- Canada

- /

- Trade Distributors

- /

- TSX:WJX

Exploring 3 Undervalued Small Caps In Global With Insider Buying

Reviewed by Simply Wall St

In the midst of a challenging global market environment, characterized by declining U.S. stock indexes due to renewed tariffs and trade policy uncertainties, small-cap stocks have been particularly impacted as evidenced by notable declines in the Russell 2000 and S&P MidCap 400 indexes. Despite these headwinds, opportunities may arise for investors who are able to identify small-cap companies with strong fundamentals and insider buying activity, suggesting potential confidence from those within the company.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MCAN Mortgage | 11.6x | 6.5x | 48.67% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 21.13% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.6x | 7.0x | 23.66% | ★★★★★☆ |

| Nexus Industrial REIT | 6.9x | 3.1x | 17.51% | ★★★★☆☆ |

| Sagicor Financial | 9.8x | 0.4x | -90.59% | ★★★★☆☆ |

| CVS Group | 45.1x | 1.3x | 38.07% | ★★★★☆☆ |

| A.G. BARR | 19.6x | 1.9x | 45.78% | ★★★☆☆☆ |

| SmartCraft | 43.4x | 7.8x | 35.36% | ★★★☆☆☆ |

| Chinasoft International | 25.8x | 0.8x | 3.13% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.8x | 47.84% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

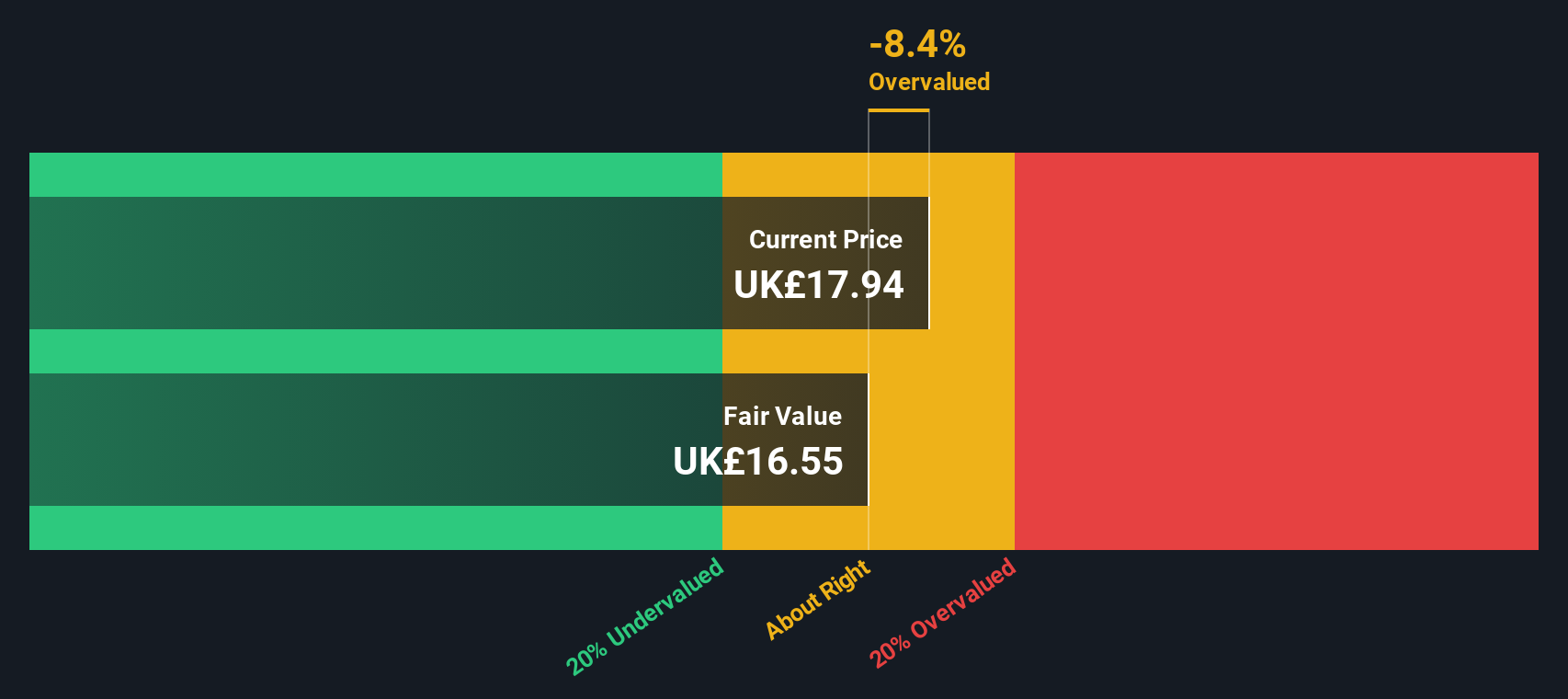

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Oxford Instruments is a company specializing in the development and manufacturing of high-technology tools and systems for industry and research, with a market capitalization of approximately £1.48 billion.

Operations: Imaging & Analysis and Advanced Technologies are the primary revenue streams, generating £330.5 million and £171.1 million respectively. The company's gross profit margin has shown an upward trend, reaching 52.35% as of September 2023, indicating efficient cost management relative to revenue growth over time.

PE: 40.1x

Oxford Instruments, a company with a market cap typically associated with smaller firms, is drawing attention due to its share repurchase program worth £50 million. This move, funded by the sale of its NanoScience business, reflects insider confidence and aims to enhance shareholder value. Despite facing challenges like declining profit margins from 10.8% to 5.2%, the company forecasts annual earnings growth of over 26%. Recent financials show sales increased to £500.6 million from £470.4 million year-on-year, indicating potential for future growth amidst industry challenges and strategic adjustments.

- Take a closer look at Oxford Instruments' potential here in our valuation report.

Explore historical data to track Oxford Instruments' performance over time in our Past section.

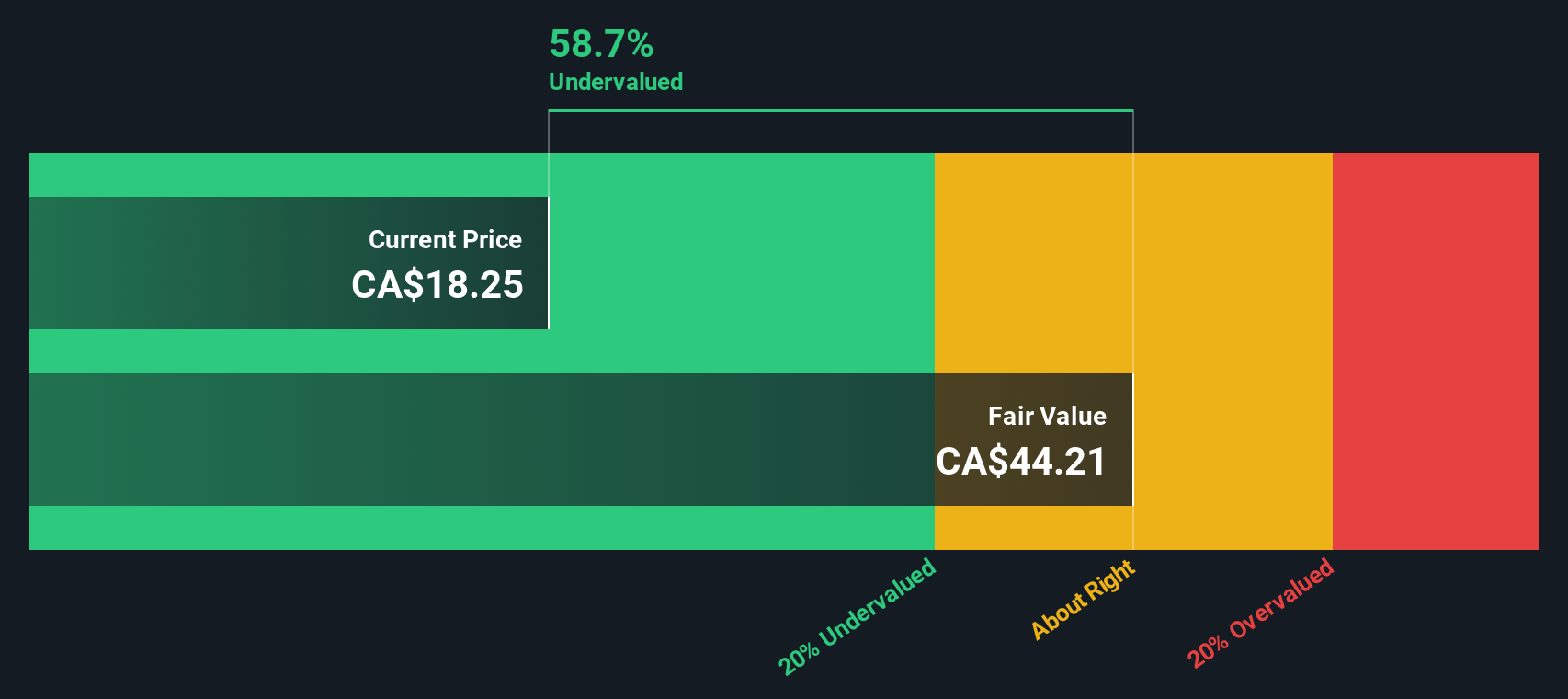

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Flagship Communities Real Estate Investment Trust operates as a real estate investment trust focusing on owning and managing manufactured housing communities, with a market cap of approximately C$0.48 billion.

Operations: Flagship Communities Real Estate Investment Trust generates revenue primarily through its operations, with a notable increase from $30.51 million in December 2019 to $92.99 million by March 2025. The cost of goods sold has also risen, impacting the gross profit margin which fluctuated between 63.89% and 66.81% over the observed periods. Operating expenses have shown a gradual increase, reaching $11.22 million by March 2025, while non-operating expenses have varied significantly across different periods.

PE: 3.4x

Flagship Communities Real Estate Investment Trust, a smaller player in the property market, has seen its sales rise to US$25.07 million in Q2 2025 from US$21.23 million a year prior, though net income fell to US$35.09 million from US$43.46 million. Despite earnings challenges and reliance on external borrowing, insider confidence remains evident through recent share purchases. The company continues rewarding investors with consistent monthly dividends of US$0.0517 per unit, signaling steady cash flow management amidst growth forecasts of 5% annually in revenue.

- Delve into the full analysis valuation report here for a deeper understanding of Flagship Communities Real Estate Investment Trust.

Learn about Flagship Communities Real Estate Investment Trust's historical performance.

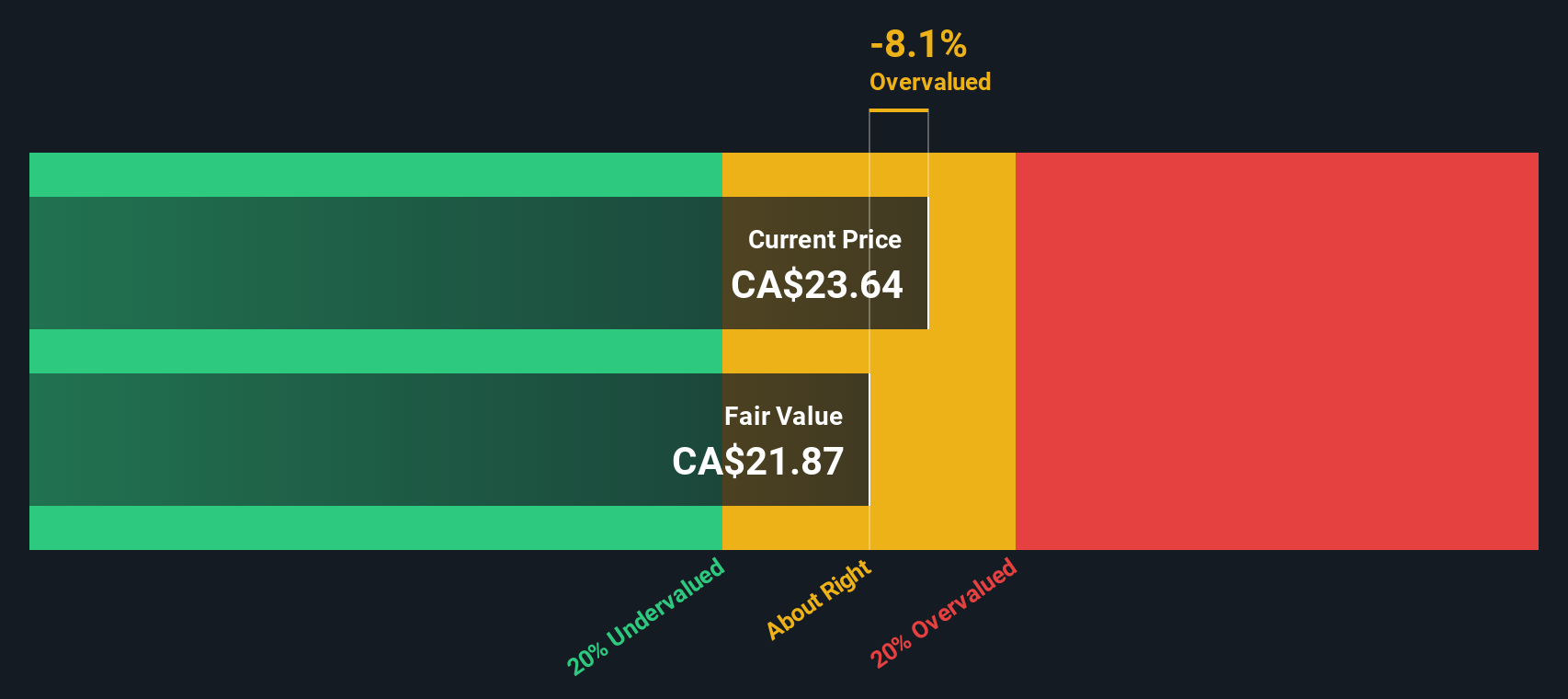

Wajax (TSX:WJX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wajax is a Canadian company specializing in the wholesale distribution of machinery and industrial equipment, with a market capitalization of CA$0.45 billion.

Operations: Wajax's revenue primarily comes from wholesale activities in machinery and industrial equipment, with a recent total of CA$2.17 billion. The company's cost structure includes a significant portion dedicated to the cost of goods sold (COGS), which was CA$1.76 billion, leading to a gross profit margin of 19.07%. Operating expenses are another major component, amounting to CA$311.57 million in the latest period analyzed.

PE: 12.2x

Wajax, a company navigating the industrial sector, recently reported a dip in both sales and net income for Q2 2025 compared to the previous year. Despite this, insider confidence is evident as President Ignacy Domagalski purchased 17,500 shares worth C$306K between May and August 2025. This move indicates belief in the company's potential amidst challenging financial metrics like declining profit margins and reliance on higher-risk external funding. The recent appointment of Michael Hachey as COO aims to bolster operational capabilities.

- Get an in-depth perspective on Wajax's performance by reading our valuation report here.

Examine Wajax's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Click here to access our complete index of 107 Undervalued Global Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wajax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WJX

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives