- Canada

- /

- Construction

- /

- TSX:STN

If EPS Growth Is Important To You, Stantec (TSE:STN) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Stantec (TSE:STN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Stantec with the means to add long-term value to shareholders.

How Quickly Is Stantec Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Stantec's EPS has grown 30% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Stantec remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 13% to CA$6.2b. That's a real positive.

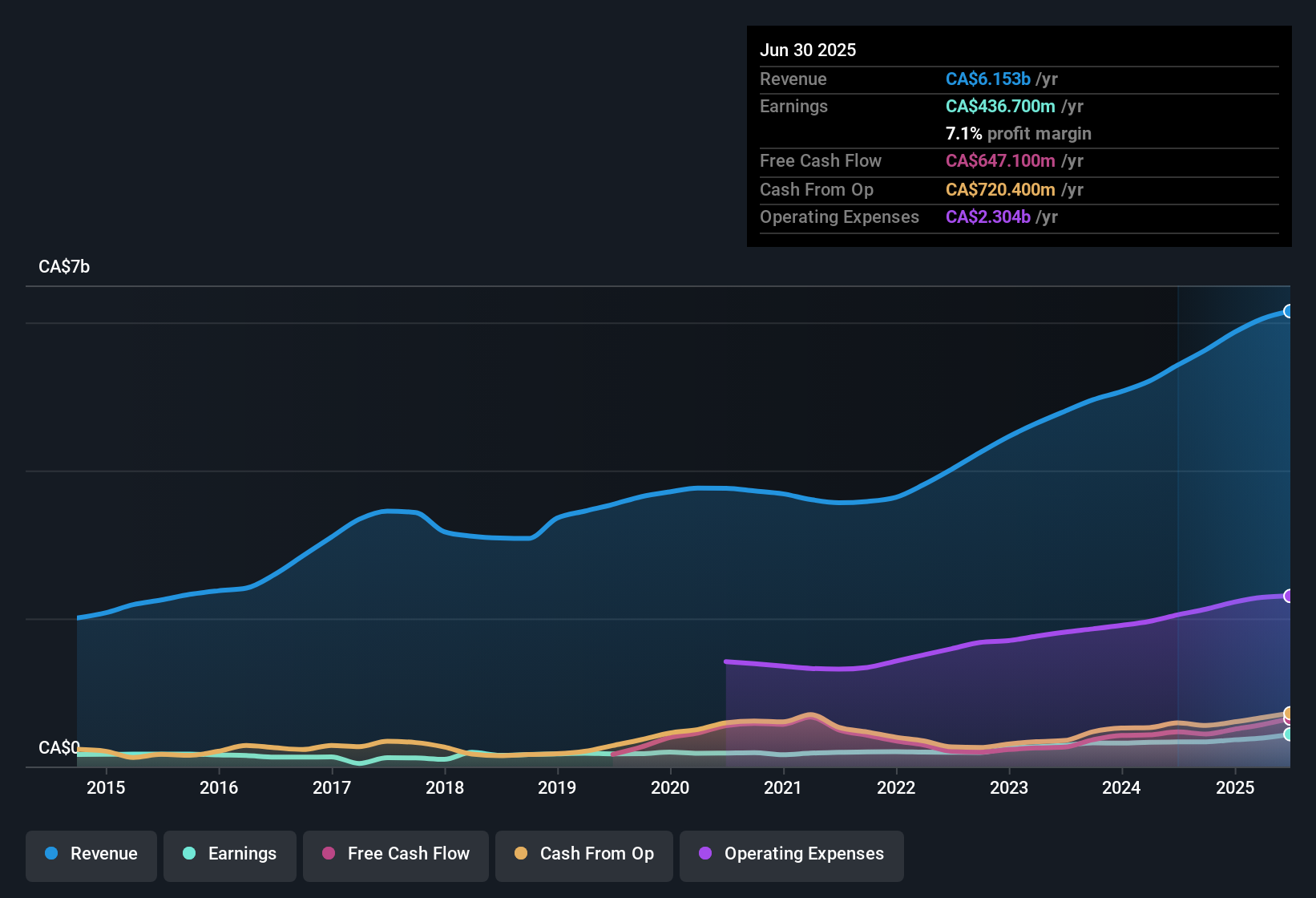

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

See our latest analysis for Stantec

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Stantec's forecast profits?

Are Stantec Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Although we did see some insider selling (worth CA$284k) this was overshadowed by a mountain of buying, totalling CA$3.8m in just one year. This bodes well for Stantec as it highlights the fact that those who are important to the company having a lot of faith in its future. We also note that it was the Executive VP & CFO, Vito Culmone, who made the biggest single acquisition, paying CA$1.0m for shares at about CA$147 each.

The good news, alongside the insider buying, for Stantec bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold CA$52m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 0.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Stantec Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Stantec's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Stantec. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Stantec, you'll probably love this curated collection of companies in CA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:STN

Stantec

Provides professional services in the areas of infrastructure and facilities to the public and private sectors in Canada, the United States, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives