- Canada

- /

- Electrical

- /

- TSX:ELVA

There's No Escaping Electrovaya Inc.'s (TSE:ELVA) Muted Revenues Despite A 25% Share Price Rise

Electrovaya Inc. (TSE:ELVA) shares have continued their recent momentum with a 25% gain in the last month alone. The annual gain comes to 170% following the latest surge, making investors sit up and take notice.

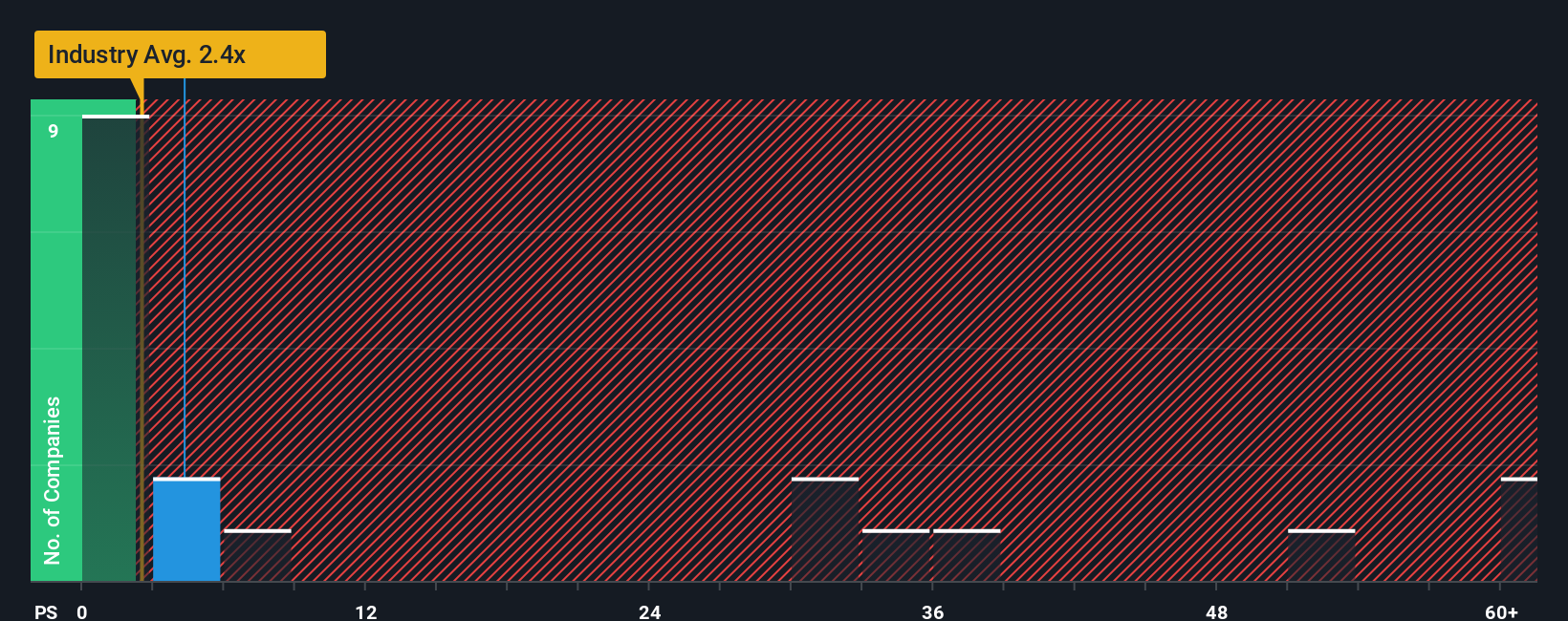

In spite of the firm bounce in price, Electrovaya's price-to-sales (or "P/S") ratio of 4.3x might still make it look like a strong buy right now compared to the wider Electrical industry in Canada, where around half of the companies have P/S ratios above 8.6x and even P/S above 36x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Electrovaya

What Does Electrovaya's P/S Mean For Shareholders?

Recent times haven't been great for Electrovaya as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Electrovaya.Is There Any Revenue Growth Forecasted For Electrovaya?

In order to justify its P/S ratio, Electrovaya would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. The latest three year period has also seen an excellent 292% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 48% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 165% per year growth forecast for the broader industry.

In light of this, it's understandable that Electrovaya's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Even after such a strong price move, Electrovaya's P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Electrovaya's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Electrovaya (2 are significant) you should be aware of.

If you're unsure about the strength of Electrovaya's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Electrovaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELVA

Electrovaya

Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives