- Canada

- /

- Aerospace & Defense

- /

- TSX:MDA

MDA Space (TSX:MDA): Valuation in Focus After Winning Canadian Space Domain Awareness Contract

Reviewed by Kshitija Bhandaru

MDA Space (TSX:MDA) has been selected, along with ThothX Group, to deliver enhanced space domain awareness services to Canada’s Department of National Defence. This new contract highlights MDA Space’s continued presence in the space surveillance sector.

See our latest analysis for MDA Space.

MDA Space’s latest contract builds on a year marked by modest but steady progress. The company’s 1-year total shareholder return sits just below 1%, reflecting a measured response from the market despite ongoing operational momentum and sector leadership. While the latest announcement showcases MDA Space’s growing relevance in the commercial space domain awareness market, overall market enthusiasm for the stock has so far been more restrained, suggesting investors are still weighing long-term growth potential against near-term risks.

If you’re interested in companies leading innovation and security in aerospace and defense, explore what else is happening in the sector with our curated list: See the full list for free.

With shares trading nearly 21% below analyst targets and strong revenue and income growth in the past year, the question now is clear: is this a buying opportunity for MDA Space, or has the market already factored in its future growth?

Most Popular Narrative: 19.8% Undervalued

MDA Space’s last close of CA$35.34 stands below the narrative’s fair value estimate, setting up a bold outlook for further upside. The most widely followed narrative, according to IndusyHoldings, anticipates significant industry tailwinds and multi-year profit growth, positioning the company for substantial re-rating if assumptions hold true.

MDA Space can benefit greatly from the tailwind of the industry as they offer a wide product range that includes LEO and MEO satellites, space robots and space rovers. The company has partnerships with OHB System AG, Huber+Suhner and ThermAvant Technologies.

Ever wondered what kind of future profit margins and top-line expansion could justify this lofty fair value? This narrative hints at an aggressive industry growth rate along with ambitious product diversification. If you want the numbers and projections powering this call, you don’t want to miss the details.

Result: Fair Value of $44.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in government projects or shifts in global trade policy could challenge MDA Space's revenue assumptions and future growth outlook.

Find out about the key risks to this MDA Space narrative.

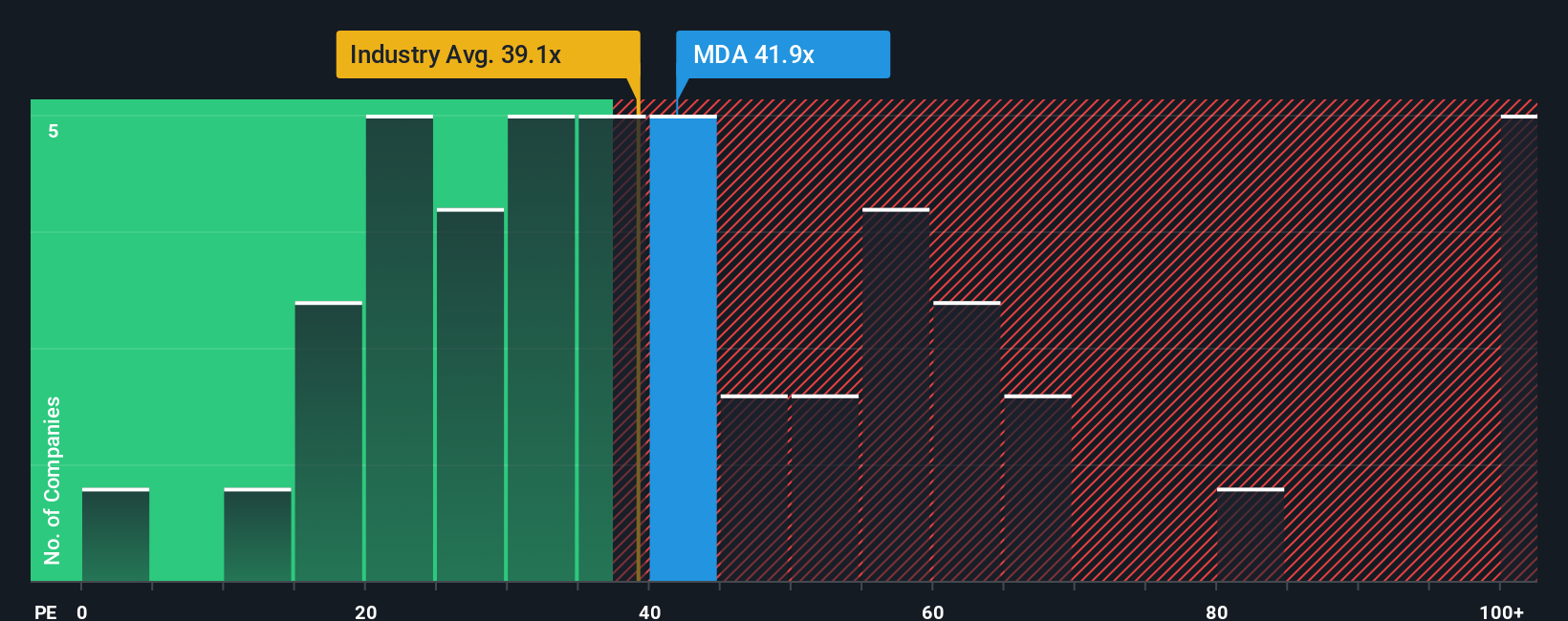

Another View: The Market’s Multiple

Taking a different tack, the market’s main valuation yardstick here is the price-to-earnings ratio. At 38.8x, MDA Space trades higher than both the North American industry average of 37.6x and its peers’ average of 28.8x, and also above the fair ratio of 32.3x. This suggests the current share price already bakes in plenty of optimism, raising the stakes: how durable is that premium if expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MDA Space Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your MDA Space research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move by tapping into tailored investment opportunities others might overlook. Don’t miss out on stocks positioned for tomorrow’s biggest trends. Let Simply Wall Street do the heavy lifting.

- Boost your potential returns by targeting shares that look undervalued based on robust cash flows with these 896 undervalued stocks based on cash flows.

- Capture the growth in artificial intelligence with these 24 AI penny stocks that are shaping the global tech landscape and driving future innovation.

- Secure reliable income with these 19 dividend stocks with yields > 3% offering market-beating dividend yields greater than 3% for your portfolio stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives