- Canada

- /

- Trade Distributors

- /

- TSX:RCH

Richelieu Hardware Ltd.'s (TSE:RCH) Stock Is Going Strong: Is the Market Following Fundamentals?

Most readers would already be aware that Richelieu Hardware's (TSE:RCH) stock increased significantly by 11% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Richelieu Hardware's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Richelieu Hardware

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Richelieu Hardware is:

15% = CA$130m ÷ CA$884m (Based on the trailing twelve months to August 2023).

The 'return' refers to a company's earnings over the last year. That means that for every CA$1 worth of shareholders' equity, the company generated CA$0.15 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Richelieu Hardware's Earnings Growth And 15% ROE

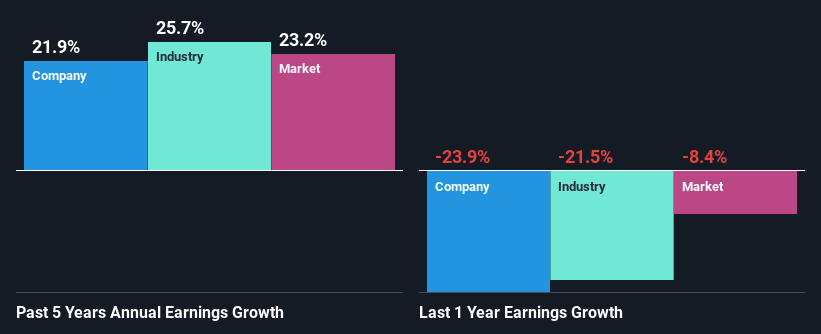

To start with, Richelieu Hardware's ROE looks acceptable. Further, the company's ROE is similar to the industry average of 15%. This probably goes some way in explaining Richelieu Hardware's significant 22% net income growth over the past five years amongst other factors. We believe that there might also be other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then performed a comparison between Richelieu Hardware's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 26% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is RCH fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Richelieu Hardware Using Its Retained Earnings Effectively?

Richelieu Hardware's ' three-year median payout ratio is on the lower side at 14% implying that it is retaining a higher percentage (86%) of its profits. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

Moreover, Richelieu Hardware is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

In total, we are pretty happy with Richelieu Hardware's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. Having said that, on studying current analyst estimates, we were concerned to see that while the company has grown its earnings in the past, analysts expect its earnings to shrink in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:RCH

Richelieu Hardware

Manufactures, imports, and distributes specialty hardware and complementary products in Canada and the United States.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives