- Canada

- /

- Aerospace & Defense

- /

- TSX:MDA

Why MDA Space (TSX:MDA) Is Up 7.1% After Raising 2025 Revenue Outlook and Reporting Strong Q2

Reviewed by Simply Wall St

- MDA Space Ltd. recently reported strong second quarter 2025 results with sales rising to CA$373.3 million and net income increasing to CA$27.2 million, while also raising its full-year revenue outlook to between CA$1.57 billion and CA$1.63 billion.

- The combination of robust earnings growth and higher financial guidance, alongside new shelf registration filings, reflects continued business momentum and growing confidence in the company’s operational prospects.

- We will explore how the raised annual revenue guidance is shaping MDA Space’s investment narrative and future earnings outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MDA Space Investment Narrative Recap

To own MDA Space stock, investors must believe that large, multi-year satellite contracts and high-volume production capacity will translate into sustained growth, despite stiff competition and hefty upfront capital spending. This quarter’s strong results and raised revenue outlook show momentum, but the most important short-term catalyst remains timely execution of major contract backlogs, while the biggest risk still centers on customer demand for new satellite constellations; the recent news does not materially alter this fundamental tradeoff. Among recent announcements, MDA’s updated revenue guidance for 2025 is especially relevant, it signals confidence in delivering on its contract backlog and addresses some concerns over possible revenue timing or execution delays, strengthening the near-term investment case. By contrast, investors should be aware that if new constellation orders slow or large deals slip, the company’s ability to fully utilize its expanded capacity may come into question...

Read the full narrative on MDA Space (it's free!)

MDA Space's narrative projects CA$2.6 billion revenue and CA$271.2 million earnings by 2028. This requires 24.5% yearly revenue growth and a CA$156.5 million earnings increase from current earnings of CA$114.7 million.

Uncover how MDA Space's forecasts yield a CA$51.43 fair value, a 14% upside to its current price.

Exploring Other Perspectives

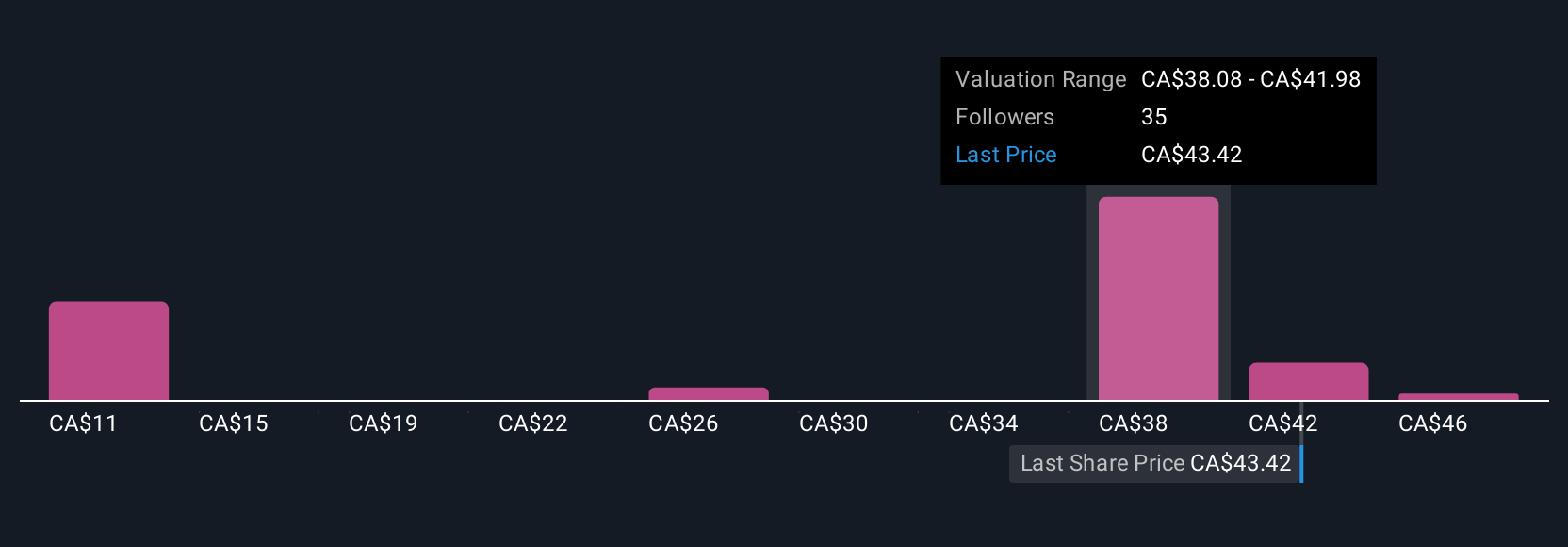

Twelve members of the Simply Wall St Community have estimated fair values from CA$12.22 to CA$51.43, reflecting broad disagreement on MDA’s worth. As you consider these opinions, remember that efficient execution of the company’s robust backlog could be a key factor shaping future returns.

Explore 12 other fair value estimates on MDA Space - why the stock might be worth less than half the current price!

Build Your Own MDA Space Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDA Space research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MDA Space research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDA Space's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives