- Canada

- /

- Trade Distributors

- /

- TSX:WJX

Global Undervalued Small Caps With Insider Action To Watch

Reviewed by Simply Wall St

In a week marked by mixed outcomes for major stock indexes, smaller-cap indices like the S&P MidCap 400 and Russell 2000 have shown resilience, posting gains amidst broader market volatility. This performance comes against a backdrop of global trade tensions and economic uncertainties, which continue to shape investor sentiment and influence market dynamics. In such an environment, identifying promising small-cap stocks involves looking at factors like financial health, growth potential, and strategic insider actions that may signal confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.2x | 0.5x | 44.70% | ★★★★★★ |

| Nexus Industrial REIT | 5.1x | 2.6x | 27.02% | ★★★★★★ |

| Chorus Aviation | NA | 0.4x | 21.30% | ★★★★★★ |

| Sing Investments & Finance | 7.4x | 3.7x | 41.54% | ★★★★☆☆ |

| Seeing Machines | NA | 1.8x | 48.22% | ★★★★☆☆ |

| Italmobiliare | 10.7x | 1.4x | -251.44% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -6.83% | ★★★☆☆☆ |

| Calfrac Well Services | 34.5x | 0.2x | 26.94% | ★★★☆☆☆ |

| Saturn Oil & Gas | 5.3x | 0.4x | -1.16% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 1.6x | -133.92% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

European Residential Real Estate Investment Trust (TSX:ERE.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: European Residential Real Estate Investment Trust focuses on owning and operating a portfolio of residential properties across Europe, with a market capitalization of €0.89 billion.

Operations: The primary revenue stream is derived from investment properties, with the latest reported revenue at €92.97 million. The cost of goods sold (COGS) was €20.10 million, leading to a gross profit of €72.87 million and a gross profit margin of 78.38%. Operating expenses were recorded at €8.65 million, impacting the net income which stood at -€64.29 million for the same period due to significant non-operating expenses amounting to €128.51 million.

PE: -2.2x

European Residential Real Estate Investment Trust, a small cap player in the property sector, faces challenges with earnings declining 31.6% annually over five years and interest payments not fully covered by earnings. Despite these hurdles, insider confidence is evident as they have been purchasing shares recently. The company maintains regular dividends, recently affirming a €0.06 annualized distribution per unit for April 2025. With no customer deposits and reliance on external borrowing, financial risks remain present but manageable given recent net loss improvements from €114 million to €64 million year-over-year.

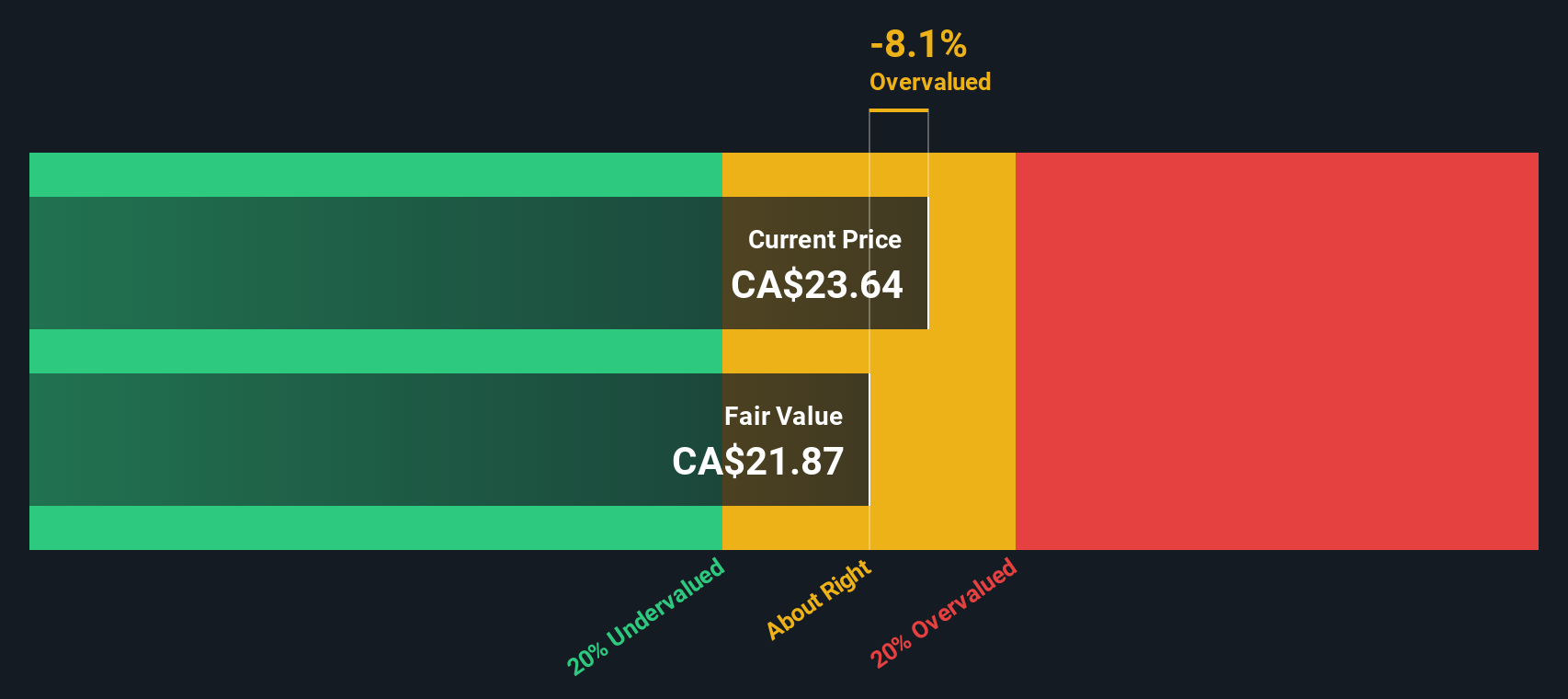

Killam Apartment REIT (TSX:KMP.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Killam Apartment REIT focuses on owning, managing, and developing residential apartment buildings, commercial properties, and manufactured home communities with a market capitalization of CA$2.18 billion.

Operations: The company generates revenue primarily from its apartment segment, complemented by income from commercial properties and manufactured home communities. Over the observed periods, the net income margin showed notable fluctuations, reaching as high as 1.82%. Operating expenses and general & administrative expenses are consistent cost components impacting profitability.

PE: 3.0x

Killam Apartment REIT, a small player in the real estate sector, presents an intriguing investment opportunity. Despite its reliance on external borrowing, which is riskier than customer deposits, the company maintains a strong financial position with sales reaching C$364.65 million for 2024. Insider confidence is evident as insiders have been purchasing shares since early 2024. Regular monthly dividends of C$0.06 per unit continue to provide consistent returns to investors, hinting at stable future prospects.

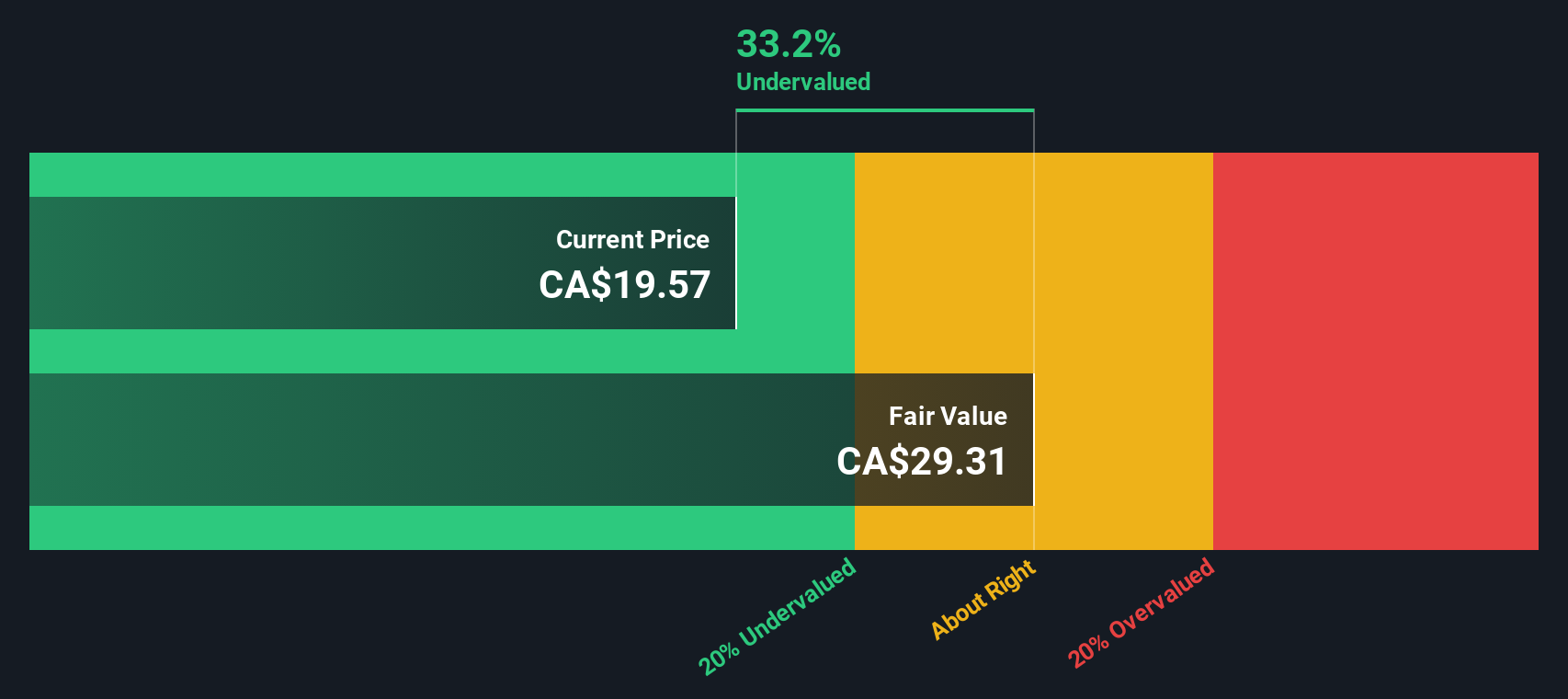

Wajax (TSX:WJX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wajax is a Canadian company that specializes in the distribution and service of industrial components and equipment, with a market cap of CA$0.53 billion.

Operations: The company's revenue primarily comes from wholesale machinery and industrial equipment, with a notable gross profit margin of 21.55% as of June 2024. Operating expenses include significant general and administrative costs, which were CA$318.75 million in the same period. Net income margin has shown variability, reaching 3.32% in June 2024 but declining to 2.04% by December of the same year.

PE: 8.6x

Wajax, a smaller company in its sector, recently saw insider confidence when President Ignacy Domagalski purchased 17,500 shares for approximately C$306,250. However, the company's financial health shows mixed signals. While interest payments aren't well covered by earnings and profit margins decreased to 2% from 3.8%, Wajax continues to distribute dividends of C$0.35 per share. Sales fell slightly to C$2.1 billion in 2024 from the prior year’s C$2.15 billion, with net income dropping significantly to C$42 million from C$81 million previously reported.

- Dive into the specifics of Wajax here with our thorough valuation report.

Evaluate Wajax's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Explore the 157 names from our Undervalued Global Small Caps With Insider Buying screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wajax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WJX

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives