For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in WSP Global (TSE:WSP). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

WSP Global's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. WSP Global managed to grow EPS by 9.4% per year, over three years. That's a pretty good rate, if the company can sustain it.

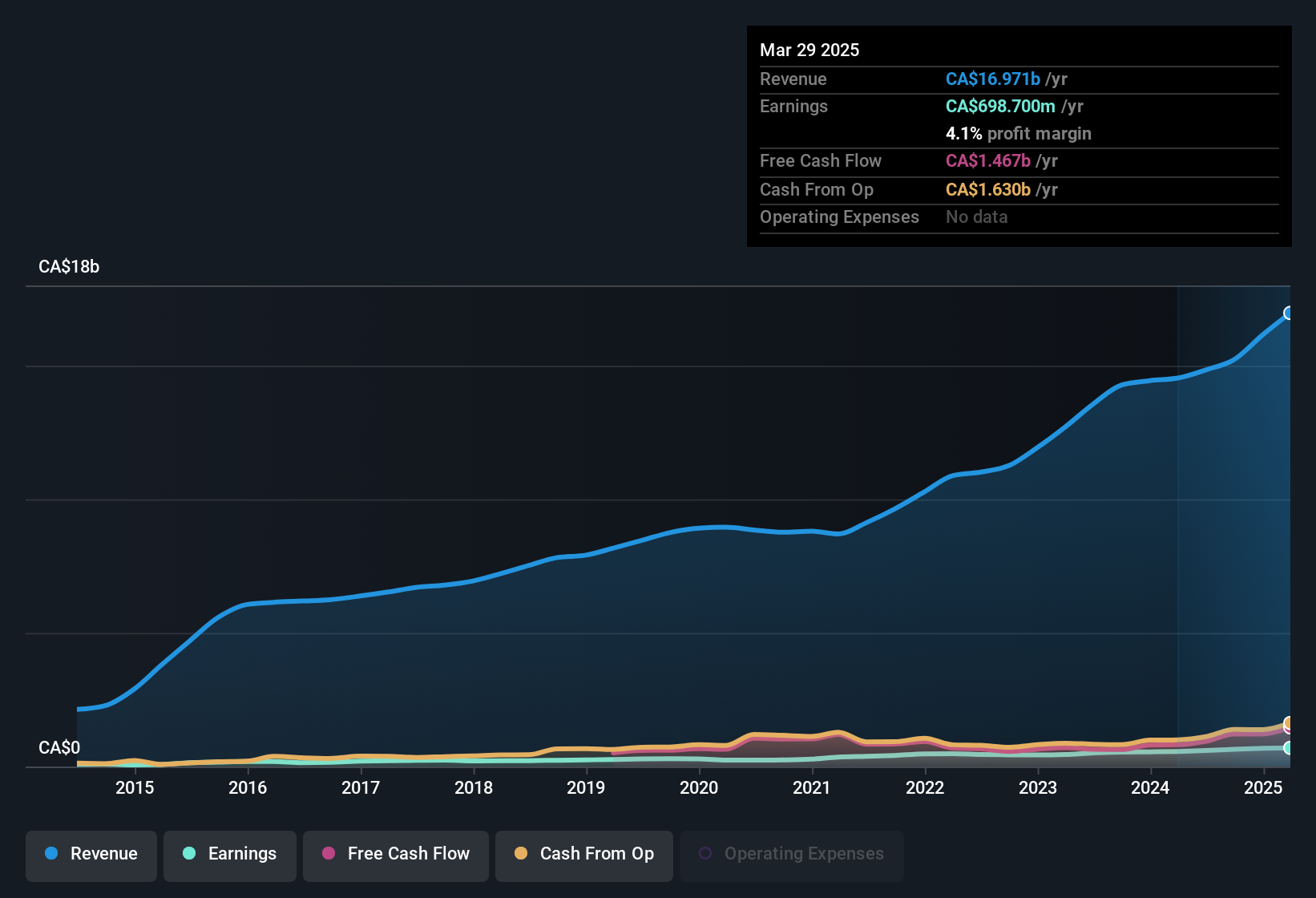

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. WSP Global maintained stable EBIT margins over the last year, all while growing revenue 17% to CA$17b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

See our latest analysis for WSP Global

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for WSP Global's future profits.

Are WSP Global Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While we did see insider selling of WSP Global stock in the last year, one single insider spent plenty more buying. Specifically the Independent Director, Macky Tall, spent CA$502k, paying about CA$244 per share. That certainly piques our interest.

The good news, alongside the insider buying, for WSP Global bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold CA$22m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.06% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is WSP Global Worth Keeping An Eye On?

One important encouraging feature of WSP Global is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. We don't want to rain on the parade too much, but we did also find 1 warning sign for WSP Global that you need to be mindful of.

The good news is that WSP Global is not the only stock with insider buying. Here's a list of small cap, undervalued companies in CA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if WSP Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WSP

WSP Global

Operates as a professional services consulting firm in the United States, Canada, the United Kingdom, Sweden, Australia, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026