- Canada

- /

- Electrical

- /

- TSX:HPS.A

TSX May 2025 Stocks Priced Below Estimated Intrinsic Values

Reviewed by Simply Wall St

With Canada's recent election behind it, the focus has shifted to addressing key economic issues, including trade and fiscal policy, as newly elected Prime Minister Mark Carney aims to balance the federal budget while supporting sectors impacted by tariffs. As the Canadian market navigates these changes and potential interest rate cuts from the Bank of Canada, investors may find opportunities in undervalued stocks on the TSX that are priced below their estimated intrinsic values, offering potential for growth amidst evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hammond Power Solutions (TSX:HPS.A) | CA$93.74 | CA$161.58 | 42% |

| Propel Holdings (TSX:PRL) | CA$29.24 | CA$44.82 | 34.8% |

| Savaria (TSX:SIS) | CA$17.81 | CA$30.96 | 42.5% |

| Badger Infrastructure Solutions (TSX:BDGI) | CA$40.44 | CA$75.79 | 46.6% |

| Docebo (TSX:DCBO) | CA$43.80 | CA$77.94 | 43.8% |

| Enterprise Group (TSX:E) | CA$1.50 | CA$2.83 | 46.9% |

| A & W Food Services of Canada (TSX:AW) | CA$33.00 | CA$58.33 | 43.4% |

| AtkinsRéalis Group (TSX:ATRL) | CA$70.56 | CA$112.36 | 37.2% |

| Obsidian Energy (TSX:OBE) | CA$5.76 | CA$8.50 | 32.2% |

| CAE (TSX:CAE) | CA$35.75 | CA$64.61 | 44.7% |

Let's dive into some prime choices out of the screener.

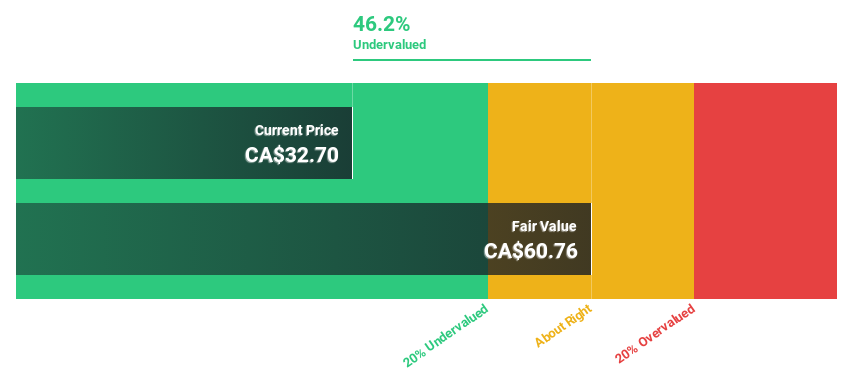

A & W Food Services of Canada (TSX:AW)

Overview: A & W Food Services of Canada Inc. operates and franchises quick service restaurants across Canada, with a market cap of CA$791.93 million.

Operations: The company generates its revenue primarily through the development, operation, and franchising of quick service restaurants in Canada.

Estimated Discount To Fair Value: 43.4%

A & W Food Services of Canada is trading at CA$33, significantly below its estimated fair value of CA$58.33, suggesting it may be undervalued based on cash flows. Despite a high debt level and profit margins dropping to 4.6% from 12.2% last year, earnings are forecasted to grow by nearly 58% annually over the next three years, outpacing the Canadian market's growth rate of 15.7%. However, its dividend yield of 5.82% is not well covered by free cash flows. Recent Q1 results show increased net income at CA$9.26 million compared to CA$7.51 million a year ago despite slightly lower sales figures.

- Insights from our recent growth report point to a promising forecast for A & W Food Services of Canada's business outlook.

- Take a closer look at A & W Food Services of Canada's balance sheet health here in our report.

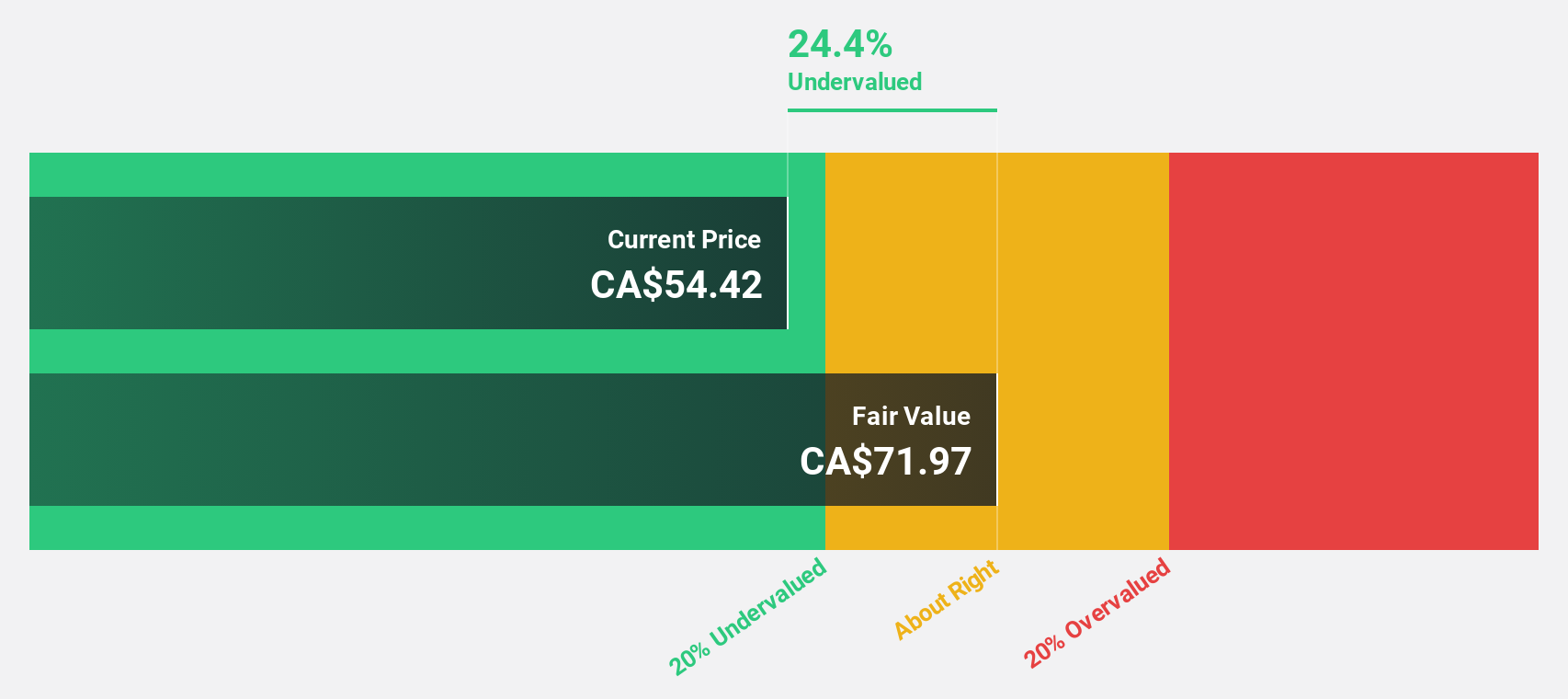

Badger Infrastructure Solutions (TSX:BDGI)

Overview: Badger Infrastructure Solutions Ltd., with a market cap of CA$1.37 billion, offers non-destructive excavating and related services in Canada and the United States.

Operations: The company generates revenue of $756.02 million from its non-destructive excavating and related services across Canada and the United States.

Estimated Discount To Fair Value: 46.6%

Badger Infrastructure Solutions, trading at CA$40.44, is considerably below its estimated fair value of CA$75.79, highlighting potential undervaluation based on cash flows. Recent Q1 results show sales increased to US$172.63 million from US$161.56 million a year ago, with net income rising to US$3.26 million from US$1.78 million. Earnings are projected to grow significantly at 26% annually over the next three years, surpassing the Canadian market's growth rate of 15.7%.

- Upon reviewing our latest growth report, Badger Infrastructure Solutions' projected financial performance appears quite optimistic.

- Dive into the specifics of Badger Infrastructure Solutions here with our thorough financial health report.

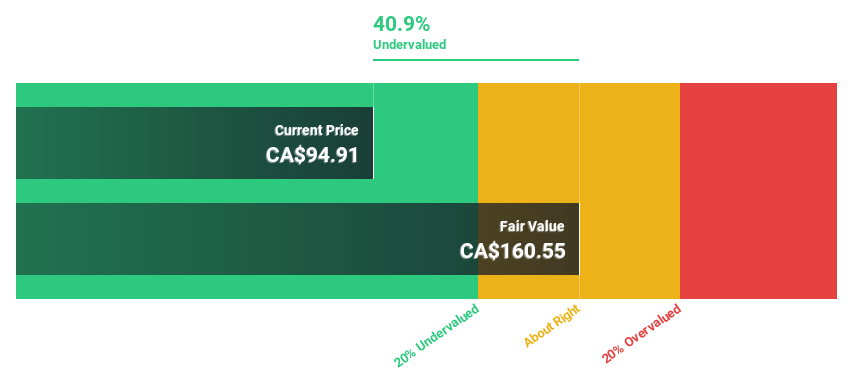

Hammond Power Solutions (TSX:HPS.A)

Overview: Hammond Power Solutions Inc. designs, manufactures, and sells transformers across Canada, the United States, Mexico, and India with a market cap of CA$1.12 billion.

Operations: The company's revenue is derived from the manufacture and sale of transformers, totaling CA$788.34 million.

Estimated Discount To Fair Value: 42%

Hammond Power Solutions, trading at CA$93.74, is significantly undervalued with a fair value estimate of CA$161.58, suggesting potential based on cash flows. Earnings are forecast to grow 16.3% annually, outpacing the Canadian market's 15.7%. Revenue growth is expected at 5.7% per year, exceeding the market average of 4.9%. Analysts agree on a potential price increase of 58.2%, and the stock trades at a good value compared to peers and industry standards.

- Our earnings growth report unveils the potential for significant increases in Hammond Power Solutions' future results.

- Get an in-depth perspective on Hammond Power Solutions' balance sheet by reading our health report here.

Next Steps

- Access the full spectrum of 18 Undervalued TSX Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammond Power Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives