- Canada

- /

- Energy Services

- /

- TSX:PHX

Top 3 TSX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

With the Canadian TSX up over 5% and positive market sentiment returning, investors are closely watching how the Federal Reserve and Bank of Canada will navigate interest rate cuts amid easing inflation and economic uncertainty. In this environment, dividend stocks can offer a stable income stream while potentially benefiting from favorable economic conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.53% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.10% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.38% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.75% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.46% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.78% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.38% | ★★★★★☆ |

| iA Financial (TSX:IAG) | 3.26% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.21% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.69% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., with a market cap of CA$254.71 million, operates as a non-deposit taking trust company in Canada through its subsidiary, Olympia Trust Company.

Operations: Olympia Financial Group Inc. generates revenue through several segments, including Registered Plans ($11.20 million), Foreign Exchange ($15.30 million), Corporate and Shareholder Services ($7.50 million), Exempt Edge ($2.10 million), Private Health Services Plan ($1.90 million), ATM Services ($0.80 million) and Division 7 Capital Inc. services ($0.60 million).

Dividend Yield: 6.7%

Olympia Financial Group reported Q2 2024 revenue of C$26.25 million and net income of C$5.89 million, showing slight growth from the previous year. The company declared consistent monthly dividends of C$0.60 per share, payable through August 2024, despite a historically volatile dividend track record over the past decade. With a payout ratio of 32.6% and cash payout ratio at 72.7%, dividends are well-covered by earnings and cash flows, although future earnings are forecasted to decline by an average of 11.7% annually over the next three years.

- Click to explore a detailed breakdown of our findings in Olympia Financial Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Olympia Financial Group shares in the market.

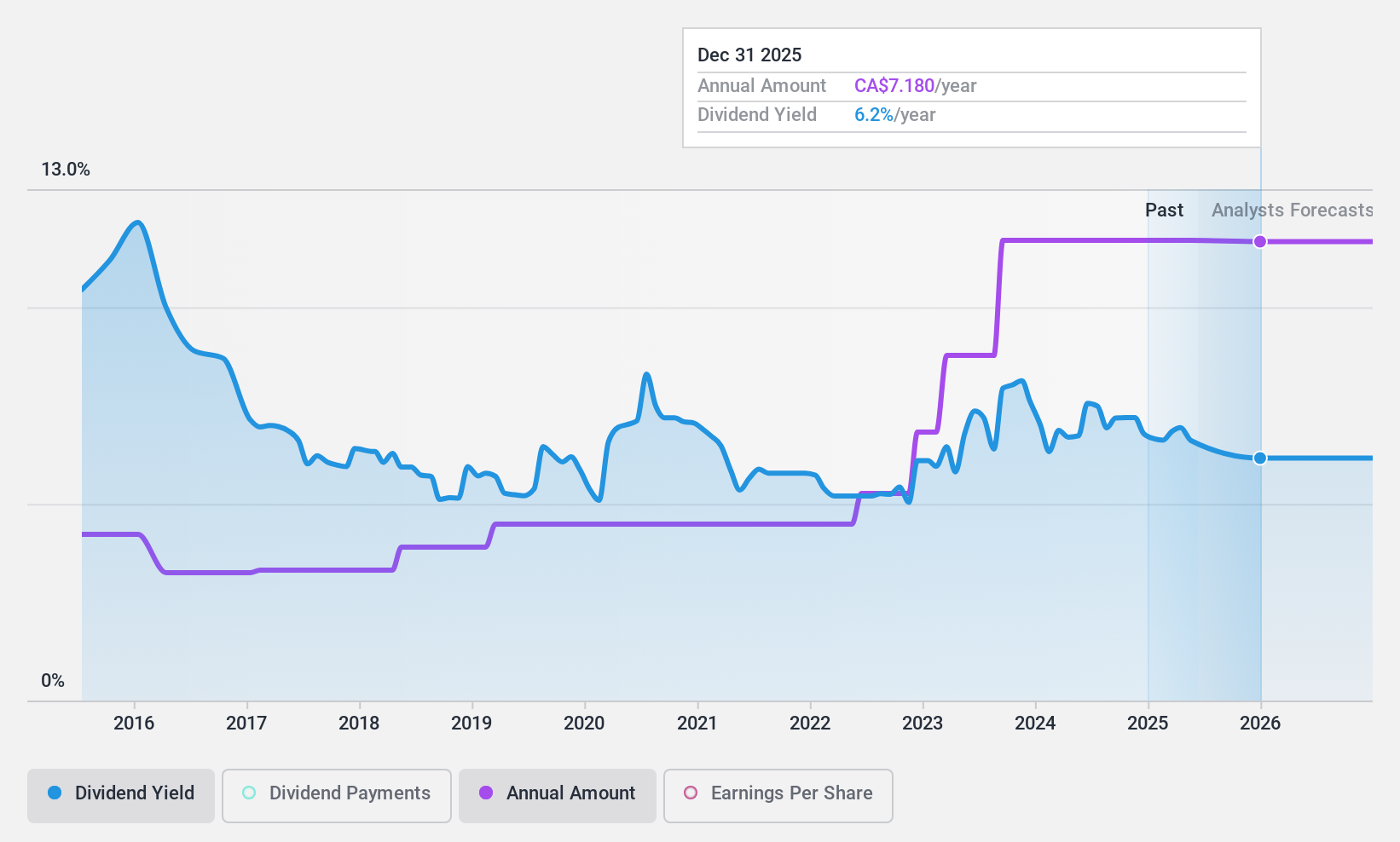

PHX Energy Services (TSX:PHX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. offers horizontal and directional drilling services, rents performance drilling motors, and sells motor equipment and parts to oil and natural gas exploration companies in Canada, the United States, Albania, the Middle East regions, and internationally with a market cap of CA$485.80 million.

Operations: PHX Energy Services Corp. generates CA$655.05 million in revenue from horizontal oil and natural gas well drilling services.

Dividend Yield: 8%

PHX Energy Services offers a high dividend yield of 7.95%, but its sustainability is questionable as dividends are not well covered by free cash flows or earnings. The company's dividend payments have been volatile over the past decade, despite recent increases. Recent buyback programs aim to enhance shareholder returns, with CAD 21.4 million spent repurchasing shares this year. However, declining earnings and high non-cash earnings raise concerns about long-term dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of PHX Energy Services.

- Our valuation report unveils the possibility PHX Energy Services' shares may be trading at a discount.

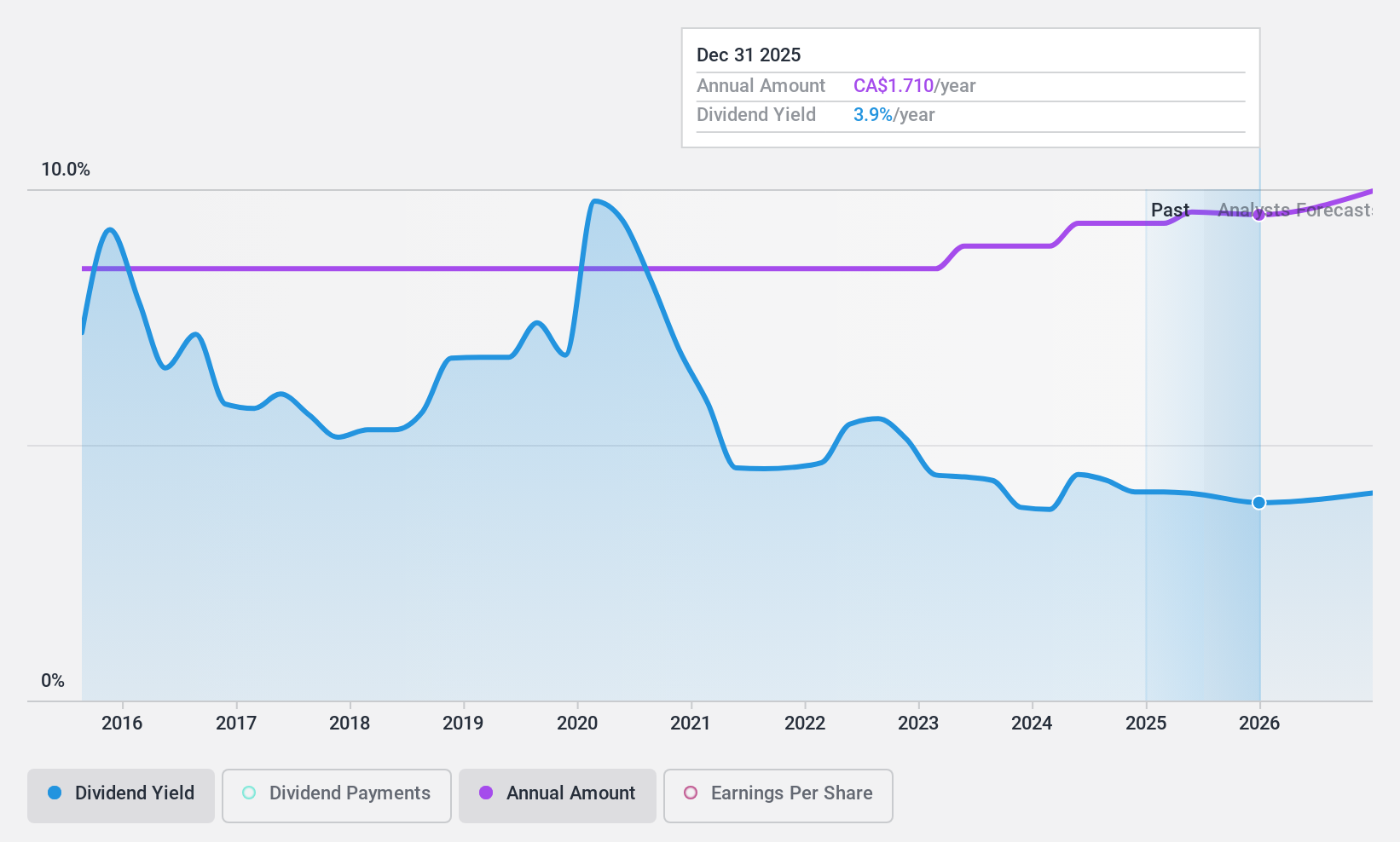

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. operates as a metal distribution and processing company in Canada and the United States, with a market cap of CA$2.23 billion.

Operations: Russel Metals Inc. generates revenue from three primary segments: CA$2.84 billion from Metals Service Centers, CA$984 million from Energy Field Stores, and CA$413.80 million from Steel Distributors.

Dividend Yield: 4.4%

Russel Metals declared a dividend of $0.42 per share, payable on September 16, 2024. Despite lower earnings and revenue compared to the previous year, the company's dividends are well-covered by both earnings (47.2% payout ratio) and cash flows (40.4% cash payout ratio). The firm’s dividend payments have been stable and increasing over the past decade. Recent buyback announcements include repurchasing up to 9.91% of its shares by August 2025, potentially enhancing shareholder value further.

- Dive into the specifics of Russel Metals here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Russel Metals is priced lower than what may be justified by its financials.

Taking Advantage

- Click through to start exploring the rest of the 31 Top TSX Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PHX

PHX Energy Services

Provides horizontal and directional drilling services, rents performance drilling motors, and sells motor equipment and parts to oil and natural gas exploration and development companies in Canada, the United States, Albania, the Middle East regions, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives