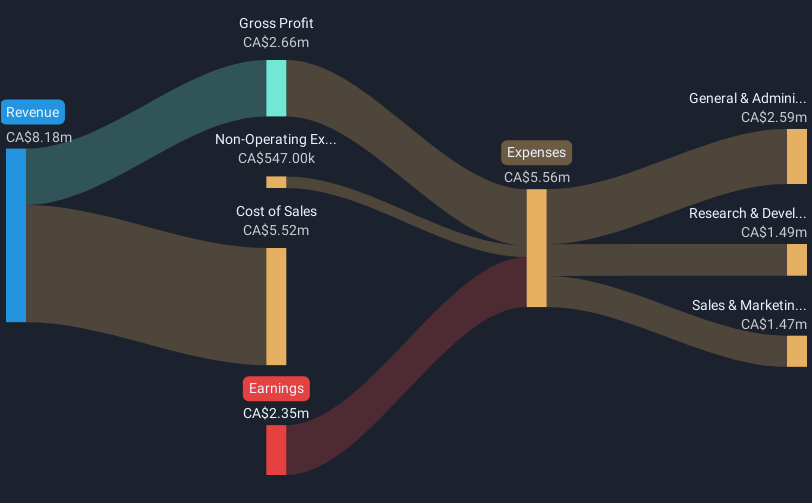

Operations: The company's revenue is primarily derived from the production of copper concentrates under a tolling agreement with DET, amounting to $184.41 million.

Market Cap: CA$301.1M

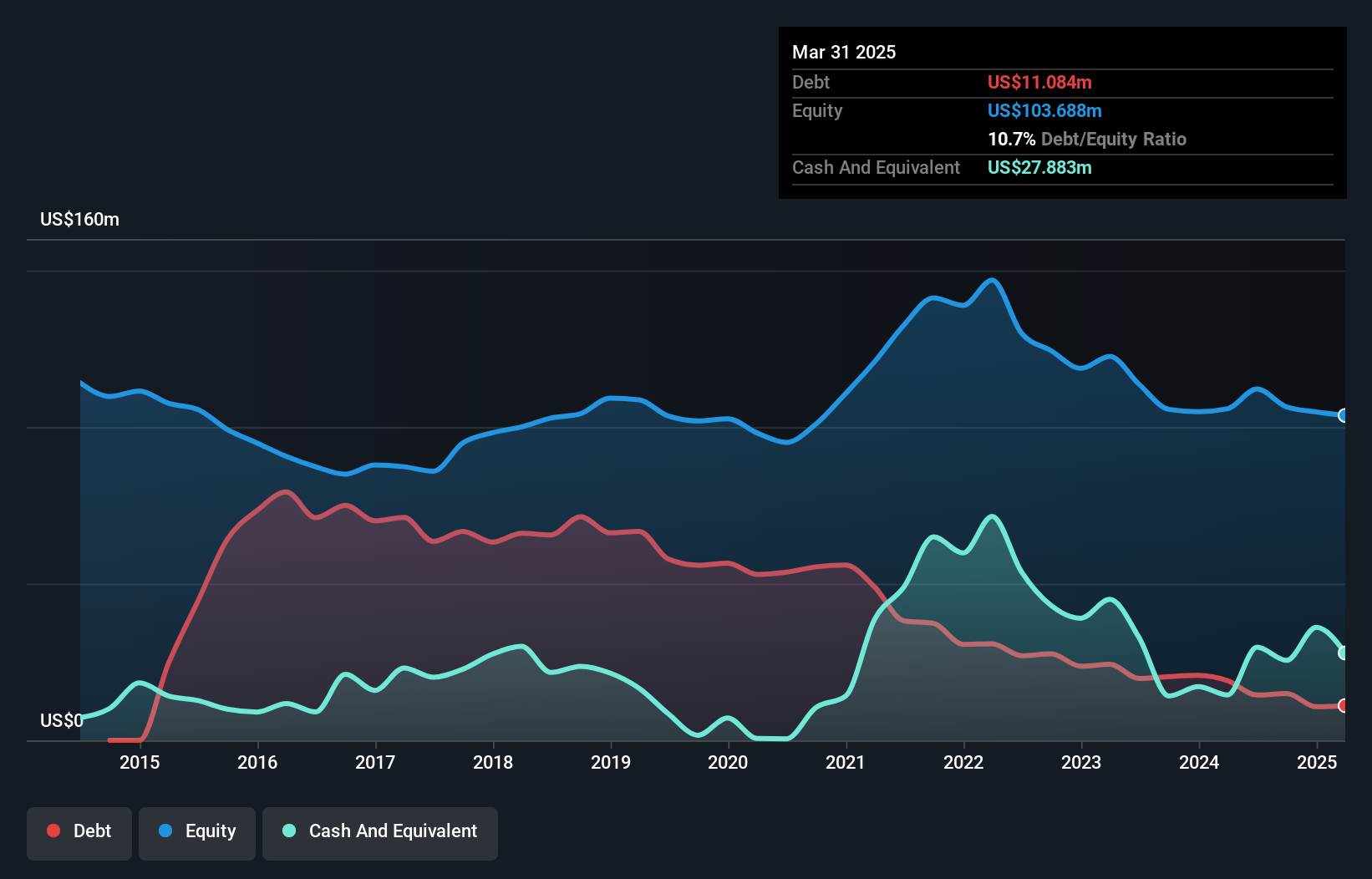

Amerigo Resources Ltd., with a market cap of CA$301.10 million, has recently achieved profitability, driven by its copper and molybdenum production from the El Teniente mine in Chile. The company reported 2024 production exceeding guidance, with 64.6 million pounds of copper and 1.3 million pounds of molybdenum produced at lower cash costs than anticipated. Amerigo's management team is experienced, contributing to stable operations despite an unstable dividend track record and short-term liabilities slightly exceeding assets. The company's strategic share repurchase plan demonstrates confidence in its valuation while maintaining a strong balance sheet with more cash than debt.

- Unlock comprehensive insights into our analysis of Amerigo Resources stock in this financial health report.

- Explore Amerigo Resources' analyst forecasts in our growth report.

EnWave (TSXV:ENW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EnWave Corporation designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries across Canada, the United States, and internationally with a market cap of CA$23.86 million.

Operations: There are no specific revenue segments reported for EnWave Corporation.

Market Cap: CA$23.86M

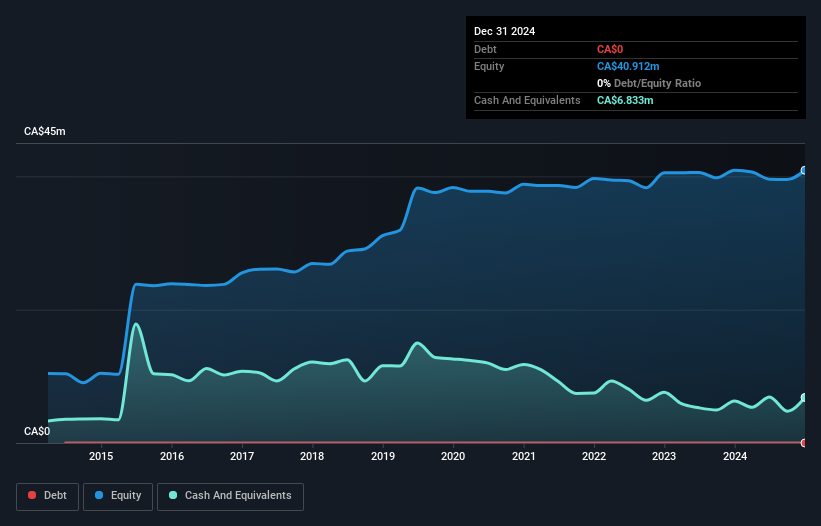

EnWave Corporation, with a market cap of CA$23.86 million, remains unprofitable but has shown progress by reducing losses over the past five years. The company operates without debt and maintains a stable cash runway for over three years due to positive free cash flow. Recent strategic agreements, including expanded royalty-bearing licenses with Patatas Fritas Torres S.L. and BranchOut Foods Inc., indicate potential revenue growth through increased machinery utilization and product offerings in the global snack market. Despite its high volatility compared to most Canadian stocks, EnWave's seasoned management and board provide experienced oversight in navigating these developments.

- Click here and access our complete financial health analysis report to understand the dynamics of EnWave.

- Evaluate EnWave's historical performance by accessing our past performance report.

Midland Exploration (TSXV:MD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Midland Exploration Inc. is a mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in Canada, with a market cap of CA$29.49 million.

Operations: Midland Exploration generates its revenue of CA$0.17 million from the acquisition, exploration, and evaluation of mineral properties in Canada.

Market Cap: CA$29.49M

Midland Exploration, with a market cap of CA$29.49 million, is pre-revenue and debt-free, maintaining a cash runway exceeding one year. Recent drilling results from the Galinée project in partnership with Rio Tinto Exploration Canada highlight promising lithium findings, including spodumene pegmatites that remain open for further exploration. The company’s short-term assets comfortably cover its liabilities, though it remains unprofitable with increasing losses over the past five years. A recent private placement raised CA$2.65 million to support ongoing exploration activities, underscoring investor interest despite inherent risks in early-stage mineral ventures.

- Click to explore a detailed breakdown of our findings in Midland Exploration's financial health report.

- Understand Midland Exploration's track record by examining our performance history report.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 933 more companies for you to explore.Click here to unveil our expertly curated list of 936 TSX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARG

Amerigo Resources

Through its subsidiary, Minera Valle Central S.A., engages in the production and sale of copper and molybdenum concentrates from Codelco’s El Teniente underground mine in Chile.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives