- Canada

- /

- Aerospace & Defense

- /

- TSX:XTRA

What Type Of Returns Would Patriot One Technologies'(TSE:PAT) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Patriot One Technologies Inc. (TSE:PAT); the share price is down a whopping 73% in the last three years. That would be a disturbing experience. The more recent news is of little comfort, with the share price down 47% in a year. More recently, the share price has dropped a further 11% in a month.

View our latest analysis for Patriot One Technologies

Patriot One Technologies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

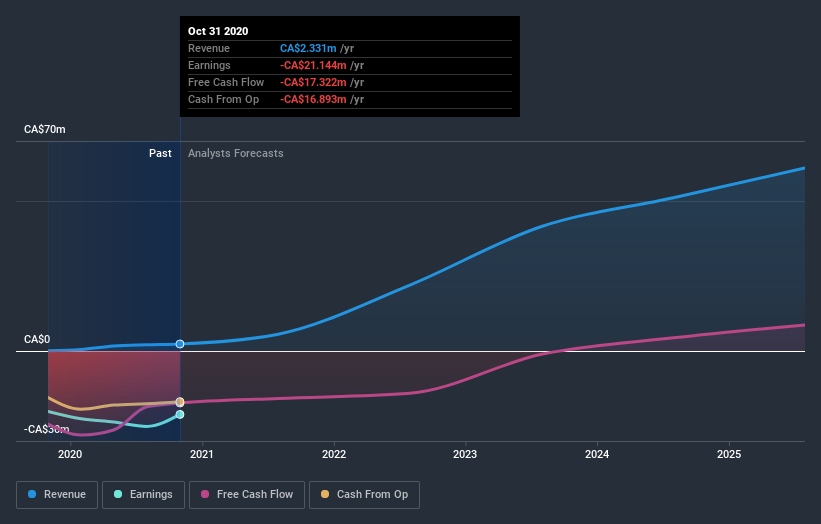

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Over the last year, Patriot One Technologies shareholders took a loss of 47%. In contrast the market gained about 34%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 20% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Patriot One Technologies is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Of course Patriot One Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Patriot One Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:XTRA

Xtract One Technologies

Engages in the research, development, and commercialization of threat detection gateway solutions in the United States, Japan, France, the United Kingdom, and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives