With EPS Growth And More, California Nanotechnologies (CVE:CNO) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in California Nanotechnologies (CVE:CNO). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for California Nanotechnologies

California Nanotechnologies' Improving Profits

In the last three years California Nanotechnologies' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. California Nanotechnologies' EPS skyrocketed from US$0.011 to US$0.017, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 58%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While California Nanotechnologies did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

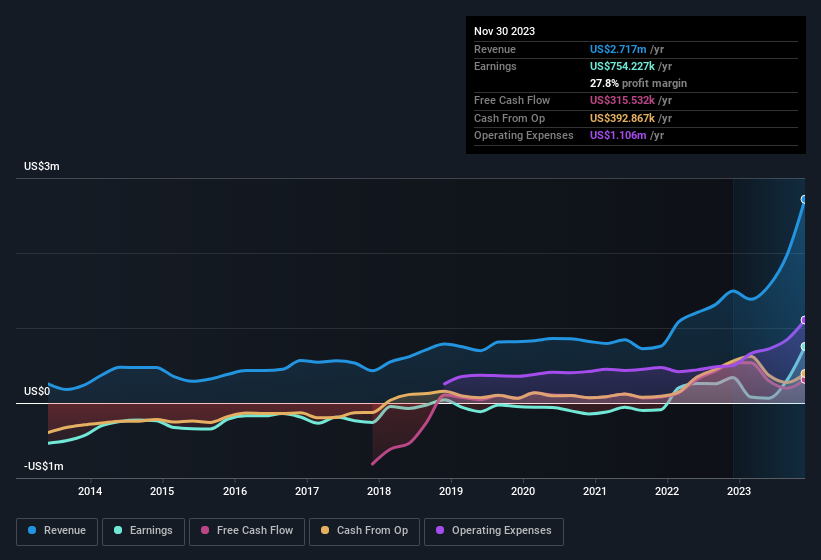

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

California Nanotechnologies isn't a huge company, given its market capitalisation of CA$19m. That makes it extra important to check on its balance sheet strength.

Are California Nanotechnologies Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see California Nanotechnologies insiders walking the walk, by spending US$448k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was CEO & Director Eric Eyerman who made the biggest single purchase, worth CA$333k, paying CA$0.15 per share.

Is California Nanotechnologies Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into California Nanotechnologies' strong EPS growth. Not only is that growth rate rather juicy, but the insider buying adds fuel to the fire. To put it succinctly; California Nanotechnologies is a strong candidate for your watchlist. However, before you get too excited we've discovered 4 warning signs for California Nanotechnologies (1 shouldn't be ignored!) that you should be aware of.

The good news is that California Nanotechnologies is not the only growth stock with insider buying. Here's a list of growth-focused companies in CA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CNO

California Nanotechnologies

Engages in the research, development, and production of nanocrystalline materials through grain size reduction.

Excellent balance sheet and fair value.

Market Insights

Community Narratives