- Canada

- /

- Electrical

- /

- TSXV:EGT

Introducing Eguana Technologies (CVE:EGT), The Stock That Soared 340% In The Last Year

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, the Eguana Technologies Inc. (CVE:EGT) share price rocketed moonwards 340% in just one year. On top of that, the share price is up 128% in about a quarter. And shareholders have also done well over the long term, with an increase of 43% in the last three years.

See our latest analysis for Eguana Technologies

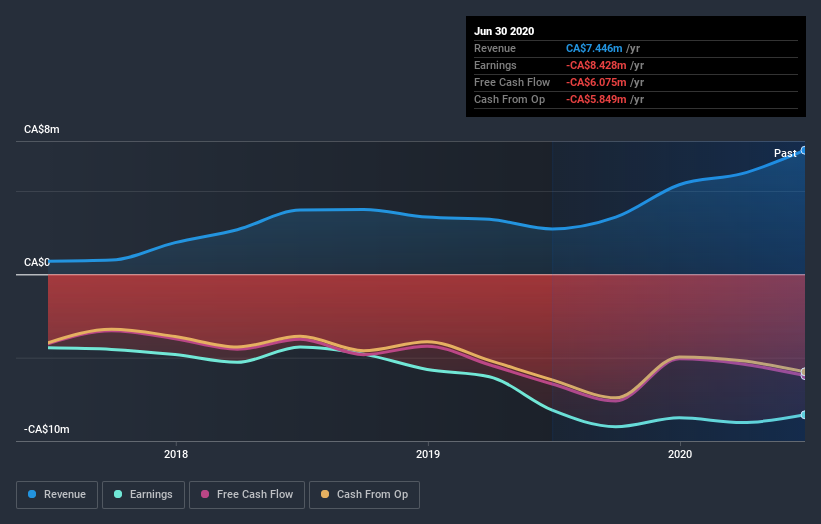

Because Eguana Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Eguana Technologies grew its revenue by 173% last year. That's well above most other pre-profit companies. But the share price seems headed to the moon, up 340% as previously highlighted. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Eguana Technologies' financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Eguana Technologies shareholders have received a total shareholder return of 340% over one year. That gain is better than the annual TSR over five years, which is 27%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Eguana Technologies (1 can't be ignored) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Eguana Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eguana Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:EGT

Eguana Technologies

Designs, manufactures, and markets energy storage solutions for residential and commercial markets in Australia, Europe, and North America.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion