Patrick Goodfellow became the CEO of Goodfellow Inc. (TSE:GDL) in 2017. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Goodfellow

How Does Patrick Goodfellow's Compensation Compare With Similar Sized Companies?

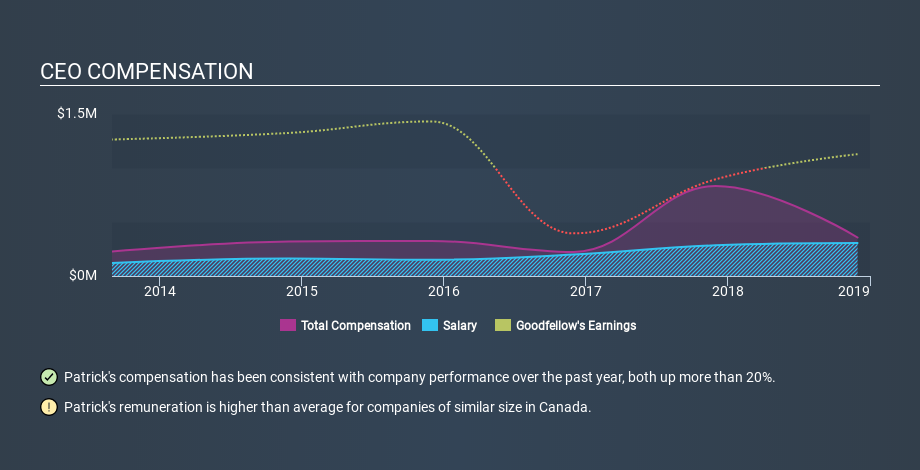

At the time of writing, our data says that Goodfellow Inc. has a market cap of CA$34m, and reported total annual CEO compensation of CA$357k for the year to November 2018. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at CA$306k. We examined a group of similar sized companies, with market capitalizations of below CA$284m. The median CEO total compensation in that group is CA$222k.

Thus we can conclude that Patrick Goodfellow receives more in total compensation than the median of a group of companies in the same market, and of similar size to Goodfellow Inc.. However, this doesn't necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

The graphic below shows how CEO compensation at Goodfellow has changed from year to year.

Is Goodfellow Inc. Growing?

On average over the last three years, Goodfellow Inc. has grown earnings per share (EPS) by 109% each year (using a line of best fit). In the last year, its revenue is down 5.4%.

This shows that the company has improved itself over the last few years. Good news for shareholders. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Goodfellow Inc. Been A Good Investment?

With a three year total loss of 52%, Goodfellow Inc. would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

We compared the total CEO remuneration paid by Goodfellow Inc., and compared it to remuneration at a group of similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. However, the returns to investors are far less impressive, over the same period. While EPS is positive, we'd say shareholders would want better returns before the CEO is paid much more. Shifting gears from CEO pay for a second, we've spotted 3 warning signs for Goodfellow you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:GDL

Goodfellow

Engages in the wholesale distribution of building materials and floor coverings in Canada, the United States, and the United Kingdom.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026